European Union (EU) countries deployed record-breaking battery storage capacity for the 12th consecutive year in 2025 but must accelerate deployment further still to meet clean energy goals.

That was a headline takeaway from the EU Battery Storage Market Review 2025, a new report from trade association SolarPower Europe, published this week and launched yesterday with a webinar featuring industry and regulatory representatives.

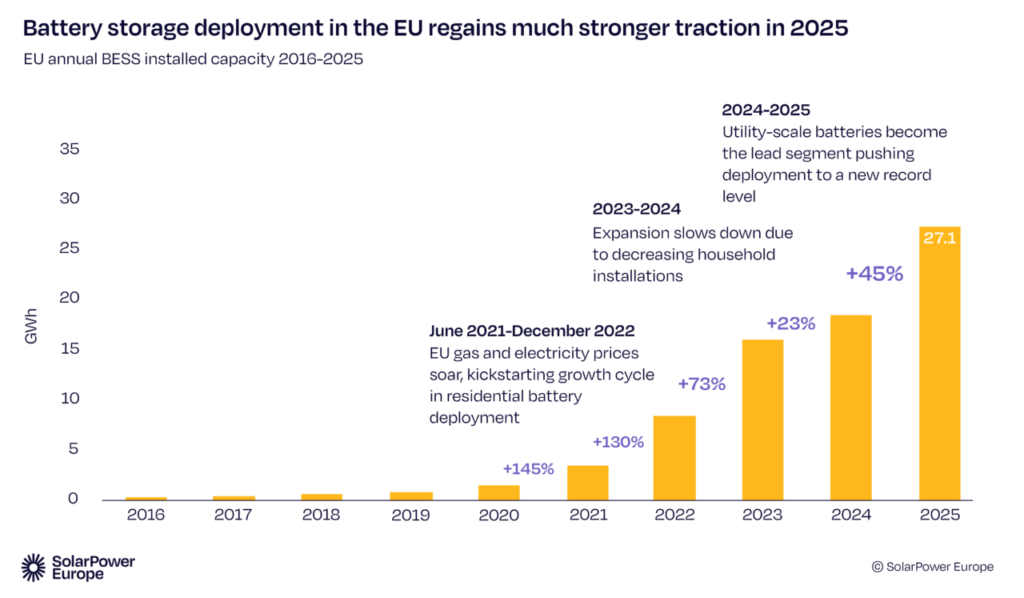

As noted yesterday in an ESN Premium article on financing European energy storage projects and portfolios, the report tallied 27.1GWh of new battery energy storage system (BESS) installations across EU Member States for last year, a 45% year-on-year growth from 2024.

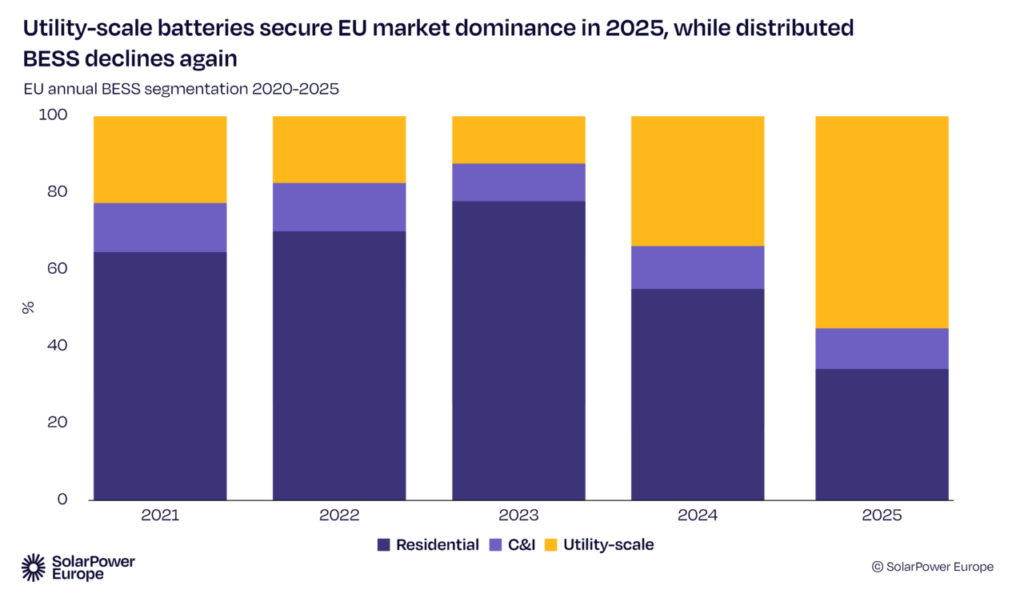

In addition to marking the 12th consecutive record-breaking year and the resumption of high growth after a relatively subdued 23% increase from 2023 to 2024, SolarPower Europe found that it was also the first year in which utility-scale BESS installations outpaced distributed residential battery adoption in the EU.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In the report’s foreword and introduction, SolarPower Europe’s CEO Wallburga Hemetsberger, deputy Dries Acke, and director of market intelligence Michael Schmela said that the report, however, carried a “dual message of progress and warning”.

Not only does energy storage need to repeat its ~10x growth over the next five years—from around 7GWh of cumulative installations in 2021 to 77GWh today—and push toward 750GWh by 2030 to meet EU clean energy objectives, but there also needs to be growth across all three segments: utility-scale, commercial and industrial (C&I) and residential in that time, the authors wrote.

In total, 15GWh of utility-scale BESS was deployed last year in the bloc, representing 55% of total annual installed capacity, with around 15% of new BESS co-located or hybridised with solar PV.

While 2024 had been a relative “breakthrough year” for utility-scale with 6.5GWh deployed, the segment’s performance that year had been hampered by factors including regulatory barriers, grid connection delays, uncertain revenue streams, skill shortages and high upfront investment requirements, according to the report.

Italy was the leading utility-scale market in 2025, with projects awarded in previous years’ auctions commissioned, followed by a growing merchant market driving activity in Germany.

Meanwhile, Spain and Bulgaria were notable in achieving gigawatt-hour (GWh) levels of utility-scale installations for the first time, Sweden and Finland exceeded 1GWh between them and France and the Netherlands came close to reaching the GWh-scale.

Commercial and industrial (C&I) installations saw 31% growth in 2025, hitting 2.3GWh of annual deployments, or 8% of the 27.1GWh total. SolarPower Europe said this is well below the segment’s potential due to limited use cases for C&I applications that still focus primarily on solar PV self-consumption and peak demand charge avoidance (peak shaving).

The residential market, conversely, declined by 6%, with 9.8GWh deployments in 2025, and the scaling down of support schemes in specific countries was not sufficiently offset by new schemes introduced in others.

This follows a boom in residential installations seen in 2022 and 2023, when rising electricity prices following Russia’s invasion of Ukraine were a significant driver of sales. With the energy cost crisis less of a factor, growth in installations had also fallen in 2024, but the residential segment still represented the largest share of deployments (56%) that year.

Deployment growth across all segments, manufacturing value chain investment needed

The EU’s battery manufacturing base has grown but still represents an incomplete value chain, particularly for stationary energy storage. There was around 252GWh of nominal battery cell production capacity within the bloc as of 2025, but over 90% of that existing capacity is for electric vehicle (EV) batteries, with about 55% nickel manganese cobalt (NMC), 29% lithium iron phosphate (LFP)—the sub-chemistry most commonly used in BESS applications—and the remainder comprising 15% nickel cobalt aluminium oxide (NCA) and 1% ‘other’.

Within the EU, upstream cathode and anode manufacturing capacity is very limited, though electrolyte and separator production has grown.

“This year’s data shows that the EU storage market is picking up speed again, particularly in large-scale systems. At the same time, the decline in distributed batteries reminds us that we still need clearer policy support to unlock more investments for businesses and households. EU battery manufacturing has made significant progress over the past years, but uncertainty remains,” said SolarPower Europe analyst Antonio Arruebo, the report’s lead author.

“Batteries remain renewables’ best allies, essential to integrate clean power, stabilise the system and deliver Europe’s energy transition. Looking ahead, accelerating deployment across all segments will be key to meeting Europe’s goals.”

Energy-Storage.news publisher Solar Media is hosting the Energy Storage Summit EU 2026 in London, UK, on 24-25 February 2026 at the InterContinental London – The O2. ESN Premium subscribers can get exclusive discounts on ticket prices. See the official website for more details, including agenda and speaker lists.