The latest annually-published figures from financial advisory and asset management firm Lazard show that the on the levelised cost of energy storage (LCOS) continues to fall, with solar-plus-storage becoming increasingly price competitive.

Lazard said its analysis shows that storage costs have decreased across most use cases and technologies, particularly for shorter-duration applications. The firm’s LCOS report is in its sixth year this year.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

PV-plus-storage projects are said to be increasingly price-competitive as utilities look for ways to supplement retiring conventional generation resources while avoiding investments in new peaking power plants. Lazard said that long-duration storage is also gaining traction as a commercially viable solution to challenges created by intermittent energy resources such as solar or wind.

The firm noted that “sustained cost declines” were observed in its LCOS for lithium-ion technologies (on both a $/MWh and $/kW-year basis). The reductions were more pronounced for storage modules than for balance of system components or ongoing operations and maintenance expenses.

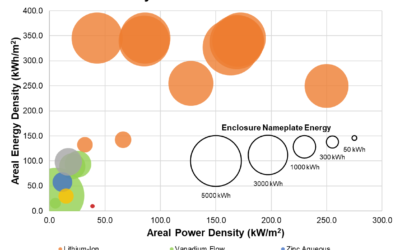

Lazard also said that while lithium-ion remains the dominant technology in 1-4 hour short-duration applications, which represent 90% of the market, “momentum in the energy storage market” appears to be trending towards favouring lithium iron phosphate (LFP) battery chemistry more frequently than before.

While LFP’s volumetric density is lower than nickel manganese cobalt (NMC), this is seen as less important for stationary storage than it is for electric vehicles – although conversely, more EV makers are also adopting LFP technologies, meaning that synergies and benefits of scaled manufacturing in the transport sector can be enjoyed by the stationary storage industry too.

While last year’s figure for LCOS for front-of-meter standalone wholesale storage was US$165-325 /MWh, that has dropped to US$132-250 / MWh in 2020. Meanwhile, solar-plus-storage wholesale went from US$102-139 /MWh to US$81-140 /MWh. Work produced earlier this year by BloombergNEF benchmarked the average LCOE of energy storage at around US$150/MWh for lithium-ion battery storage with four hours duration.

Lazard says the economic proposition of behind-the-meter projects in the commercial and industrial (C&I) sector “remains challenged without subsidies”. The consultancy added that the value proposition for C&I BTM storage appears to be shifting in some cases towards power reliability and resilience applications, with time-of-use arbitrage as a secondary benefit.

The company also said interest in long duration energy storage is growing as early pilot projects are reaching their conclusions. Long-duration storage (>6 hours) is better suited to addressing grid conditions created by increased renewable generation and climate change adaptation.

California has already decided that some long-duration energy storage will be necessary in its energy mix in the next 10 years, while Lazard drew a similar conclusion to that which market analysis firm EnAppSys recently came to when looking at Europe’s power markets: that longer duration energy storage could help mitigate the impacts of negative power pricing.

You can read the full Lazard LCOS 6.0 including full methodology here, while you can read the original version of this story, which first appeared on PV Tech and also looks at Lazard’s levelised cost of energy (LCOE) of solar analysis, here.

Additional reporting for Energy-Storage.news by Andy Colthorpe.