Europe is on track to reach 100GW of cumulative energy storage deployments this month, according to new analysis from LCP Delta and Energy Storage Europe.

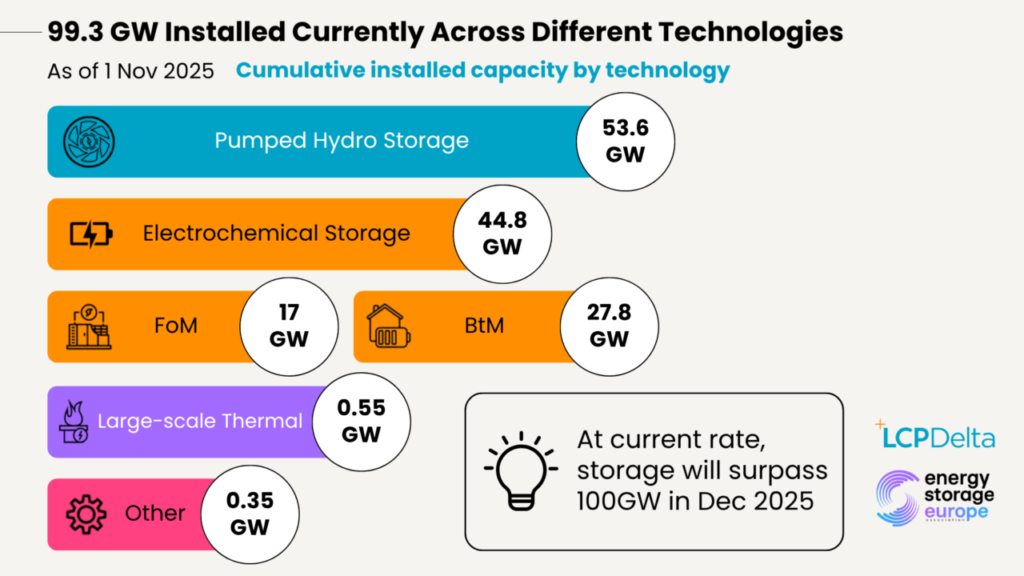

As of the beginning of November, 99.3GW of energy storage had been deployed to date across various technologies, according to the report from market intelligence organisation LCP Delta and trade association Energy Storage Europe (formerly the European Association for Storage of Energy, EASE).

The new interim version of their annual report, the European Market Monitor on Energy Storage (EMMES), tallied installations and pipeline forecasts, finding that the European Union (EU), the UK, Norway and Sweden are collectively on track to hit the century mark before December.

The technology split is still dominated by legacy pumped hydro energy storage (PHES) plants, which represent 53.6GW of cumulative installs, including 500MW of new projects commissioned this year in Belgium and Austria.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Meanwhile, electrochemical storage was unsurprisingly second with 44.8GW, having seen 4GW of additions during the year, alongside 0.55GW of large-scale thermal energy storage (TES) and 0.35GW of other technologies deployed.

Energy Storage Europe policy head Jacopo Tosoni said that energy storage is now “Europe’s fastest-growing clean technology,” with the “potential to become the engine” of European competitiveness on the international stage.

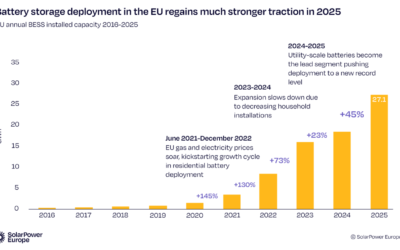

The most recent full edition of the report, EMMES 9.0, was published in March and found that during 2024, 11.9GW/21.1GWh was installed across all scales and segments of the market. Cumulative installations reached 89GW by the end of the year, making this a record-breaking year.

While Tosoni and LCP Delta energy storage lead Silvestros Vlachopoulos said there is a need to keep developers and investors engaged and put the right policies in place, their two organisations said Europe is just getting started.

“Reaching 100GW of installed energy storage across Europe is a key moment for the market. It not only unlocks more space for renewables on the grid today but sets the stage for even faster growth in the coming years,” Vlachopoulos said.

“Keeping investors and developers engaged will be essential to scaling projects and providing the flexibility needed for Europe’s 2030 targets.”

Tosoni, meanwhile, highlighted that “with the right policies, energy storage can maximise our homegrown green energy while lowering bills for households and industry alike.”

Tosoni told Energy-Storage.news that 115% growth is forecast by 2030 across Europe, “freeing up much-needed space for renewables on the grid.”

In 2022, re-dispatching energy to manage grid congestion cost Europe around €5 billion (US$5.77 billion), Tosoni said.

“Without further flexibility, European Commission–linked projections suggest these costs could rise to €103 billion by 2040. More storage isn’t a luxury; it’s a strategic necessity. And the deployment data is starting to show that,” the Energy Storage Europe head of policy told the site this morning.

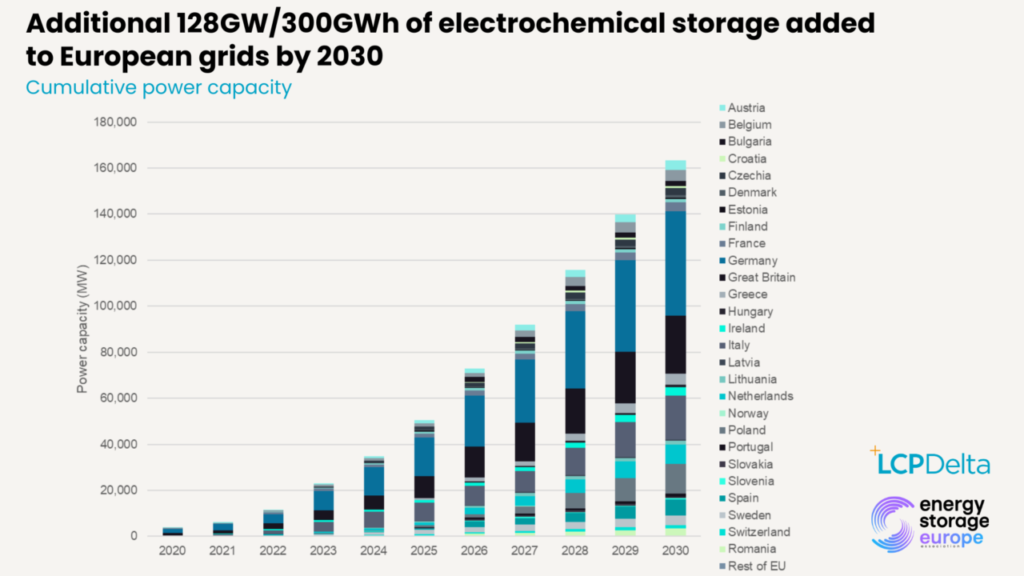

EMMES 9.5 forecast cumulative capacity to surpass 215GW by 2030, including around 160GW of battery energy storage system (BESS) assets. The rate of deployment is set to accelerate, reaching 20GW to 25GW a year by the end of this decade.

Between 2020 and 2030, that equates to an additional 128GW/300GWh of electrochemical energy storage added to grids across Europe in the analysis.

Front-of-the-meter vs behind-the-meter split

Growth in the utility-scale BESS market segment will likely see the most aggressive growth.

While installs between now and 2030 will peak in 2026, driven by support schemes in specific countries and the EU Recovery and Resiliency Facility programme, before a drop in 2027, the EMMES authors forecast 2026 to see more than 15GW of new additions. That level is also expected to be reached in 2028, 2029 and 2030, following a decline of approximately 3GW in 2027.

Unlike the US, the European market has long seen behind-the-meter (BTM) customer-sited installs outpace front-of-the-meter (FTM), and the latest figures show that BTM installs reached 27.8GW and FTM 17GW by the beginning of November.

That bears out in installs to date for the year, with 4.1GW of FTM additions to 7.3GW of BTM, in both cases already reaching or surpassing the 2024 totals. That said, the gigawatt-hour capacity numbers are very close, with 11GWh of FTM capacity and 10.6GWh of BTM added in the first ten months of this year.

Of the two BTM market segments: residential and commercial and industrial (C&I), residential storage has seen significant growth to date due to subsidy schemes and concerns over electricity prices, while the growth of C&I has been slower, but in recent months has been steady, according to EMMES 9.5.

Europe now has 18 million solar homes and four million with battery systems. Although higher borrowing costs and cost-of-living pressures subdued demand in 2024, the authors see electricity price uncertainty as a driver of activity through 2030.

Germany (2.1 million) and Italy (780,000) lead Europe for cumulative home battery installs, with the UK third (280,000), which matches the three countries’ status as leading adopters of home solar PV.

C&I, the slowest-growing market segment in both the US and Europe, is expected to see between 500MW and 600MW of installs this year, a similar number to 2024, but steady growth is expected to take annual installs beyond the gigawatt mark by 2030.

This is due to the market being driven by businesses looking to reduce energy costs, improve operational efficiency and maximise use of renewable energy, the authors said. In other words, C&I will become increasingly mainstream, and residential numbers are expected to recover from 2027 as the solar PV market is anticipated to rebound.

ESN Premium subscribers can read our two monthly series of BESS deployment and pipeline data: one from our colleagues at Solar Media Market Research, on activity in the UK market, the other from Benchmark Minerals’ battery arm Rho Motion, highlighting global statistics and trends.