While 12 projects won awards in the first tranche of Greece’s recent grid-scale energy storage auctions, what of the c.500 totalling nearly 27GW that didn’t? Jon Ferris, LCP Delta’s Head of Flexibility and Storage, looks at the dynamics which could play out in rounds two and three in Europe’s fourth largest market by 2030 pipeline.

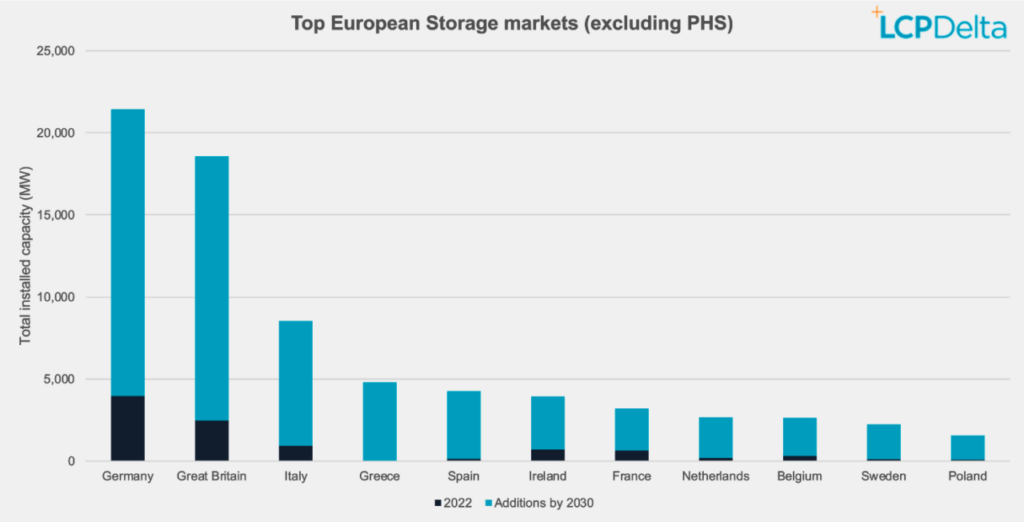

Greece: fourth largest 2030 BESS pipeline in Europe

Greece has emerged as one of the countries with the largest pipeline of battery storage projects, but as yet there has been little activity on the ground. This is changing as the long-awaited storage subsidy auctions have started, with the first projects being awarded support for both investment and operating costs.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The need for storage in Greece will accelerate rapidly over the next decade as renewables targets are revised upwards and coal plants are closed. The pivot to gas, a core part of the country’s energy strategy just a couple of years ago, has been upended by the disruption to supplies and price volatility caused by Russia’s invasion of Ukraine. The national target for storage, set in the 2019 National Energy and Climate Plan at 2.3GW of new capacity, is due to increase to 8GW in the 2023 NECP revision.

However, based on current policies, the country looks set to hit only 4.8GW of operational battery storage capacity by 2030, as shown in the above infographic from LCP Delta’s STOREtrack market intelligence platform covering energy storage across Europe.

While support is available for co-located projects that address grid congestion, and to replace diesel generation on islands, grid scale storage has lagged other countries. The long term business case for storage will be supported by increasing interconnection, opening ancillary services and Greece’s accession to the market coupling platforms, but until then, public funding is required to kickstart investment.

Funding was first announced in 2021 as part of the National Recovery and Resilience Plan. Initially a response to the COVID 19 pandemic, the focus has pivoted to support Greece’s green energy transition. The storage auctions themselves require further approval under EU State aid rules.

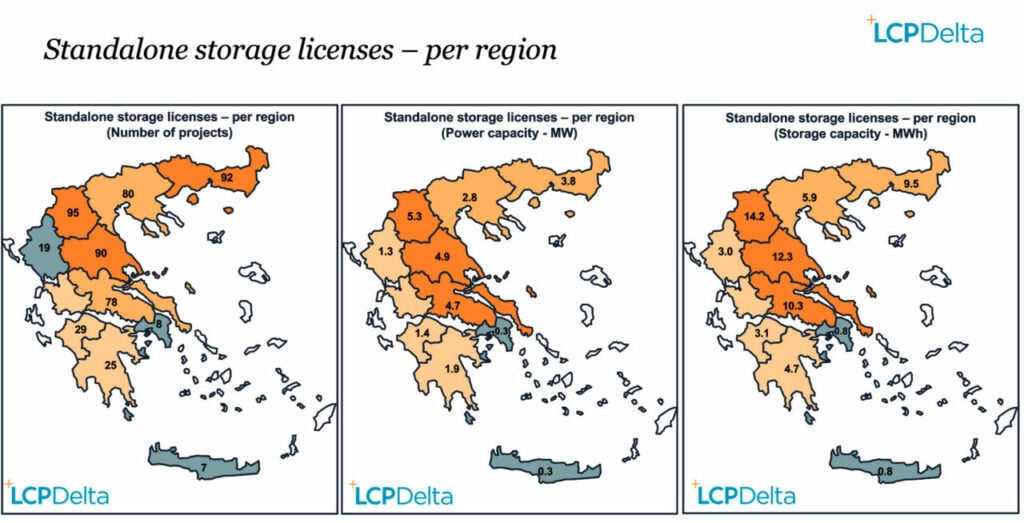

The pipeline of prospective battery storage projects now approaches 27GW, with over 500 projects granted a storage license.

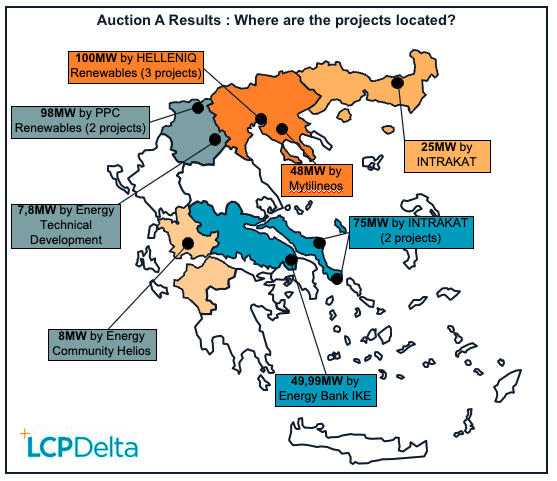

With support for 1GW of battery capacity to be auctioned 3 tranches this year, the results for the first auction of 400MW have been announced with a few winners, but lots of losers. Two more tranches are due to be auctioned later this year, with success and failure in the first having implications for companies’ bidding strategies.

Overall 3.3GW of capacity bid in the first auction, all required to have a storage license, be able to demonstrate funding, and commit to installation in 2025 of a minimum 2 hour duration battery. Further restrictions complicated the bidding process, including a maximum capacity of 100MW per project and 300MW per region, and no participant allowed to win more than 25% of any auction. These restrictions meant that Eunice and Piritium both bid 50MW for projects licensed at 250MW/1000MWh and 150MW/450MWh respectively.

Projects were then awarded support in merit order, with the exception of Taxiarches Energy Storage’s 100MW project which would have taken capacity above the 400MW limit. While the winning projects bid less than €60k/MW, most bids sought more than €70k with higher prices missing out.

While funding was awarded to established Greek companies, notable losers included Eunice and TERNA Energy. Significant international entities also missed out , with Iberdrola submitting 2 projects totalling 90MW, and Aquila Capital’s 30MW bid.

This still leaves over 23GW that did not enter the auction. For some of the more speculative projects, the need for a bank guarantee likely prevented participation in this round. Restrictions on participation in future auctions mean that PPC, HelleniQ and Intrakat have all reached the 100MW limit and cannot bid into the second auction, while Mytilineos can only bid 50MW of its 1GW pipeline. PPC also have a 1GW portfolio of projects that is excluded from the second tranche, due to be awarded in Q3.

In theory, a company can win 250MW across all 3 auctions, but in practice the mix of restrictions will limit them to 175MW. To add to the challenge, the third auction is restricted to projects in specific regions where lignite plants are closing, and for batteries with a 4 hr duration. 6.2GW of projects have storage licenses in those locations, but due to the capacity limit on companies, some projects will not be able to bid into this auction.

So what does this mean for prices in the upcoming auctions? The second auction will award up to 300MW, lower than the first and with significant overcapacity expected to bid. Price expectations will be anchored around the prices achieved in the first auction, and we are likely to see bids around the lower end of the successful range.

The additional locational restrictions of the third auction, combined with the 4 hour requirement and companies filling their quotas in the first 2 auctions means that the derated capacity able to bid will be much lower. Prices are expected to reflect this, and outturn higher than the earlier auctions.

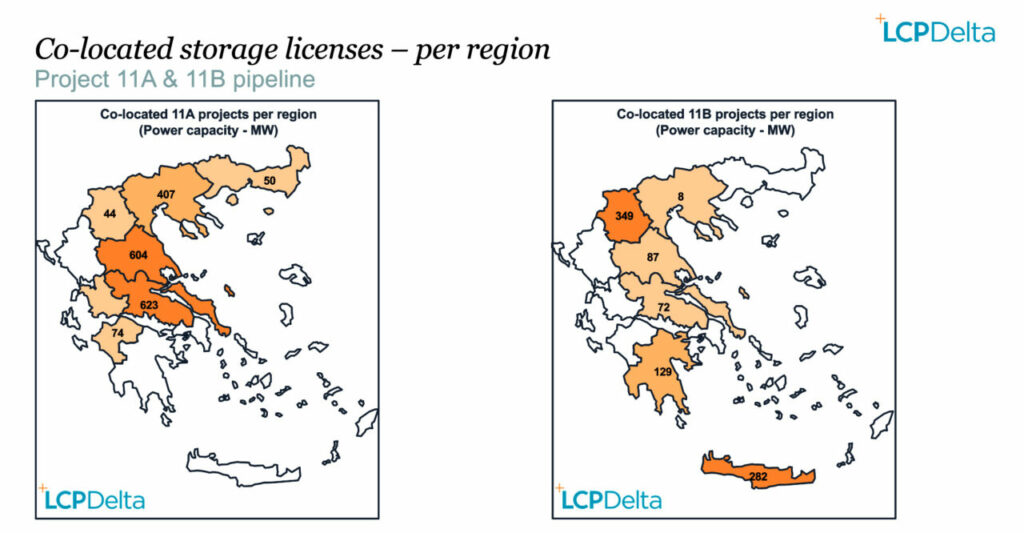

There are further opportunities for storage in Greece, with a new 680MW pumped hydro project also awarded funding, while grid congestion preventing renewables connecting is being addressed with batteries being awarded co-location licenses. As in Spain, hybrid projects with co-located batteries that charge from the grid lose access to renewables auctions, however this has not deterred projects applying for 11B licenses.

Greece is finally emerging as the next big opportunity for storage in Europe, but to gain first mover advantage companies have both had to have been preparing for years, and to commit ahead of all markets opening.

What is STOREtrack?

STOREtrack is Europe’s leading database of storage projects, helping you keep your finger on the pulse of the European energy storage markets. The database tracks the deployment of storage across 28 countries, detailing the companies involved in each project and their role, as well as project technologies, milestones, segments and technical characteristics.

Delivered through an intuitive web based interface, users can easily interrogate both individual country and aggregate pan European trends, identify key players from role-specific leaderboards, track project evolution, and target business development opportunities.

Click here for more information or here to view the free version.