US asset manager Stonepeak has entered Japan’s energy storage market, forming a partnership with CATL-backed developer CHC.

The pair’s new platform was among the successful bidders putting battery storage projects in Japan’s first-ever low-carbon capacity market auction, Stonepeak revealed in a release sent to media, including Energy-Storage.news.

Stonepeak is focused on investing in infrastructure and real estate, with approximately US$65.1 billion of assets under management. The company is headquartered in New York and recently made its first investment in a 111MW/290MWh battery energy storage system (BESS) project in Australia, which is being developed by developer ZEN Energy.

Partner CHC Energy meanwhile is focused on sourcing and developing battery storage projects, with offices in Singapore and Japan.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Its shareholders include the world’s biggest manufacturer of lithium-ion (Li-ion) batteries, CATL, along with global commodity and energy trading group Hartree Partners, and private equity firm Cathay Fortune Corporation (CFC), which owns assets including upstream battery materials firms.

In August last year, Energy-Storage.news reported that CHC was about to begin construction on a large-scale BESS project on the island of Shikoku, in a JV with local utility Shikoku Electric Power. Japanese tech company Hitachi was selected to provide the Matsuyama Mikan BESS project’s battery storage equipment and associated digital platforms including energy management system (EMS).

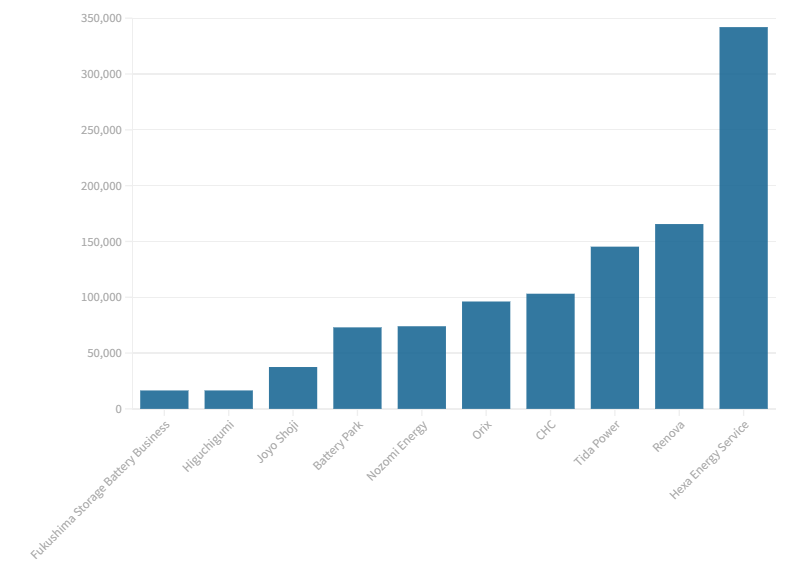

As the chart below shows, CHC was the fourth biggest winner of awarded capacity in the recent auction hosted by grid operator group OCCTO. The government-underwritten Capacity Reserve Agreement (CRA) contracts offer fixed payments over a 20-year term to help recover projects’ capital costs.

The results, announced at the end of April, included 1.1GW of wins for 32 BESS projects and 577MW across three pumped hydro energy storage (PHES) projects.

Many of the projects are concentrated on the northern island of Hokkaido and the southern island of Kyushu, both of which have become renewable energy hotspots that have limited interconnection with grids elsewhere in Japan.

In addition to the capacity market, the Japanese government has incentivised battery storage buildout through a subsidy scheme which saw the country’s first BESS assets to trade energy go into the JEPX spot market last year, and some revenues can be earned through ancillary services provision.

While Japan has been relatively slow to adopt battery storage technology at large-scale, despite being one of the countries where lithium-ion batteries were invented, it is a high per capita adopter of residential batteries and the government has promoted storage technologies in its ‘Green Transformation’ (‘GX’) policy strategy.

“As Japan accelerates the development of renewable energy projects to meet its decarbonisation goals, energy storage will have a crucial role to play in enhancing the reliability of the Japanese grid,” Stonepeak senior managing director Ryan Chua said.

“This increasing need for dependable BESS capacity, which has the long-term support of the Japanese government, is the basis for our decision to pursue this partnership with CHC which we believe will be a strong fit for our global renewables strategy.”

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.