In this blog, Kashish Shah, market development manager at Wärtsilä Energy Storage, argues that Australia’s complex battery storage market, with lengthy approval timelines and high risks, makes full-scope system integration the most viable path for successful project delivery.

In a market such as Australia, where timelines are long and risks are high, choosing full-scope integration remains the most viable path toward successful delivery and lifetime operation of battery energy storage systems (BESS) projects.

Australia’s energy storage market is at an inflexion point. With demand peaking and a flood of suppliers entering the space, developers face increasingly complex decisions that now go far beyond headline dollars-per-kilowatt-hour ($/kWh) pricing.

The supply side is evolving rapidly, with traditional battery storage OEMs, inverter manufacturers, and solar developers all offering BESS solutions. At the same time, developers are being approached by an expanding field of ‘partial-scope’ providers, who offer pieces of the system but not full accountability for performance.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Additionally, standalone software providers are entering the mix with battery management systems (BMS), power plant controllers (PPC), and market revenue optimisers.

At the same time, falling battery prices and gigawatts of new capacity – supported by competitive revenue mechanisms such as Capacity Investment Scheme Agreements (CISA), Long-Term Energy Service Agreements (LTESA) and the Firm Energy Reliability Mechanism (FERM) – are driving downward price pressure and intensifying the temptation to pursue lower cost, multi-vendor configurations.

From the outside, it may look like a race to the bottom, where the cheapest $/kWh wins. While this might be true for many global markets, Australia is different. Here, developers must find solutions that are not only cost-competitive but also meet stringent technical, regulatory, and bankability requirements that leave little room for integration misalignment.

The rise of self-integration – and its risks

Some developers, seeking cost advantages, are turning to self-integration—handpicking suppliers for components such as the power conversion system (PCS), power plant controller (PPC) and BESS, then contracting an engineering, procurement and construction (EPC) partner for delivery. While this approach can reduce upfront costs, it introduces significant risks given Australia’s unique development hurdles.

This contrasts with partnering with an experienced, full-scope integrator that can support the grid connection process, tailor project design to site-specific requirements, and ensure performance standards are met throughout development and operation through a single point of accountability.

Development Hurdles and Associated Risks

1. Grid connection approval

Securing grid connection approval is the first major challenge—and one with the longest lead time. The process begins with an early Connection Enquiry, working with grid consultants to fine-tune the models and prepare the Generator Performance Standard (GPS) submission package, locking in the PCS and PPC models at the outset.

This step is critical because the approval can take up to two years or longer, and any midstream changes to equipment or suppliers may require resubmission, causing costly delays to the project’s timeline and jeopardising contractual milestones.

Developers who choose self-integration often delay selecting the BESS until grid approval is granted. While this approach offers flexibility and bargaining power on the supply deal, it comes with trade-offs. Chief among them: losing the benefit of integrated performance warranties across BESS, PPC, and BMS systems – something only a handful of full-scope suppliers provide.

2. Financing

Once grid approval has been achieved, financing becomes the next hurdle.

Lenders increasingly favour projects with:

- Proven local market experience

- Strong parent company guarantees

- Minimal subcontracting complexity

- Long-term service agreements

These factors directly influence risk perception and the ability to reach financial close.

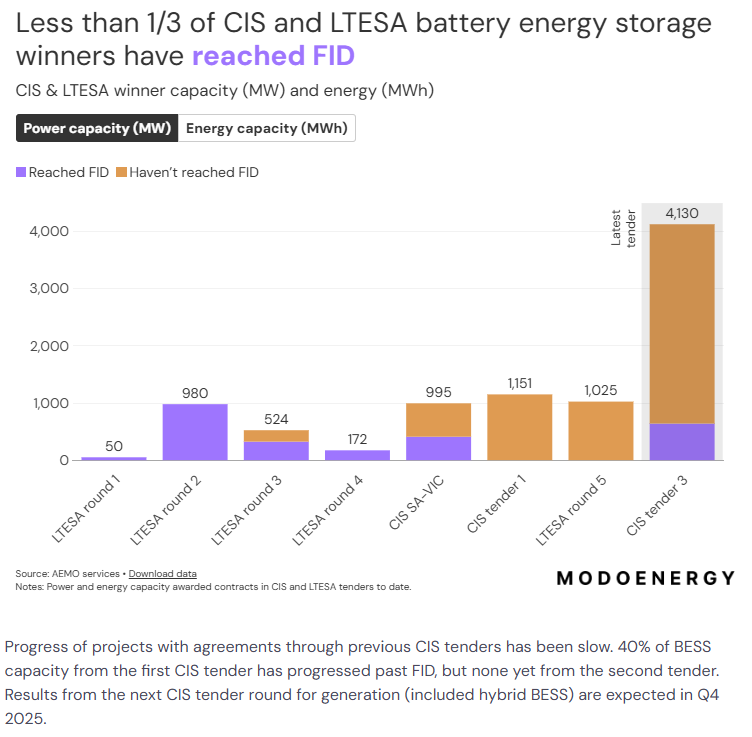

Despite a strong state-backed support and endorsement for development, many projects are struggling to move along. More than two-thirds of the BESS projects awarded in CISA and LTESA have not yet reached financial close. Some of these contract awards date back to more than 18 months in programmes such as CIS South Australia-Victoria.

There is a strong possibility that the projects lack some of the above-mentioned factors for the banks to be comfortable in lending to them.

3. Delivery and commissioning

After financial close, attention shifts to delivery, commissioning, and testing. While these steps seem routine, BESS projects often encounter unexpected challenges that can lead to delays and cost overruns.

Hidden risks: Noise and fire safety

Noise mitigation is emerging as a critical issue as BESS sites move closer to residential areas. Unlike hardware or software fixes, noise requires site-specific solutions – without them, projects risk capex blowouts or penalties.

Similarly, fire safety and cybersecurity require early and proactive engagement with authorities, communities, and project owners, necessitating a true project partner rather than a mere supplier who only delivers equipment without assuming full compliance risk.

Why full-scope integration matters

Wrapped integration – where a single entity assumes responsibility for design, supply, and integration – offers a powerful and trusted solution to these challenges. It simplifies contractual structures, accelerates grid connection approval, and enhances bankability by consolidating accountability. It also offers a better chance for “repeat business” versus self-integration with multiple vendors for BESS supply.

The Energy Storage Summit Australia 2026 will be returning to Sydney on 18-19 March 2026. To secure your tickets and learn more about the event, please visit the official website.

About the Author

Kashish Shah, based in Australia, is a market development manager at Wärtsilä Energy Storage. Kashish Shah previously worked for organisations such as Wood Mackenzie and the Institute for Energy Economics and Financial Analysis.