Investor Macquarie’s storage platform Eku Energy’s market entry and strategy speaks to the broader emergence of storage as an infrastructure asset, which its CEO discussed with us, also giving his views on BESS capex and procurement.

Eku Energy CEO Dan Burrows was speaking to Energy-Storage.news as Solar Media’s Energy Storage Summit 2025 kicks off today (18 February) in London. Burrows spoke on the ‘A Global Green Superpower: What is the Opportunity for You in Australia?’ panel at yesterday’s invite-only Day 0, dedicated to sessions and networking events around the Australian market and supporting women in the energy storage industry (with trade body Regen).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

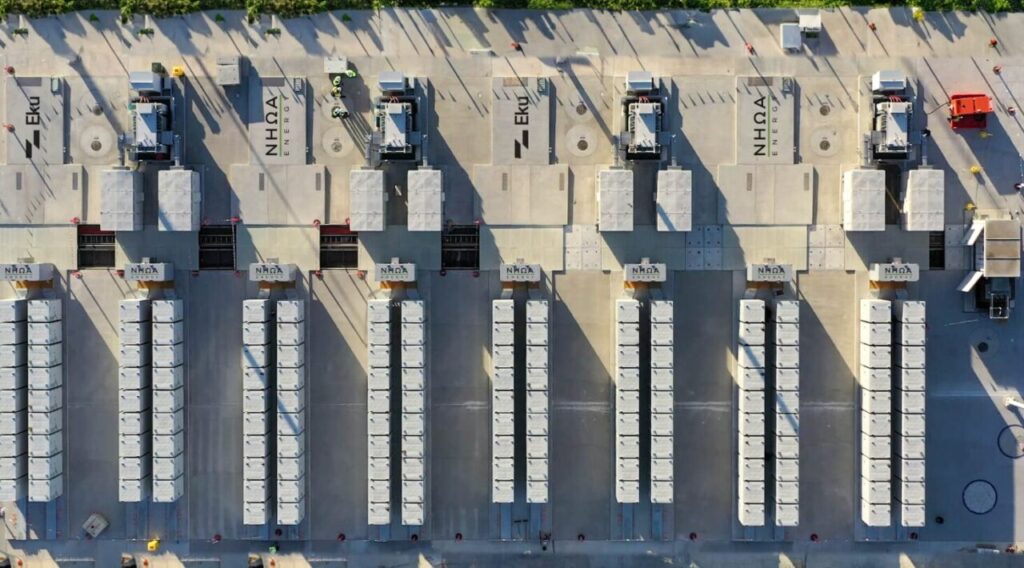

A spinout of storage investment activities from Sydney-headquartered Macquarie, Eku’s biggest projects are in Australia, including the 200MW/400MWh Rangebank battery energy storage system (BESS) which it completed in December 2024 and the 250MW/500MWh Williamsdale BESS which it started building a month earlier. For an Australia-focused interview with Eku’s CTO Elias Saba, published two weeks ago, click here.

In September it commissioned its first UK project, a 40MW/40MWh system, and in the past few weeks energised two more – the 40MW/55MWh Loudwater project and the 28MW/56MWh Basildon project – while financing its first Japan project in mid-2024.

Like most others, in Italy Eku is awaiting the final MACSE auction rules before proceeding with financing and construction on its projects. In total it has 1.3GWh under construction or in operation.

Revenue contracts for storage evolving to help de-risk business

Speaking to Burrows and looking at its projects, the infrastructure investment-minded approach to energy storage from Eku is clear.

“Our strategy is to offer the best products to retailers and offtakers by putting innovative models around storage that make them eligible for the lowest cost of capital,” Burrow said. “Our markets tend to be deregulated ones, with a sufficient level of renewables for the grid to benefit from storage, also with a level of sophistication around risk management products.”

“Globally, we’ve seen an acceleration of the sophistication of the long term revenue contracts for storage. Rangebank has a 20-year offtake with Shell, very similar to an availability PPA, and we have a similar arrangement with Tokyo Gas for 20 years. For Williamsdale, we have a 15-year revenue swap, covering half of the project’s revenue in exchange for fixed annual payments.”

The UK market meanwhile has started to see long-term offtakes for storage but still with a much shorter tenure, of 5-10 years at most, Burrow said. “The market for long-term offtake is thinner, but still with a high degree of sophistication.”

Burrows’ colleague Andy Hadland spoke to us about this topic at last year’s event, following which the first large-scale toll in the UK was announced, between Gresham House and Octopus Energy.

The entry of risk-averse, infrastructure capital into energy storage is a notable, broader trend in the industry the last few years. Some of the biggest projects being built in Europe, for example, are from infrastructure-backed platforms, including Giga Storage in Benelux and CIP’s 1.5GW/3GWh trio of Scottish projects.

The increased size of the overall market, the increased sized of individual projects, and the increased sophistication of the revenue contracts are the three main drivers of this, Burrows added.

The energy storage market in Italy offers something similar with the MACSE auction which will offer 15-20 year “high quality” revenue contracts with grid operator Terna, Burrow said. Consultancy Timera’s Steven Coppack said in an interview last week, speaking to the same themes as Burrows, that Italy would open up energy storage to the kinds of capital that so far had been excluded from the market.

Eku has 50 projects in its pipeline (alongside the seven in operation or construction), each of which “has its own use case and plan for commercialisation, and is an individual opportunity to create an asset in our portfolio”.

Procurement requires increasing risk for owners

While the conversation centred on de-risking BESS, when it comes to procurement the last few years have actually seen BESS owner-operators forced to take more risk, which Burrows explained. BESS prices have gone down and availability has gone up, for numerous reasons, but balance of plant (BOP) equipment and construction has seen the opposite trend.

“For BOP, it’s been an entirely different story. It’s been feeling the bite from inflation, there’s tightness in the supply chain which means longer build times and the need to take additional early works, which in turn means taking on more risk. It also means more capital required to hold schedule.”

An example often cited is high-voltage transformers, for which the two or three year lead time necessitates ordering them before financial investment decision (FID) is made, Burrows said.

Energy-Storage.news will also be writing about the related topic of BESS owner-operators taking on more of the specifics of BESS procurement – and risk – as the industry matures, in the coming weeks.

BESS supply and pricing, lithium hedging

The firm has so far announced supply deals with Trina Storage, NHOA, for its UK projects, and Tesla in Australia. Burrows said that the price falls seen in the last 12-18 months have started to decelerate.

“It can only accelerate for so long before decelerating. The price point came down rapidly and we’re probably now seeing pick-up in orders and a filling of order books, which would be a function of supply and demand balancing out the price points.”

“The headline price has come down but there is a big range in pricing. And, we are seeing a much greater range and differing level on warranty packages and expectation of performance from suppliers. And that comes back to the cost of financing – a proven track record lets you access capital.”

When pushed on a number, Burrows said the range in variability of pricing across suppliers could be around 20-30%, but emphasised it’s highly complex and project-specific, and also matters when you order. “One supplier might have more capacity at a specific time than another, which is less to do with the battery market and more just dynamics of supply and demand.”

Another risk that owner-operators need to take out of BESS projects is the lithium price. This hasn’t been a big topic over the last year or two as the prices came down from the wild spikes of 2022, but most supply contracts have an indexation formula linked to the lithium price. This therefore requires some hedging against that commodity exposure, to reduce the risk of the overall investment.