Tesla said that it more than doubled production volumes of grid-scale energy storage solution Megapack in the third quarter of 2020 as the company continues to ramp up production to “match unprecedented demand across the globe”.

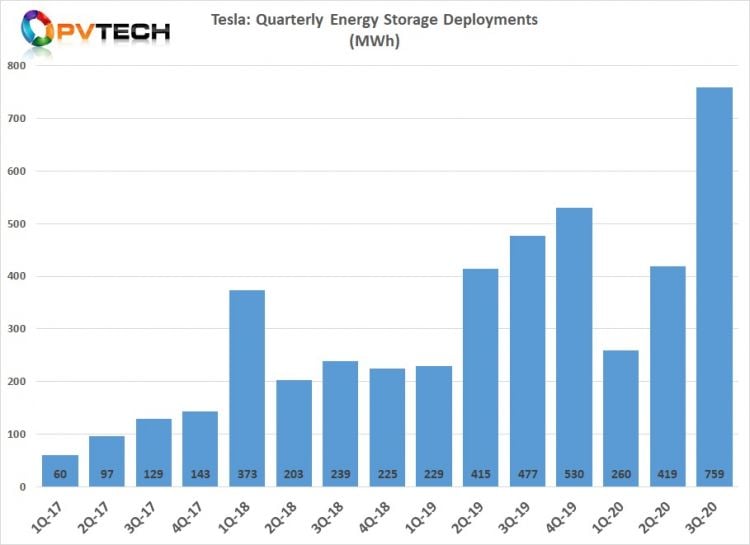

In reporting its financial results for Q3 2020, Tesla noted a significant uptick in energy storage installations, which reached 759MWh during the quarter. This was up 81% sequentially and 59% year-on-year, with Tesla indicating it had more demand than supply for energy storage throughout 2021. Coupled with a doubling of solar energy installs quarter-on-quarter, the company’s total energy generation and storage revenue for Q3 2020 stood at US$579 million, up 44% year-on-year.

In a quarterly earnings call with Tesla leadership, company global head of commercial energy RJ Johnson said it had been a strong quarter for the Energy Business division with energy storage and solar poised for strong growth.

Johnson said Megapack “is going to be a large growth segment for the business,” with deployments expected to continue expanding rapidly. There is more demand than supply booked for 2021 and production will continue to ramp to match this “unprecedented demand across the globe through 2023 and beyond”.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Tesla’s order book is “rapidly filling up through 2023 in a multiple gigawatt-hour scale,” Johnson said, and large-scale solar-plus-storage is more cost-effective than traditional fossil fuel generation in “many locations across the globe”. As costs continue to decline, existing and new fossil fuel generation will be further displaced.

Tesla customers are also able to follow this trend with standalone energy storage projects too, according to the head of commercial energy. Johnson talked up how Tesla’s market optimisation software platform AutoBidder is being used for its customers to “outperform the market” with “advanced real-time bidding strategies”.

In the residential segment too, RJ Johnson said, customers are increasingly seeking reliability and backup power in their home generation, describing the backlog for Powerwall orders as “very large”. Tesla continues to invest to increase production capacity to fulfil customers’ orders, Johnson said.

In a Q&A session with analysts that followed a presentation, Phillippe Houchois, industrial goods analyst with investment bank Jefferies asked executives to share their views on where the stationary storage business “is probably going” and for clarity on the business model Tesla is using for that segment.

Houchois said that in Australia, the successful use of Tesla battery storage systems to help stabilise the grid suggested that, “given the savings that are achieved, your hardware could have been sold at a higher price”.

CEO Elon Musk said the analyst was “probably right about that,” while RJ Johnson explained that the use of aggregated behind-the-meter systems in Australia to provide services back to the grid “effectively reduces the price to the customer and reduces the prices for the grid operator”.

This trend is likely to continue to spread across the globe from early adopter markets such as Australia, Johnson said, while Drew Baglino, Tesla senior VP for powertrain and energy engineering clarified that energy storage systems installed alongside renewable energy, such as the 150MW Hornsdale Power Reserve project in South Australia can continue to serve their primary purpose as power plants while also helping to balance the grid.

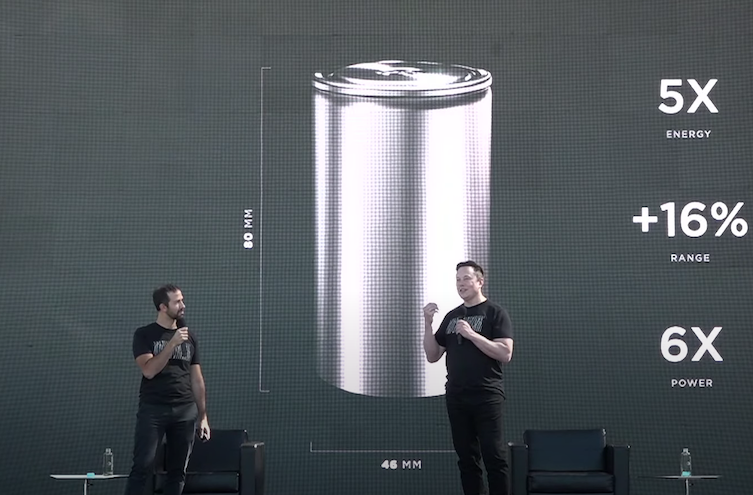

Late last month Tesla hosted its Battery Day where it detailed plans to reduce manufacturing costs for energy storage through various means. It expects the changes to be transformational for Tesla’s energy business as a whole, and CEO Elon Musk continues to back the division to be just as big, if not larger than its automotive arm in the future.

Additional reporting by Liam Stoker. Visit PV Tech to read Liam’s coverage of Tesla’s financial results from a solar energy perspective.

Transcription of Tesla earnings call by The Motley Fool.