Energy storage could replace new gas peaker plants "post-2020", Nextera chief JIm Robo said. Image: wikimedia user: Jim Henderson.

NextEra Energy’s CEO sees energy storage as one of three areas driving “tremendous growth” for the group and has said that discussions about renewables are “naturally” leading into dialogue on storage.

Jim Robo, chairman as well as chief exec of the Florida-headquartered Fortune 200 utility which has a number of subsidiaries including the NextEra Partners yieldco, spoke at the Power & Gas Leaders Conference hosted by Wolfe Research in New York on Tuesday.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Robo said that there had “never been a better time to be in the renewable business than today”, owing to a combination of circumstances, including improvements in technology for both wind and solar generation and broad levels of policy support such as the investment tax credit (ITC).

Outlining that the company’s long term vision is to be the “largest and most profitable” provider of clean energy in the US, Robo referred to a “terrific first half” of the year and said NextEra Energy expected dividend payout ratio to increase from 55% at current levels to 65% by 2018. The strategy to reach this vision would include leveraging the NextEra Partners yieldco vehicle, Robo said, as well as closing down the Cedar Bay coal-fired power plant, which is the highest emitting power station in Florida. The company has also gained approval for a project in Florida which would add high-efficiency natural gas generation and three solar plants with a combined capacity of 1,622MW.

In building platforms to continue to drive future growth, NextEra would focus on three major areas: the natural gas pipeline business, its competitive transmission business and on energy storage.

In response to questions from the audience on the last of those three, Robo said Nextera had a “good-sized team learning all there is to learn”. He also said that as many of the biggest utilities in the US are customers to the parent company or its subsidiaries, NextEra had an opportunity to greatly open out this process of education and dialogue. Further to that, the NextEra CEO said that over the next 12 months the company would be executing projects in regional storage markets of the US.

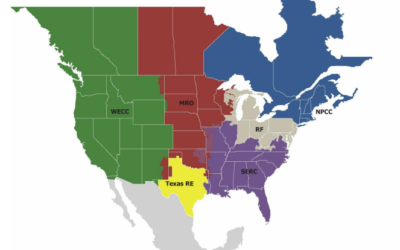

The first of those regional markets to get a mention was the frequency regulation market in the service area of regional transmission operator PJM. PJM hosts a competitive market in which providers are rewarded for being the fastest to respond to signals to adjust grid frequency. This means battery-based storage systems are to play in that process successfully due to their ability to respond much more quickly to signals to adjust grid frequency than gas peaker plants, which have traditionally been used.

Robo even said that he could envisage a time, perhaps as soon as “post-2020” when the US no longer built natural gas peaker plants for regulating the frequency of the grid. Many renewable energy and energy storage industry sources have said that using storage instead of gas for frequency regulation is the quickest way to replace large amounts of greenhouse gas emissions on electricity networks.

“It’s just very likely you’ll build energy storage instead [of a peaker plant],” Robo said.

A study last year by grid-scale energy consultancy Energy Strategies Group (ESG) which focused on one specific battery maker, ViZn Energy, appeared to show that flow batteries could perform the role played by the gas power stations, which exist to meet peak demand.

In the near future, the company had “several projects” lined up, most of which are in the frequency regulation space, according to Robo, but another project next year is likely to be a long duration (four hour) battery “that won’t do frequency regulation”, implying that it is more likely to be a project to defer investment in substation in Florida, another potential high value application for storage to “drive and improve reliability” and an area in which the company is keen to conduct R&D. These projects highlighted that storage could be used across a “variety of applications,” the Nextera man said.

NextEra would also be looking to execute projects in “places like” Arizona and California, Robo said and iterated a view that renewables integration with battery storage remains a “Holy Grail” for the energy industry and that much talk around renewable energy was naturally leading into dialogue about energy storage as well.

However, there was a strong sense that much of the company’s focus remains on natural gas. NextEra has received Florida Public Service Commission approval for its modified natural gas reserve guidelines which could see US$100 million a year in investments, while also eyeing a “billion dollar investment opportunity” in a gas pipeline from Oklahoma to Texas.

One of Nextera's wind power assets. Jim Robo also said there has "never been a better time" to be involved in the renewable energy business than today. Image: Flickr user: Jim Fuller.