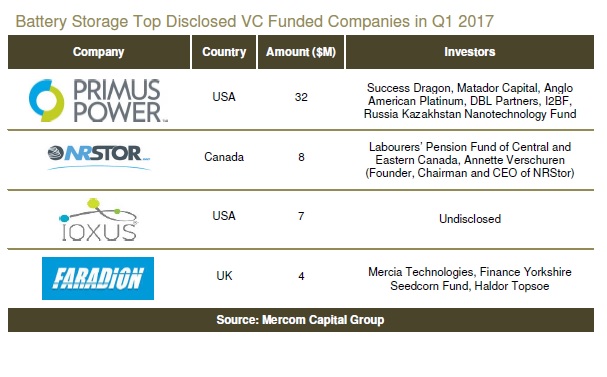

Flow battery maker Primus Power was leader of the charts in VC funding in the first quarter of 2017, securing US$32 million from a range of investors, according to Mercom Capital’s latest report.

Mercom’s quarterly “Battery storage, smart grid and efficiency funding and M&A” report found that US$58 million was raised across eight deals, involving 15 different investors or investment institutions in the first four months of this year.

By comparison the previous quarter had seen US$156 million invested across nine deals. Having said that, year-on-year the picture appears to have improved, with just US$54 million in VC cash flooding into energy storage companies in Q1 2016 in 10 deals. Notably, this time last year there was also a significant drop from the previous quarter. This time around, the average deal size also dipped in Q1 2017 to US$7.2 million, compared with US$17.3 million in the last quarter of 2016.

While Mercom said VC funding was spread across eight sub-technologies: flow batteries, energy storage systems, supercapacitors, sodium-based batteries, battery management, lead acid batteries, zinc-air batteries and of course lithium batteries. Out of all of these, and boosted by Primus Power’s performance, flow batteries raised the most cash.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Primus Power makes zinc bromide flow batteries, available in 25kW modules, designed for long duration energy storage applications. Backers include early Tesla investors DBL Partners, investment managers Matador Capital, electronics investor Success Dragon, platinum producer Anglo America Platinum, pureplay venture capital firm I2BF and the Russia Kazakhstan Nanotechnology Fund.

In second place was Canadian energy storage developer NRStor. While the amount raised was considerably lower than Primus’ US$32 million, with NRStor netting US$8.4 million in the quarter, it was interesting to see the profile of investor – part of the money came from the company’s founder and CEO Annette Verschuren while the rest was from the Labourers’ Pension Fund of Central and Eastern Canada (LiUNA). The involvement of institutional investors in energy storage is still in its early stages and this was touted as a big win by the company – especially when paired with the huge project funding agreement it reached with the pension fund.

In third place was Ioxus, a maker of devices including hybrid capacitors and supercapacitors, which raised US$6.5 million while Faradion, a UK maker of sodium-ion batteries, came fourth with US$3.95 million raised from three backers.

The headline news from Mercom’s report for the past two quarters – and indeed the 2016 full year appraisal – appeared to have been a significant rise in project funding for energy storage systems. During 2016 a total of US$820 million in project funding was reported by the firm, compared to just US$30 million in 2015. This included US$625 million raised in the third quarter. This strong showing has continued with one project fund announced worth US$152 million in Q1 2017 – also netted by NRStor from LiUNA in a separate deal to the VC funding deal.