Innovations in new distributed energy technologies are challenging conventional thinking around the most effective ways to serve electricity customers and utilise grid infrastructure. These innovations in hardware, software and business models are helping to drive the overall transition to a more resilient and intelligent energy system that aims to deliver cleaner and more efficient electricity to an increasingly engaged customer base.

Maintaining and upgrading transmission and distribution (T&D) networks represents one of the most significant expenses for electric utilities and traditionally there were few alternatives to costly investments in expanded capacity. The new generation of less expensive and more intelligent distributed energy resources (DER) and energy storage technologies located on both the T&D grid and customers’ properties has opened the door to a compelling array of new options for how to best utilise existing infrastructure.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

These technologies will disrupt the conventional T&D industry by maximising the value and efficiency of existing grid assets while empowering customers to participate in the management of the grid. This article will explore the overall drivers of T&D upgrades and the challenges facing these projects as well as new alternatives, with a focus on diverse non-wire alternative (NWA) projects, their benefits and challenges and the emerging trend of using purely energy storage to defer costly upgrades.

A need for upgrades

The electric T&D system is a constantly evolving machine that requires continual monitoring, maintenance and upgrades. Traditionally, the required upgrades to the T&D system were relatively easy to predict and could utilise a consistent and standard set of grid equipment and infrastructure to meet growing electricity demand. Rapidly evolving technologies and evolving customer demands have made predicting and performing grid upgrades much more complex in recent years.

There are three primary issues driving the need for T&D upgrades:

- Congestion and generation curtailment: The growing amounts of variable renewable generation have exacerbated congestion challenges in many areas, leading to the curtailment of energy. Actual rates of curtailment vary considerably in markets around the world. The highest average curtailment rates have been seen in China, where some provinces have wasted nearly 39% of wind generation due in part to limited transmission capacity.

- Load and peak demand growth: Typically, increasing demand for electricity and load growth has closely followed overall economic development. However, load growth rates have decreased or remained flat in many developed economies in recent years, while the dynamics of peak demand periods on the grid continue to evolve. Some utilities are experiencing decreasing overall load growth rates, yet increasing growth in their peak demand. New sources of load, notably EVs, are expected to reverse the trend toward decreasing electricity demand growth over the coming years. This new load growth will be variable and often concentrated in specific areas, providing an advantage for more flexible NWA-type solutions.

- Reliability: Improving reliability is a particular concern for commercial and industrial (C&I) customers, which often place a premium on reliability as they risk significant financial losses from an outage. Utilities are increasingly focused on improving reliability in the face of competition from third-party energy service providers targeting C&I customers. Furthermore, the overall resilience of the grid is becoming a greater focal point for governments and regulators in the face of both natural disasters and physical and cyber security threats. The diversification and expansion of the grid can reduce the potential effects of these events.

Building new T&D infrastructure has been the default solution to issues facing the electricity grid for decades. However, there are many challenges to upgrading grid infrastructure, particularly large-scale transmission projects. These challenges include concerns from local communities, the time required to develop and build projects, uncertainty around future load growth and demand patterns, and the rising costs to build new infrastructure in both urban and remote areas. Given these challenges, the falling costs of energy storage and DER technologies are presenting an increasingly economical alternative to conventional T&D projects.

Innovations in grid management and DER technologies have presented a new set of possibilities to maximise the use of existing grid infrastructure and defer or entirely avoid costly upgrades. At the same time, many utilities are seeking to engage customers and provide more value-added services in response to growing competition. Creative solutions to address infrastructure needs at a lower cost with greater customer and environmental benefits, known as NWAs, are being tested around the world.

Navigant Research defines an NWA as:

“An electricity grid investment or project that uses non-traditional T&D solutions, such as distributed generation, energy storage, energy efficiency, demand response (DR), and grid software and controls, to defer or replace the need for specific equipment upgrades, such as T&D lines or transformers, by reducing load at a substation or circuit level.”

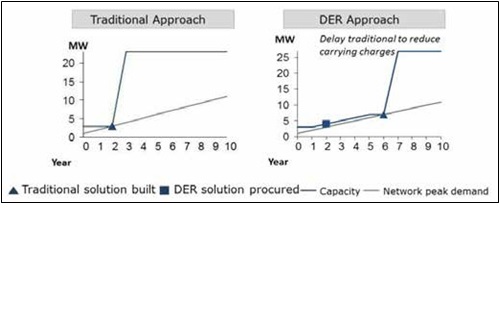

Overall, the major advantage is the greater flexibility provided by NWAs compared to traditional investments. A DER-based approach to meeting load growth can more closely match actual conditions on the grid without unnecessary investments. The graphic below illustrates how a DER approach can better match growing demand and defer a much larger investment.

Driving Growth

Although there is a wide range of specific factors leading to the development of NWA projects, there are five primary drivers in the market which also represent some of the fundamental changes underpinning the shifts in this industry and the challenges to the traditional utility business model. These drivers include:

- Regulatory policies: Regulations and policies can provide incentives to utilities to implement more NWAs, such as allowing the sharing of economic benefits between customers and shareholders rather than all savings going to customers. Many of these policies are designed to reduce the environmental impact of electricity generation and usage by limiting the need for new power plants and T&D infrastructure.

- Economics: By far the most significant economic benefit of an NWA is the deferral benefit of the large capital investment. Traditional T&D upgrades have risen in cost and complexity in recent years, while DER technologies and grid management software and communications have seen dramatic price decreases.

- Utility customer engagement: Faced with competition from customer-owned DER technologies and third-party energy service providers, utilities are working to offer new solutions and improve customer engagement.

- Load growth uncertainty: Short-term investments in NWAs can defer much larger infrastructure investments, giving a utility time to assess whether the infrastructure investment is truly required and to investigate other potential options.

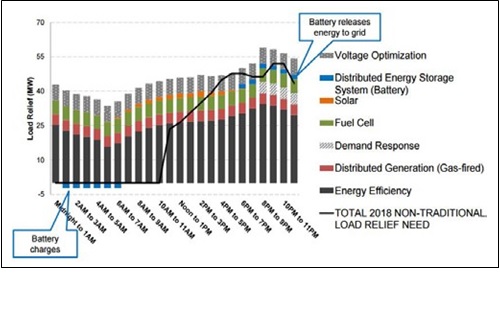

To date, most NWA projects developed have been in the US and the list of projects is expected to grow quickly. New York utility Consolidated Edison (Con Edison) was one of the early pioneers of NWA strategies. The utility began geographically targeting energy efficiency investments in 2003 when growing demand caused several distribution networks to approach peak capacity. These efforts evolved into the well-known Brooklyn Queens Demand Management Programme (BQDM). This programme intends to use many forms of DER to defer or avoid costly T&D infrastructure projects, specifically a new US$1 billion substation for the Brooklyn/Queens area, a region expected to see significant demand growth. The BQDM programme is expected to spend US$200 million on demand-side load management (DSM) programmes to shed 52MW of load – 41MW from the customer side and 11MW from non-traditional, utility-side measures. Figure 2 illustrates the anticipated resource portfolio of the programme in 2018, highlighting the diversity of DER being utilised.

On the West Coast of the US, two of the largest grid operators and electricity providers, Bonneville Power Administration (BPA) and Pacific Gas & Electric (PG&E), are also exploring NWAs. While BPA has been evaluating NWA options for many years, its first commercial project was announced in May 2017, aiming to avoid replacing a large and expensive transmission line in Oregon and Washington. After almost 10 years of planning the upgrade with strong public opposition and increasing project costs, BPA decided instead to implement various NWA options, including energy efficiency, DR, rooftop solar and possibly energy storage to avoid the large transmission system investment. PG&E in California has also been experimenting with NWAs for many years, with a focus on targeted DSM efforts. Using DSM to defer investments in T&D capacity frees up constrained capital to fund other, more valuable projects for its system. Furthermore, PG&E believes that engagement with a DSM programme significantly increases customer satisfaction.

Part 2 of this technical paper, originally published in ‘Storage & Smart Power’ – a dedicated, Energy-Storage.News-curated section of the quarterly journal PV Tech Power (Vol.13) – will feature on the site later this week.