Ed Porter is the Business Development Director at Invinity Energy Systems, a provider of vanadium flow battery energy storage systems for commercial & industrial sites, grid network infrastructure projects and off-grid applications, either standalone or alongside renewable energy such as solar PV.

Energy generation has never been a single technology market. Gas, coal, nuclear, hydro, solar and wind all make a significant contribution to our global generation capacity, and each play different roles based on their specific characteristics.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

For instance, nuclear provides low-carbon baseload, whilst gas generally meets more flexible, peaking requirements with a higher carbon cost. Renewables, once a high-priced subsidy-only option, are now considered to be a key low-cost and low carbon part of our future generating mix.

The energy storage market is no different. I don’t believe there will be a ‘one size fits all’ technology solution, given the wide variety of technical requirements and market designs that allow grids to operate effectively.

Could one energy storage technology technically perform every conceivable requirement? Yes, quite possibly, but specialisation in the market will deliver far more economically optimal solutions.

Approaching the roles that storage can play with a single technology would be like leaving your toolkit at home and turning up to a DIY job with just a hammer – it’s capable of a great many things, but it really isn’t the best tool to paint the bedroom with.

Differentiation will emerge as energy storage grows in future grid scenarios

Instead of a one-size-fits all situation, I believe the future will see a segmentation in the energy storage market, driven by myriad factors including; technology type, age, warranty limitations, control systems, financing structures and operating strategies. The technical and economic factors driving this segmentation will necessitate different storage products for different applications; once deployed, a further segmentation for dispatch will evolve.

We can see this today, for example within gas there are a wide range of solutions, from reciprocating engines to combined-cycle gas turbines (CCGTs). Selection amongst these competing solutions is made at the time of deployment based on the specific purpose they are intended to serve. During their operational lifetime, each generator is dispatched to meet market requirements at lowest cost. The same will be true for energy storage. Within a storage fleet you’re going to have older installations (based on earlier technologies) coming to the end of their life, competing in the same markets alongside newer systems, with different chemistries, warranties and operating strategies. It is easy to see how differentiation will emerge as energy storage grows in future grid scenarios.

With organisations such as the UK’s Committee on Climate Change (CCC) – an independent body advising government – highlighting the need to seize the opportunity to turn the COVID-19 crisis into a force for good in the wider energy transition, net zero targets are driving us inexorably towards a high renewable-penetrated global energy system. The increased pace of solar deployment over the next five to 10 years will fundamentally change whole market dynamics, with high price periods emerging in the morning and evening combined with very low summer daytime pricing.

I see two broad opportunities for energy storage:

- The first, to take advantage of renewable curtailment in high penetration grids, which is already happening in places like California. Put simply, where the continuing deployment of ultra-low cost solar or wind assets means excess energy is frequently available, certain storage technologies can particularly benefit by storing energy at very low cost.

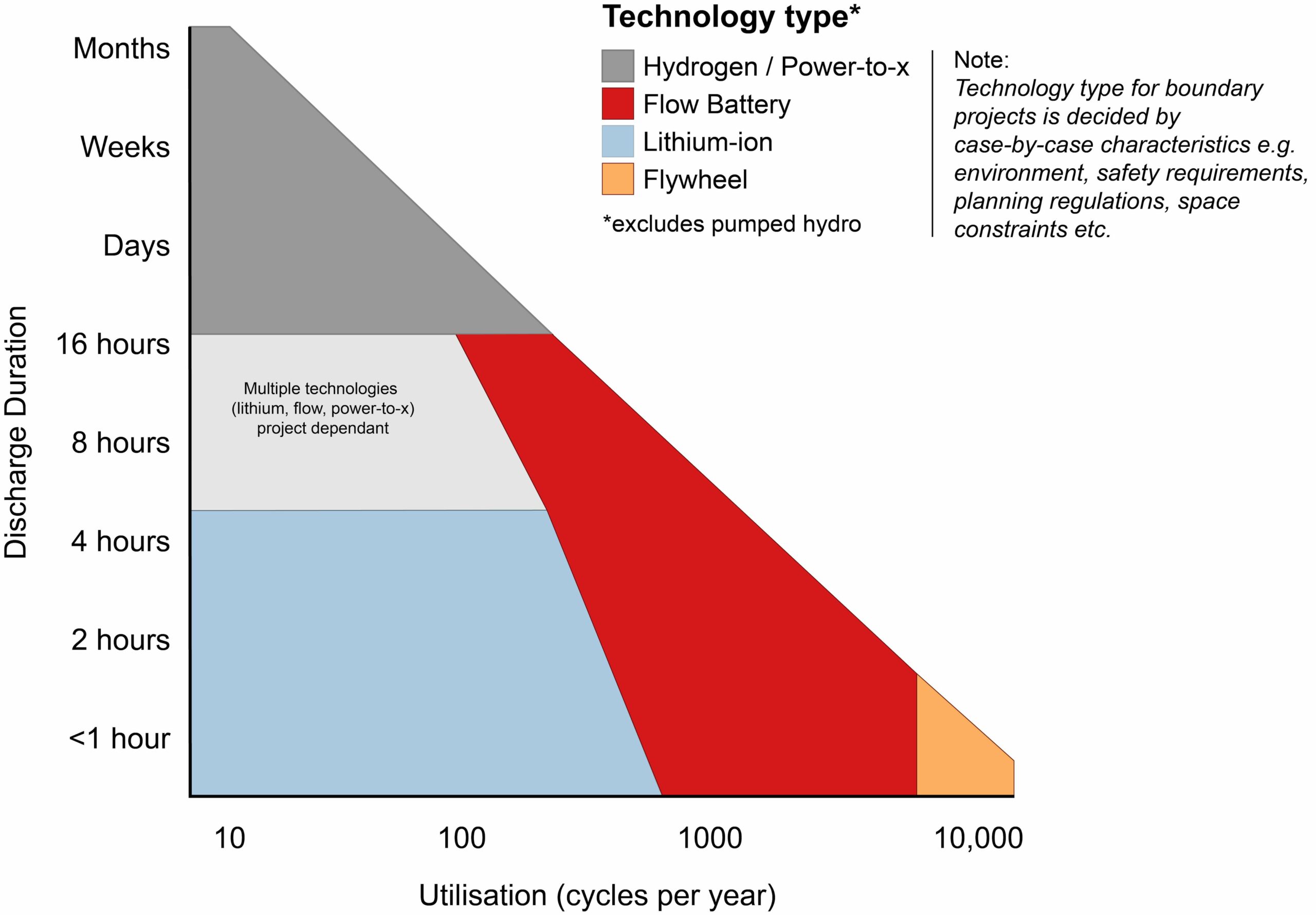

The key characteristic here is the ability to shift large volumes of energy over weeks or months. The low number of cycles means that the solution must be extremely inexpensive to build, but can have a higher cost-per-cycle (including efficiency losses); storage technologies in this space such as, “power-to-x” technologies like hydrogen or compressed air storage will have an important role.

Batteries are also well-placed to take advantage of this opportunity, though more likely in shifting energy through hours and days rather than weeks. Moreover, because they can be easily sited, batteries are more likely to be deployed to solve curtailment issues, particularly behind the meter and on off-grid sites.

The differentiation between individual technologies – lithium versus flow, for example – will depend on the characteristics of those solutions, with lithium likely to dominate at lower cycle frequencies where capex and efficiency are the most important factors, and flow being dominant where cycle capacity and lowest per-kWh-delivered costs are most important. For front-of-the-meter projects, flow will be dispatched on a higher throughput strategy, with lithium serving the higher power, lower throughput portions of the energy storage merit order dispatch.

- The second opportunity for energy storage is to replace thermal assets’ role in delivering system stability and flexibility. The range of ancillary services and balancing required is broad in nature and the characteristics of each storage technology will make them suitable for different applications.

Consider frequency control, for example. There are two distinct but complementary service types that suit different storage technologies:

- Dynamic regulation applications, which you could think about as a ‘pre-fault’ service, requires high utilisation from your storage asset, meaning constant, dynamic work to keep grid frequency stable. This application is suited for flow batteries, which can support high throughput without degrading.

- Dynamic containment, on the other hand, could be thought of as a ‘post-fault’ service, and requires bursts in order to correct system frequency. This necessitates assets to be standing by but only called to do so infrequently – an ideal application of lithium-ion batteries.

An evolution and segmentation of markets to meet our needs

Taking these factors into account, my view is that if we segment different technologies around the storage duration and frequency of discharge, our future energy storage mix can be thought of in the following way – a concept I first came across in the Imperial study ‘Projecting the future levelized cost of electricity storage technologies’ (Oliver Schmidt,Sylvain Melchior,Adam Hawkes,Iain Staffell, published in the journal Joule, January 2019).

Storage costs, in particular for lithium, have seen a sharp decrease, similar to the wind and solar cost reductions. Lithium solutions are now dominating the annually deployed storage volumes (excluding pumped-hydro), but only where lithium is fit for purpose.

Non-lithium technologies are beginning to move down the cost-curve rapidly too and are starting to reveal areas where lithium is not the best fit.

For energy storage to help facilitate a net-zero future, there are three key challenges. The first is the bias towards current technologies in current markets. Developers, investors, and asset owners are aware new technologies are emerging, but may tend to stick with the technologies they already know which deliver reasonable returns. This is true explicitly because markets don’t evolve in a vacuum; rather, they evolve at the intersection of emerging needs and proven technical capabilities.

Storage markets today are a great fit for lithium, because markets were designed for lithium capability. Organisations planning to take a role in the energy transition must look to the future, identify needs not served in totality by current technologies, and begin deploying solutions whose capabilities will close those gaps and deliver a clean, reliable, and economical future electricity market.

The second challenge is a lack of standardisation across business models and financing, insurance, warranty, planning and legal structures that support deployment of grid-scale energy projects. This standardisation has been one of the key drivers the wide deployment of wind and solar projects; these structures will allow storage adoption to accelerate.

The third challenge is huge policy variations globally and at national level, creating an uneven playing field for projects and uncertainty for investors. In our business, we see a tremendous amount of geographic fragmentation among the market and regulatory structures. Some of these are related to local differences in market conditions (e.g. abundant solar or hydro power). But there is also sometimes a desire to conform with historical norms or support a national technological winner; these barriers should be removed, especially at a technical level.

There’s no better time than now to get acquainted with the future

The way forward lies in addressing these challenges head-on. A bias towards current markets can be alleviated by identifying opportunities adjacent to existing markets where new technologies can deliver improved performance, paving the way for new market rules to take advantage of emerging capabilities.

Standardisation needs to be driven by the market and we are increasingly seeing improvements every day as projects reach financial close and ‘firsts’ diminish. From a policy perspective, the storage market needs manageable and competitive steps to further adoption, providing a stable environment into which large-scale, long-term and profitable projects can be developed.

Simply put, renewables are coming – further and faster than many expected. Energy storage has an initial path to supporting low-cost renewable generation, while maintaining the reliability and cost-efficiency of our current grid. To realise storage’s full potential, a group of solutions based on mature technologies embodying a broad variety of technical characteristics will be required.

For those developers, regulators, and grid operators who seek to do so, there is no better time to begin adopting the solutions and market-based incentives that will accelerate our path to a clean and profitable future electric grid.