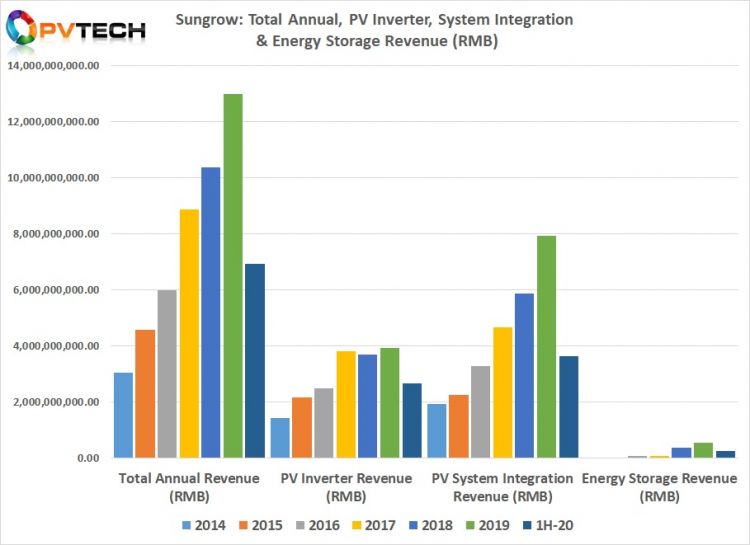

Major PV inverter manufacturer Sungrow has reported a significant recovery in revenue and profitability in the second quarter of 2020, after financial figures suffered in the first quarter, due to the impact of COVID-19 on both its PV project and EPC business and demand for PV inverters in China.

Sungrow’s total operating income (revenue) in the first quarter of 2020 fell to RMB 1,846 million (US$ 269.8 million), compared to record revenue of around US$850.4 million in the fourth quarter of 2019. Net profit had followed the same downward path, resulting in figures of US$23.3 million in the first quarter of 2020, compared to a net profit of US$49.4 million in the previous quarter.

However, the second quarter of 2020 marked a complete turnaround with revenue reaching RMB 5,095 million (US$744.67 million), Sungrow’s second highest quarterly figures. Net profit was RMB 286.62 million (US$41.88 million).

As a result, first half year revenue reached RMB 6,942 million (US$1,01 billion), a 55.57% increase over the prior year period, Net profit in the reporting period was RMB 446,13 million (US$65.2 million) 71.95% increase, year-on-year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Key to the rebound was the growth in PV inverter sales within its PV Inverter & Power Conversion business segment, which reached around RMB 2,669 million (US$390.12 million) in the first half of 2020, compared to around US$243.3 million in the prior year period, a 60% increase, year-on-year.

Overall sales in the reporting quarter were also boosted by its energy storage segment, which was claimed to have increased sales to around US$35.6 million, up almost 50% from the prior year period, according to the company.

The energy storage business continued to grow during the reported period. Sungrow said its systems are “widely used” in territories including China, the US, the UK, Canada, Germany, Japan and Australia, while the company also believes that it has achieved a 20% share of the commercial and industrial (C&I) energy storage markets in Australia, India and North America. Sungrow also claims that it has cornered around 20% of Australia’s household storage market through a local partnership.

In other highlights, the company launched a high voltage lithium iron phosphate (LFP) storage system during the quarter, while it also pointed out that some of its products were tested under UL9540 safety standards for lithium-ion battery modules for energy storage and work on the first pilot projects in China for solar-plus-storage to really combine the technologies at large-scale got underway, as did a couple of other key projects for Sungrow in China for storage to provide frequency regulation and other services.

It became clear a while ago that for Sungrow, diversification and adding new business lines such as energy storage and project development alongside its core business of making and supplying inverters has been important both strategically and financially. In a recent feature article for our quarterly journal PV Tech Power, Sungrow director of R&D Dr Zhuang Cai talked about what it takes to design and build battery energy storage systems (BESS) for different global territories and applications.

Additional reporting for Energy-Storage.news by Andy Colthorpe.

To read the original version of this story, which includes more reporting on Sungrow’s sales and performance in other business segments, visit PV Tech.