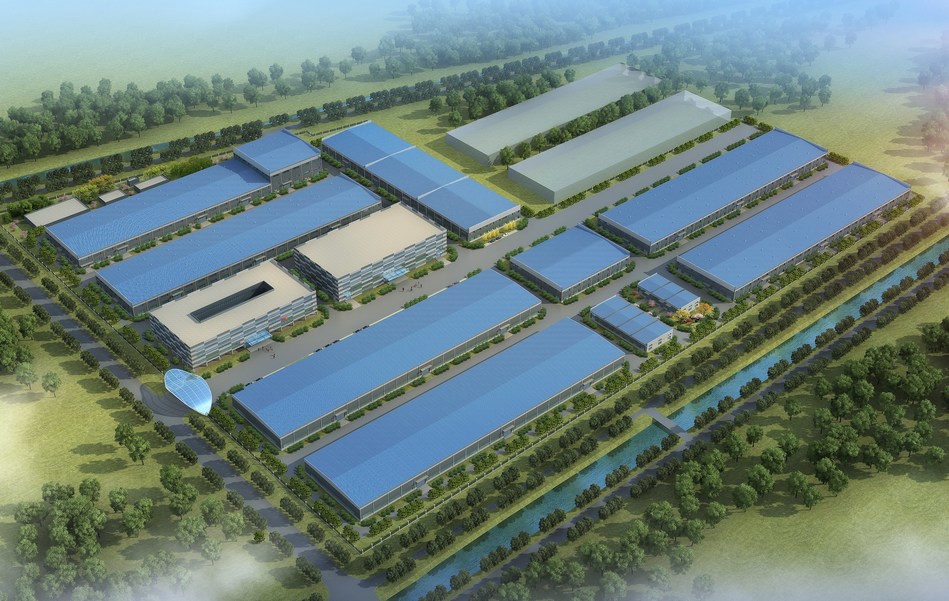

Pylontech has said it will have 4GWh of battery energy storage system manufacturing facilities in operation within three years, after it raised around US$300 million from listing on the Shanghai Stock Exchange.

The China-based vertically-integrated battery and energy storage system manufacturer, which is headquartered in Shanghai, produces everything from battery cathode materials to lithium-ion cells, battery management system and integrates components into complete energy storage system (ESS) solutions.

Active in numerous global markets including the US, Australia, Europe and of course China, the company said it reached 1GWh of cumulative ESS shipped worldwide by 2018 and 1.5GWh of system manufacturing capability in 2019. Making products aimed at market segments including residential, telecoms and utility customers, with high voltage and low voltage solutions, the company focuses on lithium iron phosphate (LFP) battery chemistry. The company’s systems are compatible with a range of kit from international equipment providers including solar inverter manufacturer Ingeteam and Schneider Electric. In 2017, its systems were the first by any maker to be certified by accreditation group TÜV Rheinland as meeting a number of standards deeming them suitable for installation and use in Germany, at the time described by a TÜV Rheinland Greater China representative as “the most rigorous certification standard in the world”.

Pylontech listed on 30 December 2020 on the Shanghai Stock Exchange Star Market, which is for science and technology companies. The company said it is the first dedicated energy storage company to list on there and that it raised over CNY2 billion (US$301 million) from it.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“We took only few days off this Chinese New Year holiday so we could continue with both cell production and capacity expansion,” Pylontech CEO Wen Tan said.

“This is highly unusual in Chinese tradition, but we are eager to supply our customers, who have been waiting, with more resources.”

The company said its schedule for expansion is “tight” but that it expects to be able to meet global demand, which it said is “booming,” with its dedicated ESS manufacturing lines. As well as residential, industrial and grid-tied ESS markets, Pylontech has identified telecommunications base stations as a likely source of growing market demand for battery storage over the next five years.

A few days ago, another vertically-integrated battery storage company, Northvolt, said it is building a European ESS assembly ‘gigafactory’ in Poland with an initial capacity of 5GWh. Northvolt is a recently-founded startup which is currently building its first large factory for ‘sustainable’ battery cell production for electric vehicle and stationary ESS use in Sweden.