The Capacity Market T-1 auction cleared at a record high price in the UK this week, with 17 batteries winning spots.

This was a sizeable jump from last year, when just two assets managed to secure spots, as the role of renewables and storage continues to grow in the country.

A total kDe-Rated Capacity of 2252.116MW was procured by National Grid ESO, just shy of the target announced by the Department of Business Energy and Industrial Strategy of 2.4GW. This was significantly higher than the initial target set by the government department of 0.4GW in July 2020, in an effort to manage a “range of non-delivery uncertainties”.

Capacity margins had grown tighter over the past year due to the closing of Calon – which went into administration last summer, with two of its gas fired power plants, Severn and Sutton Bridge, being put into a ‘dormant’ state in August – along with a number of nuclear power outages.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

This contributed to the record high prices in the T-1 auction, which cleared at £45/kW/year on day one. In contrast, last year’s auction cleared at just £1.00/kW/y in February 2020, leading some to question its efficacy.

“With a tighter auction, our forecast noted a high clearing price would happen should certain plants, particularly coal, be able to exit the auction early,” he continued. “The provisional results showed this to be true, with EDF’s West Burton A coal units failing to secure agreements, with the company saying it will now consider all options for the station.”

The capacity for 2021-22 is made up of 156 units, from 53 companies and 48 parent companies.

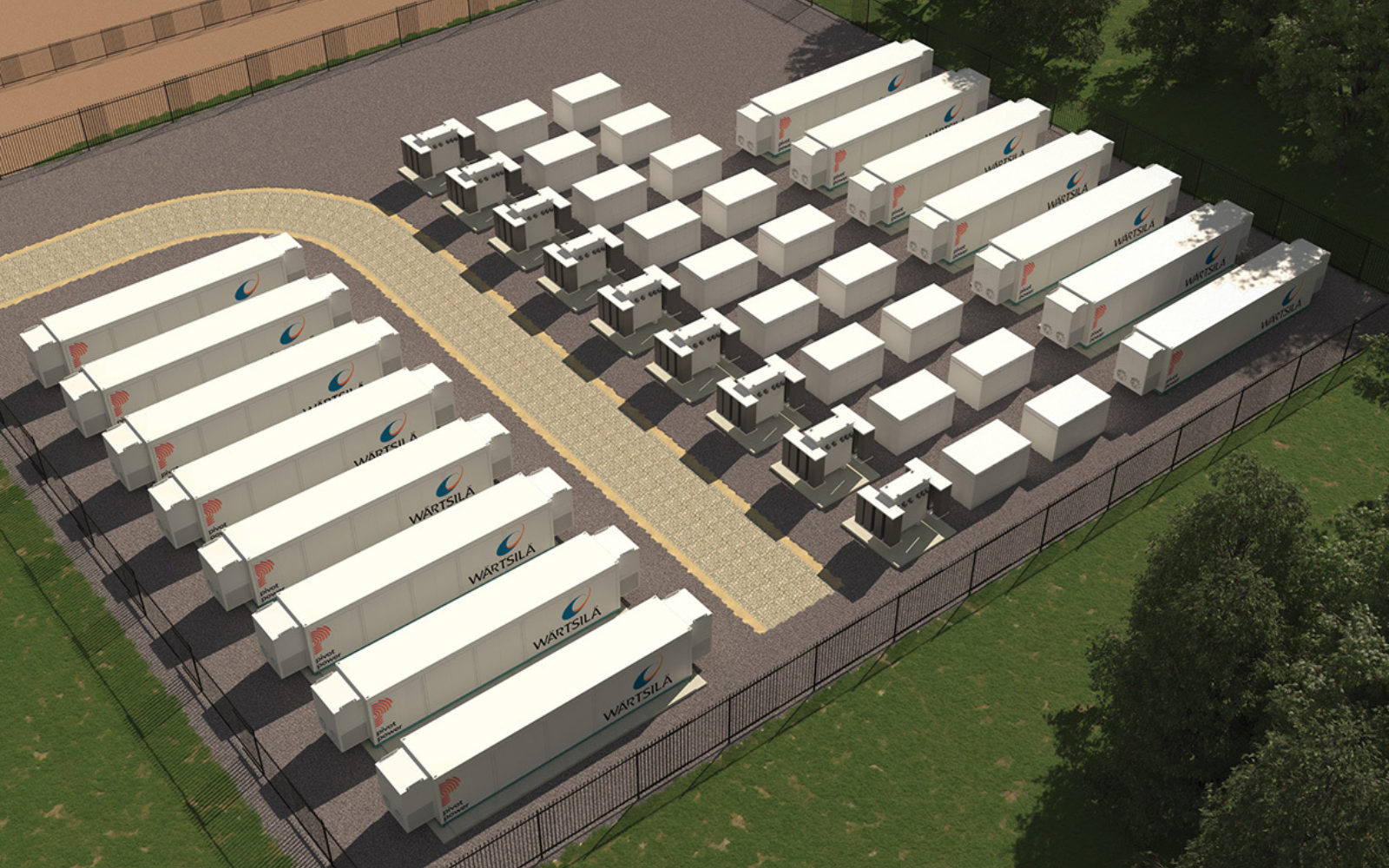

The battery storage companies to successfully have their assets cleared include Limejump, Pivot Power (the Cowley and Kemsley sites), Minety Battery Storage, Power Up Generation, GRIDSERVE, Harmony, ESB, Eelpower, Thrive Renewables, Amber Energy, Bagnall Energy and Anesco. It is a significant jump from the last auction, where only two battery assets managed to clear.

Limejump told Energy-Storage.news in a statement: “At these levels, the market is definitely providing a signal for flexibility and, with our support, customers will certainly have more confidence for any future investment. We can expect to see more interest in the T-1 auction next year, even at low volumes.”

Both wind and solar assets also cleared, including the Crossdykes wind farm, Douglas West Wind Farm and two ScottishPower wind farms. Warrington Renewables and Energy Store both had solar assets clear. Additionally, 29 units of demand side response also secured contracts.

Prices are expected to stay high over the next few years in the Capacity Market explained VEST’s managing partner Aaron Lally, continuing to provide an attractive revenue stream for batteries as short term procurement.

“There will be a large amount of value that will be locked in at lower levels or missed for battery storage. Owners need to select a trader who has a firm view on this market and where prices are going.

“For a long time with revenues so low (alongside de-rating factors), value add from traders has been limited but obviously this is changing. If you have an adjustable risk appetite and are able to benefit from price spreads in the CM going forward then your trader should be advising/executing on this (in the same way as any other revenue stream).”

For more details on the T-1 Capacity Market, see our sister site Current±