We have the technological tools to decarbonise, but can we do so at pace and scale? It depends on the politics, says James Basden, co-founder and director of Zenobe Energy, a UK-headquartered company working on clean energy infrastructure including grid-scale battery storage and fleet transport electrification solutions.

COP26 needs to answer two key questions:

First, can delegates ensure we limit global warming to 1.5°C?

Second, can the assembled countries agree on shared criteria and timeframes for decarbonisation?

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

A ‘yes’ to both of these questions would supercharge the energy transition. It would mean more confidence, more clarity, and more incentives for finance to divest from fossil fuels. But make no mistake: even if negotiations flounder, the energy transition is here to stay.

What are the driving forces behind decarbonisation?

COP26 aside, financiers are being driven to invest in decarbonisation by the brute reality of the climate crisis, by public pressure, and by shifting market forces.

Spooked by the risks of inaction, 45% of banks disclosing to CDP — the global environmental impact disclosure non-profit group — have aligned their portfolios with net zero. This empowers green technology companies.

Despite the pandemic, 260GW of new renewable generation was deployed globally in 2020 – smashing former records by almost 50 per cent. The electric vehicle (EV) sector raised US$28 billion, 10 times more than in previous years.

And we are seeing increasing support for the key technology linking renewable generation with zero-carbon transport: battery storage.

The forces behind the energy transition are expanding the market for new storage technologies. The global storage market is poised to increase by 23% by 2030. As the market grows, regulation will respond, making it easier for battery operators to meet the needs of energy systems.

We are already seeing this in the UK. The Government is consulting on opening up the transmission network to competition, so that new technologies can resolve constraints at lower costs to consumers. The Pathfinders programme of the national electricity system operator National Grid ESO, is enabling operators to stack revenues, so that they can provide multiple flexibility services at once.

These changes make it more likely that we will hit the 18GW of storage capacity we need to run a zero-carbon system.

What more is there to be done?

As the young activists gathering in Glasgow would no doubt remind us, all this goes to show that the market alone can’t fix the climate crisis. We wouldn’t have reached this early position on the long, winding road to net zero without the tireless work of campaigners and researchers.

To go further, phasing out fossil fuels and deploying zero-carbon alternatives, we need the Government to listen to the innovators with the solutions, and to support them with bold interventions.

The time for talk is over. The energy sector needs decisive action today to achieve the 2030 carbon reduction targets – literally today, given the project timescales.

To hit our 2050 targets, we need to lay a strong foundation by 2030.

This means using the knowledge and tools we have available now and improving them over time, rather than waiting around for hypothetical techno-fixes, such as carbon capture or nuclear fusion, to show up and save the day.

We already have exciting new technologies in our toolkit – from new chemistries with long-duration capability, to demand-side response and second-life techniques. But these technologies face barriers to implementation.

We need more funding for research and development, a public engagement strategy for net zero, and stronger rules to bring about a circular economy. And above all, our slow-moving regulatory processes must speed up, keeping pace with fast-changing technologies.

Will all the pieces fall into place?

UK policy issues like these won’t get resolved at COP26. But if all goes well, the conference will send a powerful global signal, forcing investors and policymakers to take decisions with the climate in mind. For all the finance flowing to renewables, banks have invested $3.8 trillion in fossil fuel companies since COP21.

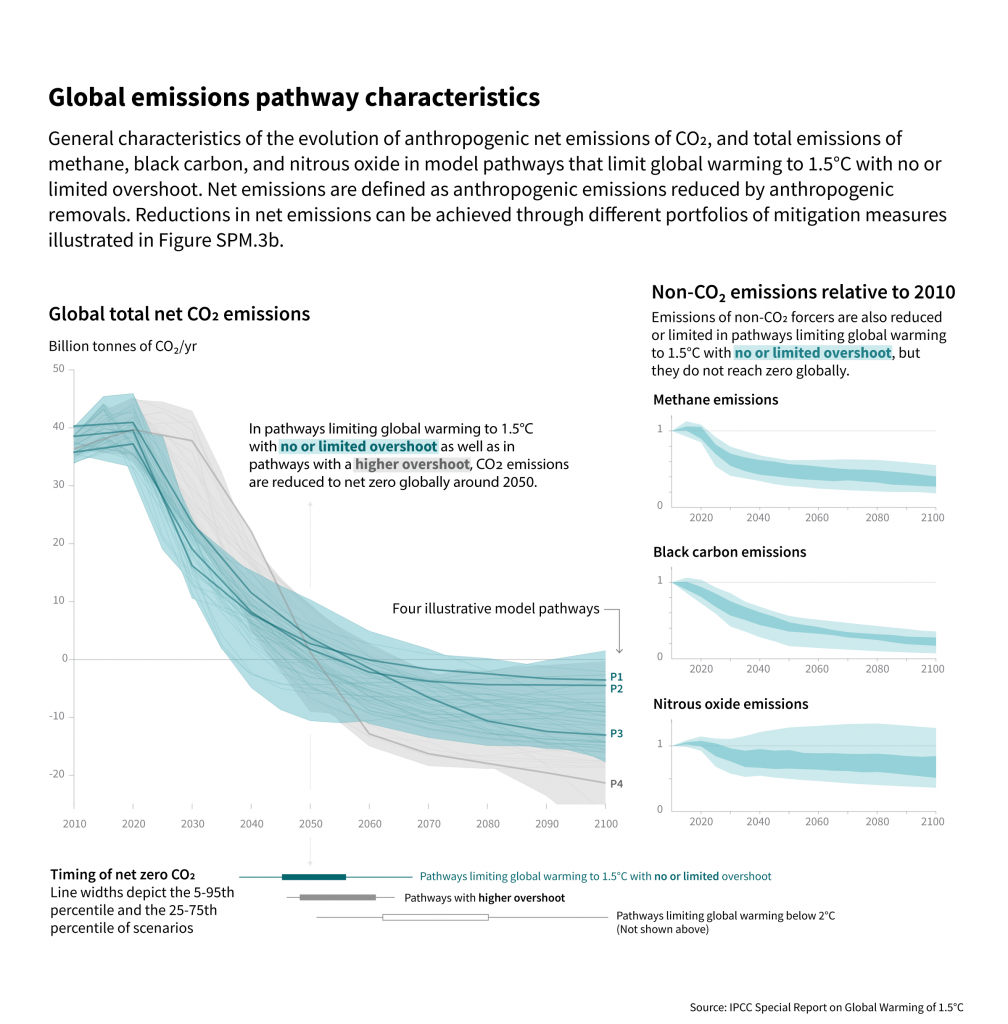

To strip away the greenwash, remember that to limit warming to 1.5°C, we need a 45% decrease in GHG emissions over the next 10 years. To stay under two degrees, we need a 25% reduction. But at the time of writing, the 192 COP26 countries were on track for a 13.7% increase in GHG emissions by 2030, compared with 2010.

We have the technological tools to decarbonise.

Whether we can do so at pace and scale depends on the politics.

About the author

James Basden is co-founder and director at Zenobe Energy and leads the company’s Network Infrastructure business. Zenobe was established in 2017 and owns and operates grid-scale battery storage assets in the UK as well as working on electric fleet vehicle electrification. The company recently began its expansion globally and is targeting the deployment of at least 3,000 e-buses and 1GW of battery storage by 2025.