The Democratic Republic of Congo (DRC) supplies most of the world’s cobalt, but exporting semi-finished or finished products rather than raw materials would better help the country capture the value of the metal used in high power lithium-ion batteries.

A new report has found that the export of raw materials is not economically beneficial to the DRC and other countries with significant resources in the long-term, compared to exporting products like battery cathode precursor materials. At present, nearly all of the DRC’s cobalt capacity is exported to Europe and China for processing.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Not only that, but it would actually be cheaper to build manufacturing facilities for battery cathode precursor materials in the DRC than in the US, China and Poland and would have less intensity of carbon dioxide emissions.

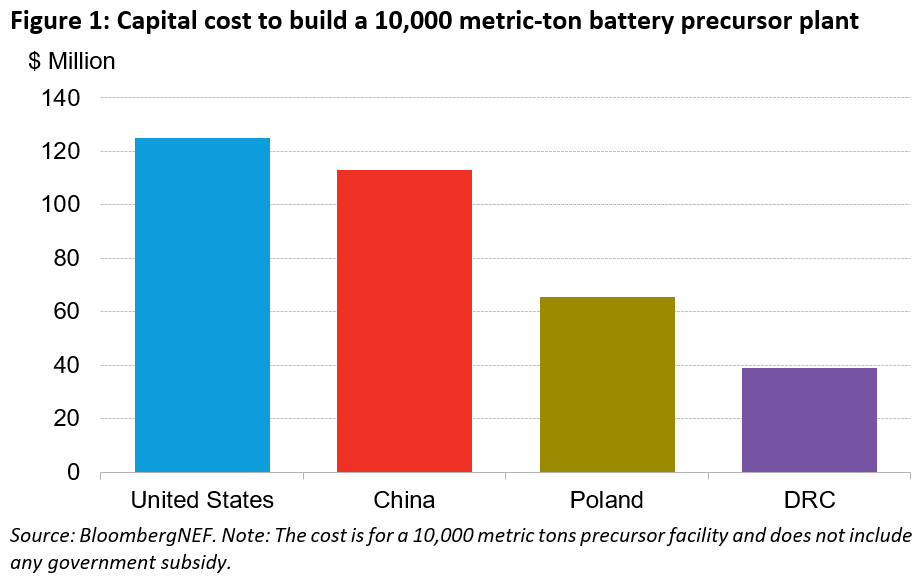

In a new study, ‘The cost of producing battery precursors in the DRC,’ analysts from BloombergNEF found that at a calculated cost of about US$39 million, it could be three times cheaper to build a 10,000 metric tonne cathode precursor plant in the African country — which currently supplies about 70% of the cobalt used in global lithium-ion batteries — than in the US.

It would be more than twice as expensive to do so in China and about US$25 million more expensive in Poland. With the DRC largely using hydroelectric power, a new supply chain involving precursor materials made there would reduce emissions associated with battery production by about 30% from existing supply chains reliant on China.

Despite efforts to scale up cobalt sourcing from a number of other countries like Australia over the next few years, the Democratic Republic of Congo (DRC) will still be the dominant source by 2030. However, as BloombergNEF pointed out in September when it published a global lithium battery supply chain ranking, countries with the most abundant raw material resources are not always able to maximise the value their industry could be providing.

Raw materials make up 85% of the total cost of operation of an NMC 622 cathode chemistry precursor plant, including cobalt, manganese and nickel. If mining can be integrated with such facilities, the DRC could be very competitive in producing the essential ingredient, especially with significant manganese and nickel able to be sourced from nearby countries like Madagascar, Mozambique and Gabon.

It makes sense, the study said, for the DRC to focus on supply to its largest and closest end-demand market in Europe, as well as building up demand for electric vehicles within Africa and the country itself.

However, for this to happen, the study’s authors at BloombergNEF said, various policy steps need to be taken which include the creation of a diversified capital market in countries across Africa to support battery research and early stage products. Investment also needs to be made into the local workforce.

‘DRC can take a central role in driving the fourth industrial revolution’

The African Continental Free Trade Area (AfCFTA) which became operational early this year and covers 54 African Union nations, could be the world’s biggest free trade area and could result in African countries capitalising on natural resources as well as growing an electric vehicle sector.

The DRC’s infrastructure, including the grid — which is low carbon but not reliable — roads, ports and rail networks need to be upgraded and the government needs to create laws and regulations that support local businesses, to promote fiscal certainty.

“The Africa Continental Free Trade Area, the largest trading bloc globally, provides a compelling case for the Democratic Republic of Congo to leverage its and Africa’s abundant mineral and clean energy resources to become a growth pole of the global clean energy transition and inclusive resilient development that leaves no one behind,” Vera Songwe, UN under-secretary general and executive secretary of the UN Economic Commission for Africa — one of a number of partners which tasked BloombergNEF with carrying out the study — said.

Songwe said that while the DRC only currently captures about 3% of the battery and EV value chain, the country could leverage the resources of partners in the AfCFTA from South Africa to Morocco to receive “other upstream mineral inputs needed for lithium-ion batteries”.

“The DRC can truly become the regional and global centre of gravity for the production of precursor materials for batteries to drive the fourth industrial revolution. In so doing, the country and the rest of Africa can extend their access from the US$271 billion battery precursor segment to the more lucrative US$1.4 trillion combined battery cell production and cell assembly segments of the battery minerals global value chain.”

In related news, Norway-headquartered lithium battery manufacturing startup FREYR Battery recently announced that it has joined the Fair Cobalt Alliance (FCA), a group which believes the artisanal mining of cobalt in the DRC can become fairer and more equitable.

Existing members of the group include Glencore which is the world’s leading producer of cobalt, producing about 31% of global supply from two mines in the DRC, and Tesla. Glencore and FREYR recently announced a collaboration on sustainably sourcing, as well as recycling, cobalt.

FCA executive director Dr Assheton Carter said that FREYR had joined other industry players “in recognising the legitimacy of cobalt from responsible artisanal mining operations,” and committing to investing in making the mines safer, minimising their environmental impact and in creating better working conditions.

The BloombergNEF report can be found here.