Just over a year ago, the passing of the Inflation Reduction Act brought in what has been considered the biggest legislative action on climate seen in the US. It brought with it investment tax credit (ITC) incentives for standalone energy storage, answering one of the industry’s biggest asks of policymakers.

Ravi Manghani, director of strategy and market analytics at battery storage system integrator LS Energy Solutions discusses the impact of that answered call, and the questions for the industry that still remain.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

What the Inflation Reduction Act means for energy storage

It’s been a year since the 16 August 2022 passage of the Inflation Reduction Act (IRA), and the excitement in the renewable industry is palpable. The broader impact of the IRA on the decarbonisation of the power grid and transportation sectors has been covered at length.

The general consensus remains that the IRA will accelerate the US’s transition to net zero but may not be sufficient to get us all the way there. A few market analyses released soon after the bill’s passage in the summer of 2022 attributed an upside of 20-30% to solar, wind, and energy storage installations in the next decade.

The IRA benefits that positively impact energy storage growth are the energy community adder, qualifying advanced energy project credit (48C) programme, direct pay and transferability of ITC, and, of course, the extension of wind and solar tax credits. Notably, the energy storage sector has specific incentives up and down the value chain.

The key features of the energy storage-specific IRA benefits include the following:

a) Standalone storage investment tax credit: The industry has availed the ITC benefit on solar-paired projects in the past few years, but this is the first time that standalone energy storage is eligible for an ITC. While there are several tiers for the ITC value, it is generally accepted that most projects will at least qualify for a 30% tax credit by meeting the prevailing wage and apprenticeship requirements.

The improved storage project economics will undoubtedly lead to more storage orders and deployments. The flip side of this rapid acceleration is that it puts other headwinds under renewed focus for renewable and storage deployments, none more significant than interconnection delays.

b) Advanced manufacturing tax credit 45X: The IRA introduced a manufacturing tax credit for various clean energy technologies, including battery cells and modules, as well as inverters, although the inverter class does not explicitly list storage inverters. The bill defines inverters as “an end product which is suitable to convert direct current electricity from 1 or more solar modules or certified distributed wind energy systems into alternating current electricity.”

The industry believes this limited definition to be an oversight rather than an intended exclusion of storage inverters.

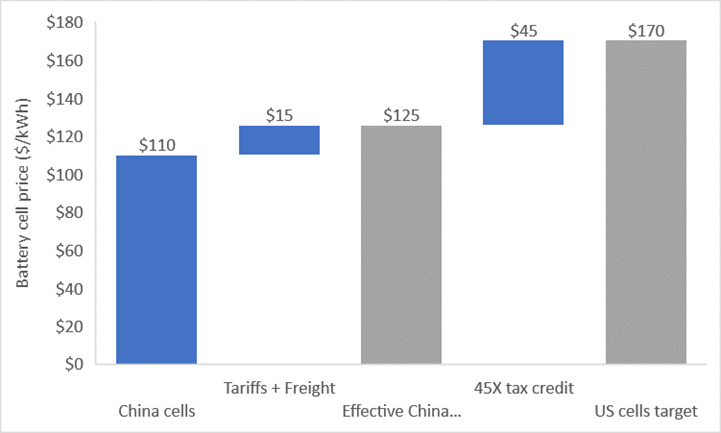

The US$45/kWh credit on US-manufactured battery cells plus modules will undoubtedly close the gap for American products. However, the jury is still out on whether it will be sufficient to make them competitive with Asian products.

For illustrative purposes, if we consider the recent lithium iron phosphate (LFP) cell prices coming from China of low US$100s/kWh, after factoring Section 301 tariffs on Chinese imports as well as the 45X manufacturing credit for US-made cells, for the US-made cells to be competitive in the market, they will need to be priced in the US$170/kWh range.

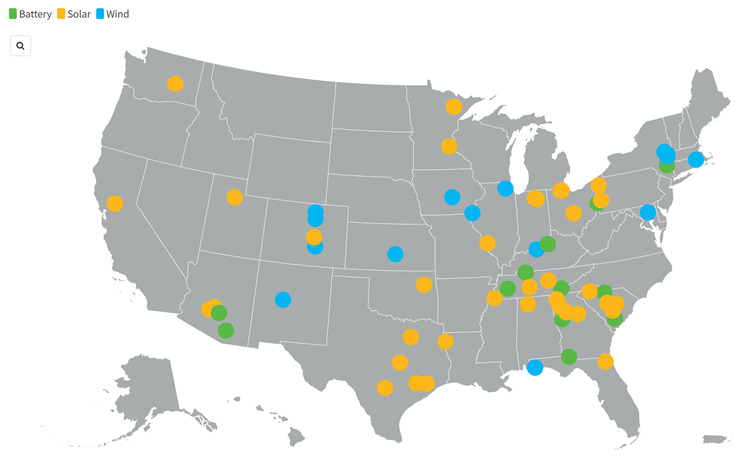

The IRA has spurred an increase in new battery manufacturing capacity announcements. Per the national American Clean Power Association (ACP), as of August 2023, 14 new battery manufacturing facilities have been announced to serve the energy storage market since the passage of the IRA.

This potential growth of manufacturing capacity should offer more domestic battery options that could reduce exposure to trade risks and freight disruptions.

The question that all system integrators will grapple with is: what will be the cost premium for domestic supply?

c) Domestic content adder: Similar to the energy community adder, the ITC also has another 10% bonus for projects using 100% steel or iron produced in the US, and at least 40% of manufactured products used in these projects are mined, produced or manufactured in the US.

May 2023 domestic content notice of intent raised more questions

The industry had been waiting with bated breath for clarification on the domestic content requirements (as it has been waiting for guidance on advanced manufacturing tax credit). Treasury and IRS issued a notice of intent in May 2023 to provide guidance on the domestic content bonus credit requirement.

The industry responded to the notice with across-the-board disappointment as the requirements box the industry into all or nothing on the bonus eligibility based on the origin of the battery cell.

While the classification of the manufactured products (MP) and their components (MPCs) are problematic, the way the NOI is written, it overexposes system integrators and battery suppliers. The cost basis in the notice is defined in terms of direct costs to the manufacturers.

Such a construct should be generally interpreted as requiring system integrators to disclose their costs and profit margins. In the industry’s view, this approach goes against the premise of “cost to the taxpayer,” who ultimately benefits from this ITC adder and not the manufacturer.

Additionally, the restrictive domestic content percentage calculations make it almost impossible to achieve without battery cells and modules and other related components such as BMS and thermal management made in the US.

These unattainable domestic content requirements have made the notice a non-starter for the industry, and the expectation is that the Treasury and IRS will be receptive to industry stakeholder feedback. In the meantime, very few projects, if any, are going into the construction phase, with the domestic content 10% bonus baked into their financial models.

Part 2 of this article will be published on Energy-Storage.news in the coming days. The Inflation Reduction Act will also be a major focus of the upcoming edition of our quarterly journal, PV Tech Power (Vol.36). You can subscribe to the journal, either as a standalone subscription here or as part of the package for Energy-Storage.news Premium. Printed and digital copies will also be distributed to attendees at the upcoming RE+ trade show in Las Vegas, Nevada (11 – 14 September).

About the Author

Ravi Manghani is director of strategy and market analytics at LS Energy Solutions, a US-based provider of battery energy storage system (BESS) solutions at grid and industrial scale and part of South Korea’s LS Group. With more than 15 years of strategy and technical experience in the energy storage and solar industries, Ravi Manghani was previously director of market intelligence at Clean Energy Associates (CEA), and prior to that led the market research teams for solar and energy storage at Wood Mackenzie.