Although vertically integrated ESS-cell suppliers retain more control over their supply chain, system integrators’ flexibility may help them in the medium-term, writes Solar Media Market Research analyst Charlotte Gisbourne.

Adapting methodology for a developing industry

Energy storage is still a nascent market when compared to the established renewable energy industries of solar and wind. As global adoption increases, market dynamics continue to evolve.

Our StorageTech Bankability Rating Report strives to represent the current state of the energy storage market, and a core part of this is adapting the methodology as needed.

As integrators gain a larger market share of end shipments, the importance of vertical integration becomes increasingly relevant to discuss.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

System integrators versus vertically integrated cell suppliers

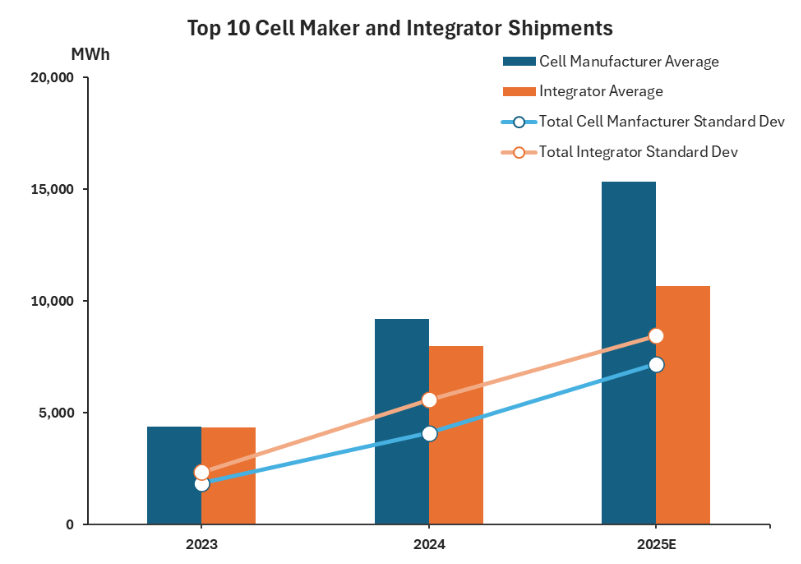

The following graph looks at the average shipments of the top 10 leading cell manufacturers and integrators from each category covered in the report.

Despite three of the top five energy storage system (ESS) suppliers by shipment volume last year being integrators, and a similar grouping expected this year, it seems to be the stand-out performance of a handful of companies rather than integrators as a whole outperforming cell manufacturers, who are still more likely to ship higher volumes.

The standard deviation, and therefore spread, of shipments from all integrators has been consistently higher than for cell manufacturers. However, for both groups, the disparity between the top players and the rest has been widening as market leaders solidify their place at the top.

The market is still relatively concentrated; the 10 suppliers with the highest shipments in the report are estimated to supply over 50% of total shipments this year. However, as the market gains traction globally, more companies are using these industry tailwinds to either expand into or place more emphasis on energy storage.

Higher growth predicted for integrators

Integrators are predicted to see higher year-over-year growth in shipments this year; having a more flexible business model and typically procuring cells from multiple suppliers means the companies are less limited by in-house production capabilities and can scale up faster.

New suppliers entering the market are more likely to be integrators given the higher investment required for cell production.

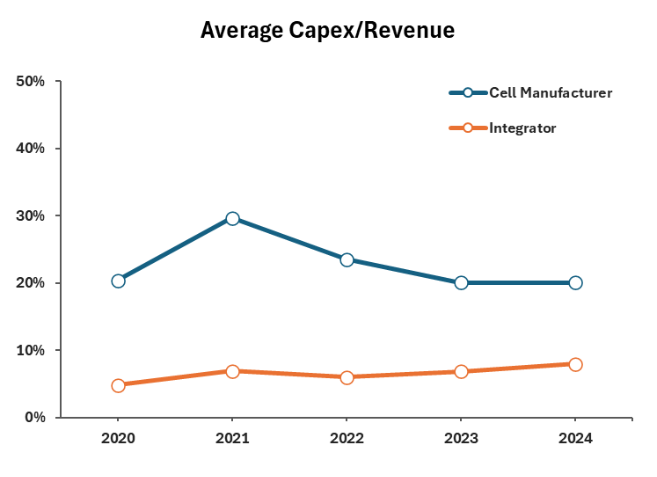

The majority of energy storage cell manufacturers also produce cells for EVs, another very competitive market, and some companies may have been heavily investing early to increase production capacity in a bid to gain market share. For example, CALB’s capex exceeded its revenue from 2020-2023.

However, with the oversupply of batteries and the resulting price fall, companies are in general pulling back on heavy investments. This may be more apparent with smaller companies who feel the capex pressure more acutely.

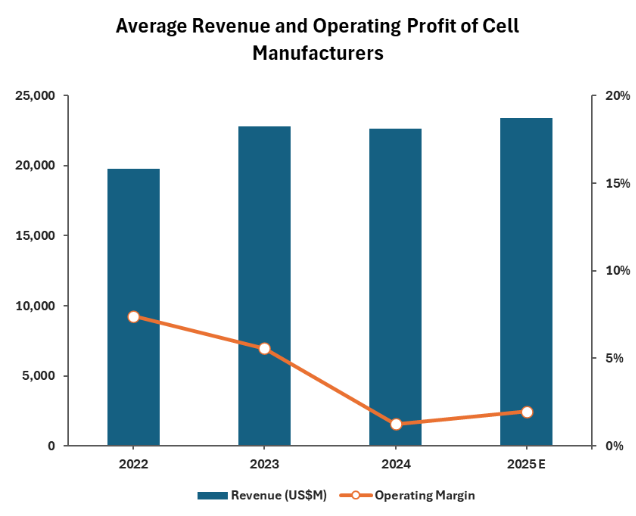

Operating margins of cell manufacturers generally follow overall cell prices. Since 2022, the decline in lithium prices and oversupply have pushed cell prices even lower, which in turn could benefit energy storage integrators.

Operating margins for cell manufacturers have been mixed so far this year, but with overseas revenue increasing for many suppliers and efforts in cost reduction, there is room for full-year margin growth.

Integrators tend to have more diversified revenue streams with ESS contributing a smaller percentage to overall sales, which could soften any blows in a potential market downturn. However, both groups are seeing ESS as a share of revenue increasing.

Conclusion

As the methodology stands, both financial and manufacturing factors are taken into account to evaluate the bankability of a company, as not just the longevity of a company is important but the continuation of its energy storage business unit.

While the financials are primarily based on the Altman-Z score, the manufacturing metric comes from a combination of cell production, assembly, and end product shipments.

Both integrators and cell manufacturers are evaluated together and in the current market, some integrators have proven themselves to be able to compete against vertically integrated suppliers.

We believe that despite cell manufacturers still having a strong place in the market with a firmer control over both supply chain and quality of components, there is a case for a reduction in the weighting of cell production in the overall manufacturing score. This has been implemented in the latest edition of the report and is set to continue under the current market conditions.

About the author

Charlie Gisbourne is a market analyst at Solar Media, focusing on energy storage systems (ESS). Her research encompasses ESS deployment across the UK and Ireland and the global upstream landscape for ESS manufacturing. She has a BSc in Physics from Durham University.