Interest in hydrogen is scaling up fast around the world, and in the UK the government published a strategy last year for its role in achieving net zero emissions by 2050. Solar Media Market Research analyst Mollie McCorkindale offers insights into the country’s green hydrogen sector.

Green hydrogen has recently emerged as a key component within the UK’s overall drive to ‘net-zero’, with many project developers and investors now prioritising this segment by entering into partnerships to develop new sites across the UK.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The UK government has been vocal in wishing to establish a ‘goal’ to reach up to 5GW of low-carbon hydrogen production by 2030, including aims to replace up to one-fifth of natural gas with green hydrogen.

Hydrogen production is considered by many as essential in decarbonising the energy system and is being promoted as a possible replacement for industrial and domestic gas supplies.

However, hydrogen is only likely to be optimal for decarbonisation if it is ‘low-carbon’, readily available, and with minimal capital investment. Hydrogen can be used in fuel cells or combusted in a boiler, turbine or engine to generate heat or electricity, while producing no carbon emissions.

New investment has now started to flow into various projects in the UK, with a number of pilot plants already successfully completed, followed now with plans for large-scale electrolyser plants.

This article outlines the scale of project development underway within the UK, utilizing new analysis compiled by our in-house market research team and taken from the first release of the new UK Green Hydrogen Project Database Quarterly Report.

Hydrogen production options

Hydrogen can be produced through a wide range of technologies and chemical reactions, with the current nomenclature categorising them by source of energy input (solar, nuclear, etc.) and chemical process.

Current hydrogen production in the UK is mostly created from fossil fuels, using steam methane reforming, without capturing any of the carbon emissions; this is categorised as grey hydrogen.

When hydrogen is produced in the same way with carbon emissions captured and stored, it is considered low-carbon hydrogen production and is categorised as blue hydrogen.

Green hydrogen refers to hydrogen produced through electrolysis (splitting water into hydrogen and oxygen), when powered by renewable energy. This is considered zero-carbon hydrogen production as no carbon emissions are produced throughout the process.

British companies such as ITM Power, Johnson Matthey and Ceres Power are already producing technology for low and zero-carbon hydrogen facilities, with ITM Power having emerged as the current front-runner for green hydrogen technology.

When tracking the smart money from institutional investors, green hydrogen is seen to be a clear favourite.

There are many reasons for this: the ability to own facilities, decoupled from legacy carbon-generating entities; using co-owned or readily available renewables (in particular solar) as the input energy source; minimal capex risk by scaling from pilot-line to mass-production phases over time; demonstrated results to-date; and creation of a fully-renewable/zero-carbon eco-system.

Therefore, when looking at the different hydrogen production schemes in operation and planned within the UK, we focused our efforts in understanding exactly what was happening within the green hydrogen segment.

Rapid growth of UK’s pipeline for green hydrogen

The pipeline of projects in the UK for green hydrogen plants has grown in recent years, and now stands at 484MW across 34 different sites.

Project sizes range from 10kW to 200MW. Currently, the installed capacity for green hydrogen is just 13 MW (across 33 sites); most of these projects are either hydrogen refuelling stations or green hydrogen pilot plants.

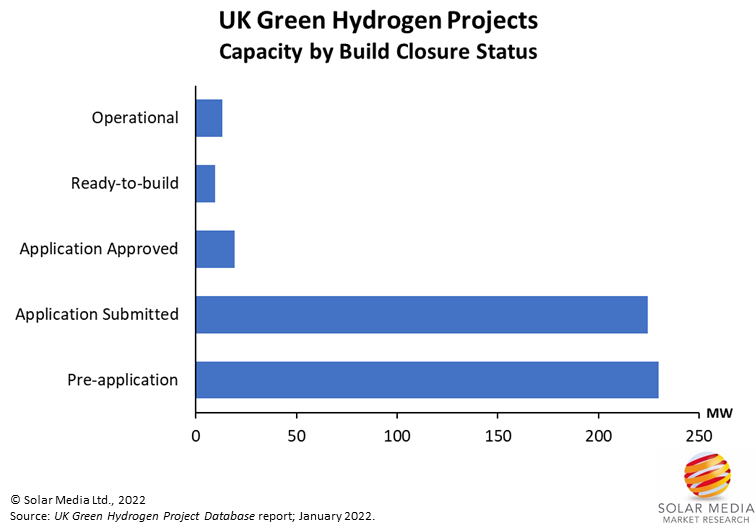

Some of the large-scale projects (>50MW) are still at the pre-application stage and are yet to submit applications to the local planning authorities. The remaining planned large-scale projects have submitted applications but are still awaiting approval. The graphic below shows planned green hydrogen capacity within the UK by build-closure status.

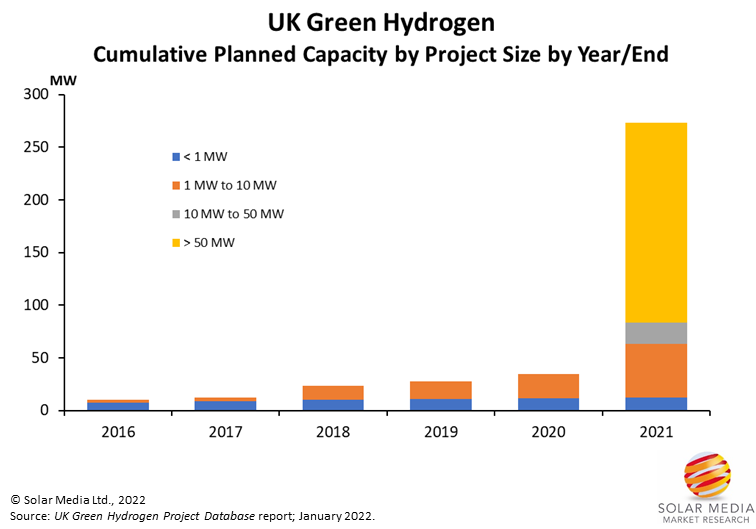

The following graphic shows the cumulative planned capacity for green hydrogen projects where an application has been submitted. Most applications so far have been small-scale or pilot plant proof-of-principle designs (<1MW capacity). The sharp uptick in 2021 is coming mostly from large-scale planning (>50MW), in particular the 200MW site being developed by Carlton Power.

Our in-house research team has been actively tracking green hydrogen projects, and we can announce now the release of a new report that tracks and audits each of these projects, including details on project size, technology, construction, planning and location.

For details on how to access the report and subsequent quarterly updates, please contact us through the report landing page here.

If you would like to learn more about the UK green hydrogen market, we will be hosting a webinar to discuss key findings and provide details and analysis on the projects. The webinar, ‘Understanding Green Hydrogen Development across the UK – Planned & Operational Projects,’ on 17 February 2022, is free to attend and you can register through the link here.