Solar PV combined with energy storage represents a “zero-emissions threat” to gas generation in the US, according to a new report from BloombergNEF.

While PV and batteries can perform the same services and “offer similar value” to natural gas power plants, dynamics of the competitive threat posed in the US energy market by solar-plus-storage and different types of gas generation are nuanced, the analysis firm said.

As the US largely transitions away from burning coal to generate electricity, the reliance on gas, which is cheaper and emits less carbon dioxide, is growing. This can be seen in terms of both the utilisation of gas generation and in the building of new facilities. Nearly 90% of the country’s combined cycle gas turbine (CCGT) fleet ran at nameplate capacity for over 24 hours consecutively in 2019, for example.

Even as renewables capacity grows, natural gas plants are being called on to help balance the system, and these power plants have become the “workhorse of the US power generation fleet,” according to BloombergNEF.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, with over 8.9GW of solar-plus-storage projects in the pipeline in the US and another 69GW of hybrid resources in the queue for interconnection, most of which are expected to be online within three years, utilities increasingly realise that solar-plus-storage plants provide a “viable, dispatchable clean energy resource”.

Stakeholders urged to consider future needs in decision making

While natural gas remains low-priced enough to remain economically attractive in many parts of the US, around 80% of gas peaker plants – only called into action to deal with relatively short periods when electricity demand peaks – were utilised at capacity factors of less than 15% during 2019. Solar PV with storage is already economically competitive against building new peaker plants in much of the country, BloombergNEF found.

Conversely, however, while open cycle gas turbine (OCGT) plants used for peaking capacity therefore have a levelised cost of energy that solar with storage can undercut, particularly in solar-rich parts of the US, competing with CCGTs that typically provide energy and capacity for longer hours is still challenging.

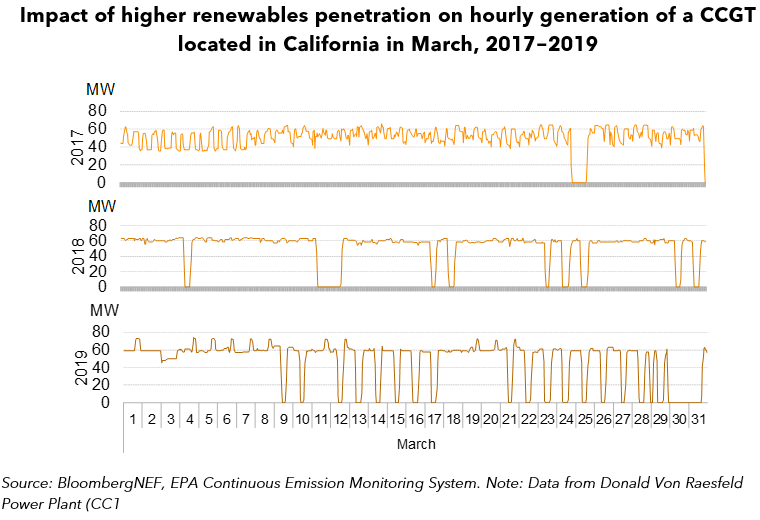

That said, in some of the US, notably in California, the rise in solar penetration is “eating into CCGT operating hours,” requiring the gas plants to shut down and start up again more frequently, increasing their operating costs due to fuel requirements and wear and tear.

As more solar-plus-storage and standalone wind and solar comes online, this dynamic will likely play out in “many markets,” BloombergNEF said. The analysis firm said that the industry, policy makers and investors should “plan for the future rather than current need,” and take this into account. As adoption of renewable energy grows, fewer hours of operation will be required by CCGTs, in other words.

Not only that, but while hybrid facilities of solar and batteries alone may not be able to displace CCGTs, combining a number of different clean energy resources including wind, solar, storage and demand-side flexibility could provide the equivalent service to the gas power plants. BloombergNEF also recognises that while there will still be a “need for some firm capacity in future power systems,” zero or low-emissions to fossil fuel gas should be explored: hydrogen and carbon capture, use and storage are among the “early-stage options” available.

Power sector emissions have been successfully reduced by the transition away from coal and the increase of renewables, but BloombergNEF said the next step is to reduce the role gas plays in power markets. This should be a particularly important consideration for regulators and utilities, because building new gas power plants today will make it much harder to decarbonise in the future – and could leave a host of expensive and under-utilised or stranded natural gas-burning assets.

The report follows on from a theme found in BloombergNEF’s levelised cost of energy (LCOE) report published earlier this year. According to an April 2020 Energy-Storage.news interview with BloombergNEF analyst Tifenn Brandily, the rapid reduction in cost for battery storage made it competitive with peaking gas plants for applications requiring up to two hours of energy, although longer-running gas generation was harder to beat. This year’s annual levelised cost of storage (LCOS) analysis published by financial advisory group Lazard also found that utilities increasingly see solar-plus-storage as cheap enough to be a viable alternative to investment in new peaker plants.

Meanwhile, recent analysis from Strategen Consulting took a detailed look at the feasibility of replacing peaker plants on New York’s Long Island and found that batteries could replace 2,300MW of the peakers in utility Long Island Power Authority’s service area – some of which use fuel oil as well as others that use gas – cost-effectively by 2030. On a related note, another utility in that state, the New York Power Authority (NYPA), has agreed to investigate cleaner alternatives for providing peaking capacity than its existing fleet of thermal generation resources. NYPA said that energy storage was among the potential options.

You can read BloombergNEF’s full report: ‘How PV-plus-storage will compete with gas generation in the US’, here.