Alper Peker and Dominic Multerer of CAMOPO explain how flexibility is the key to long-term profitability for hybrid renewables-plus-storage power plants.

The energy industry is undergoing a significant transformation, driven by the need for sustainable and reliable power solutions.

One of the most promising developments in this field is the integration of hybrid energy assets, which combine renewable energy sources (i.e. PV, wind) with battery energy storage systems (BESS). This article explores the innovative approaches being implemented in the industry, highlighting the crucial role of intelligent energy management and optimisation algorithms in maximising the potential of these hybrid systems.

Solving industry challenges: How hybrid assets address real pain points

The energy industry faces several challenges that hybrid assets are uniquely positioned to address:

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

- Limited grid and interconnection capacity:

The queue for grid connection approvals is long and costly. Hybrid assets can alleviate this issue by providing ancillary services that support the grid and/or smooth renewable feed-in, reducing the need for extensive grid expansion.

- Green electricity purchasing:

Industrial offtakers often struggle to match their consumption needs with green electricity. Hybrid systems offer a reliable and flexible solution, ensuring predictable purchasing costs and consistent supply.

- Investor and asset owner needs:

Investors and asset owners seek contracted revenues with the flexibility to boost profits through merchant market participation. Hybrid assets fulfil this need by combining the secured revenues of power purchase agreements (PPAs) with the dynamic potential of merchant models.

Unlocking the dual benefit: Combining PPA stability with merchant upside

Hybrid energy assets offer a unique advantage by being able to operate in both the PPA and merchant markets. Traditionally, renewable energy projects have relied on subsidised regimes and PPAs to secure long-term, stable revenues.

On the other hand, standalone BESS projects have typically played in the merchant market, where they can capitalise on fluctuating energy prices and ancillary services.

By combining these two approaches, hybrid assets can mitigate risks and enhance profitability. This dual market capability enables independent power producers (IPPs) to be flexible and react to market changes in real-time—a necessity in today’s increasingly volatile energy landscape.

Adapting to volatility: Flexibility and risk mitigation in action

Hybrid assets provide the flexibility to switch between PPA and merchant models based on market conditions. This adaptability is crucial in an evolving energy market where the way energy is bought and sold is constantly changing.

For example, falling capture rates, negative price hours, and curtailments can significantly impact PV revenues, while saturating grid service markets can negatively affect BESS revenue streams. Hybrid systems hedge against these risks by dynamically adjusting their operational strategies—optimising for yield, not just uptime.

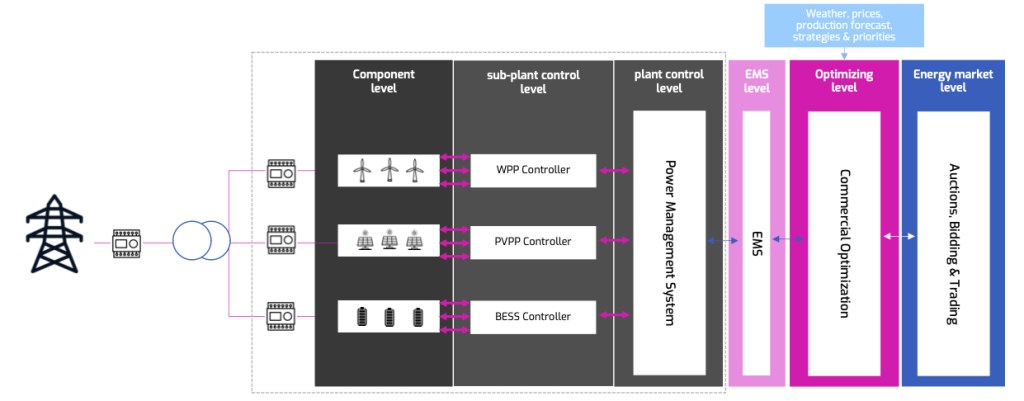

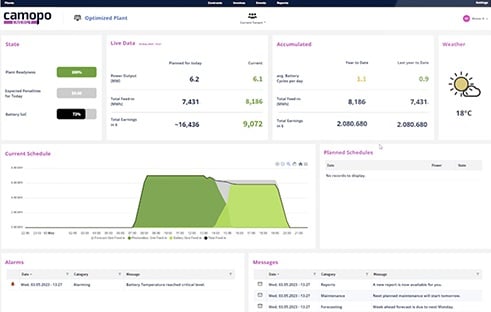

Profitability through intelligence: The role of energy management

Intelligent energy management systems play a pivotal role in optimising the profitability of hybrid assets. These systems use advanced algorithms to analyse a multitude of parameters—including energy market signals, grid constraints, weather forecasts, and plant availability—to determine the optimal dispatch strategy at any given time.

For example, during periods of low renewable output, the system can prioritise battery discharge to meet demand or PPA commitments. During peak production, excess energy can be stored for later use or sold in the merchant market when prices are favourable.

This kind of dynamic operation is impossible without software-driven optimisation, and it’s what separates high-performing hybrid plants from underutilised assets.

Case study: Project Green and the real-world impact of hybrid optimisation

In a recent project, a hybrid power plant — referred to here as “Project Green” — was developed to optimise the use of renewable energy and battery storage. This site successfully integrated PV and lithium-ion batteries into a flexible and efficient system.

The primary goal of Project Green was to fulfil a power purchase agreement while leveraging available capacity to boost profitability through merchant revenues. The results speak for themselves:

- PPA compliance was maintained through smart dispatching of stored energy during off-peak production.

- Merchant revenues were increased by timing injections to favourable market price periods.

- Operational risk was minimised through forecasting and grid-aware control strategies.

This case illustrates how the combination of hardware and intelligent control can unlock the full commercial value of a hybrid asset.

Planning for profit: Why optimisation starts before the plant is built

While much attention is paid to the operation of hybrid plants, one critical phase is often overlooked: the planning stage.

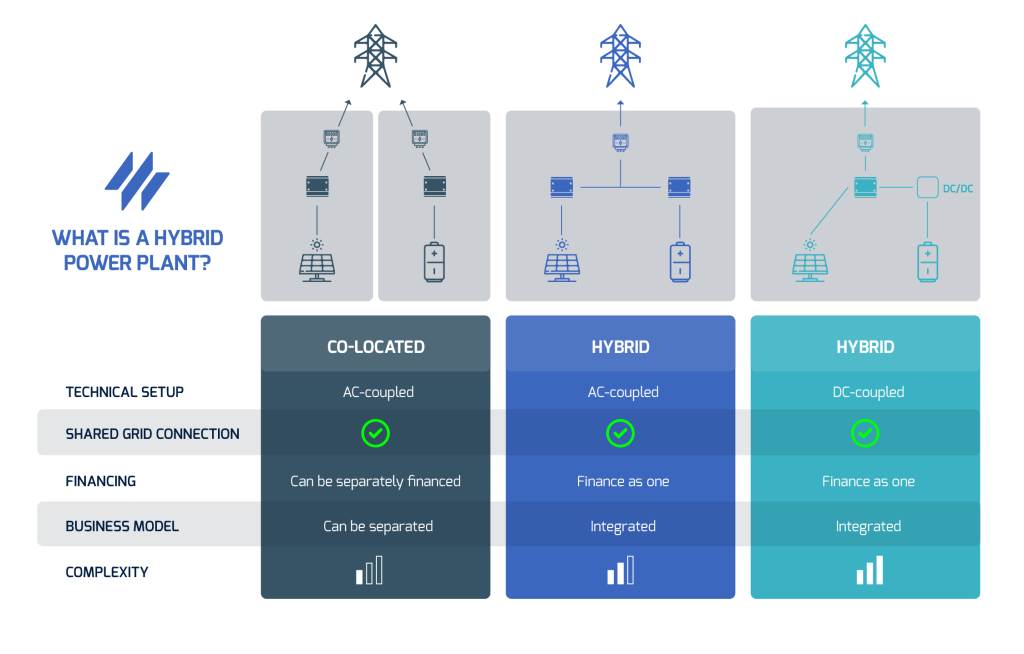

In reality, many hybrid projects today — especially co-located PV+BESS developments — face fundamental questions before construction begins:

- Will the grid grant a connection at all?

- Is AC or DC coupling the better choice for this site?

- How should we split the project between PPA and merchant?

- What BESS sizing provides the best return?

This is where CAMOPO comes in.

CAMOPO’s approach: Simulation-based project design and optimisation

At CAMOPO Energy, we go beyond real-time operations. We help developers, investors, and IPPs answer critical questions early in the development process through simulation-based feasibility studies.

Our service enables:

- Evaluation of AC vs. DC coupling – helping you choose the right integration model for your asset.

- Revenue stream modeling – including PPA, merchant market participation, and ancillary service stacking.

- Battery sizing & control strategy optimisation – to match site-specific generation patterns and market behaviour.

- Split-model analysis – to determine how much of your project should be dedicated to contracted vs. merchant sales.

This provides a solid foundation for informed investment decisions, reducing uncertainty and making hybrid projects bankable, long before the system goes live.

Conclusion: A smarter way to build the future of energy

The energy transition demands new thinking. Hybrid power plants are no longer a niche — they are quickly becoming the gold standard for future-proof, flexible energy generation.

But flexibility alone isn’t enough. Success depends on how smartly these assets are planned and operated.

That’s where intelligent optimisation and data-driven simulations make the difference—and where CAMOPO delivers real value. Whether you’re still sizing your asset or ready to bring it online, our tools and expertise help you:

- Design smarter projects

- Reduce risk

- Maximise long-term returns

We believe the future of renewables is hybrid, and the future of hybrid is intelligent.

Want to find out how CAMOPO can support your next project?

CAMOPO is globally active in hybrid PPA optimisation and across a full range of services in Europe. Visit www.camopo.com or contact us directly to start the conversation.

About the Authors

Alper Peker is a product manager at SMA Solar Technology AG and responsible for CAMOPO.com, a commercial optimisation software for hybrid power plants. His focus is on the development of digital products and business models related to the integration of renewables into the energy market. This includes especially solutions for the optimised plant operation of power plants. He has extensive experience in the energy market and energy management.

Dominic Multerer supports and advises CAMOPO on commercial topics with a focus on marketing, sales, and strategic orientation. He supports to integrate the CAMOPO software solution in SMA AG’s global solutions portfolio for Large-Scale Projects. For CAMOPO, he is the first point of contact for interested investors, developers, IPPs, etc. With his experience in building new and digital business models, he is a valuable support to the team and is very familiar with the subject matter.