As US Senators vote on the tax reconciliation bill, experts Jessica Dunn of Union of Concerned Scientists (UCS) and Tonja L. Wicks of esVolta discuss its potential impact.

US president Donald Trump pushed Senators to hurry along the voting process and deliver a bill by 4 July.

The latest draft of the bill ends the Section 45Y production tax credit (PTC) and Section 48E investment tax credit (ITC) for wind and solar PV projects placed into service after 31 December 2027.

Notably, Section 25 residential clean energy and energy efficiency tax credits will no longer apply to purchases made after 31 December 2025.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Furthermore, the foreign entity of concern (FEOC) restrictions suggested in the bill would significantly hinder developers’ capacity to access tax credits.

The draft additionally suggests implementing a new excise tax on projects that begin construction after 16 June and utilise a certain amount of FEOC materials.

Energy storage is the clean energy sector that relies most heavily on importing materials and components from China, and regulations regarding energy storage projects that receive support from restricted foreign entities are especially strict.

Jessica Dunn is a clean transportation programme scientist specialising in lithium-ion (Li-ion) battery sustainability. Tonja L. Wicks is the Vice President of Government and Regulatory Affairs at energy storage project developer, owner and operator esVolta.

Impacts of the tax reconciliation bill on the energy storage industry

It is widely agreed that the reconciliation bill will have a significant impact on the energy storage industry, though the full details of that impact are dependent on the final form of the bill.

Isshu Kikuma, analyst at BloombergNEF (BNEF), said the bill’s elimination of tax credits, which passed the House in late May, would cause solar and energy storage installations to “plummet”.

Ravi Manghani, Senior Director of Strategic Sourcing at Anza Renewables, noted that the bill, as passed by the House, would likely raise project prices by the end of the year as developers rush to lock in supply for the next three years.

Jason Grumet, CEO of the American Clean Power Association (ACP), said the bill, as proposed in Senate Finance Committee chairman Mike Crapo’s draft legislation, would raise electricity prices and “threaten hundreds of thousands of jobs”.

Now, the Senate has begun voting on a draft of the bill published on 27 June.

This bill puts developers, like esVolta, in a precarious situation. Federal policy is uncertain at the moment, and could remain so for some time.

Wicks maintains that esVolta is well-positioned for the future, if the reconciliation bill is passed with fair access to ITCs, saying:

“If the final reconciliation bill signed into law by President Trump continues fair access to investment tax credits for energy storage, we fully expect the storage sector will continue to grow rapidly through 2033, delivering much needed new electricity resources, and supporting the domestic energy dominance, robust job growth and strong economic development.”

Wicks supports this, citing the exponential load growth seen and expected throughout the country.

“With unprecedented load growth expected throughout the US, driven by the rejuvenation of the US manufacturing sector, increased electrification of transportation, and large load additions including from data centres, energy storage is needed now more than ever to meet the supply deficit in the short and long term.”

She continues, “There is a place for ‘all of the above’ new resources on the grid, but energy storage is flexible, clean, cost-efficient, and ready to deploy quickly, making it the ideal technology to meet reliability and resource adequacy needs.”

On the expansion of data centres in particular, Wicks says that our power grid today is not equipped to handle their expected growth, but that battery energy storage systems (BESS) is well-suited to address the need.

The esVolta Vice President of Government and Regulatory Affairs again notes that a reconciliation bill with ITCs for BESS will be crucial for ensuring that BESS can adequately meet the demands of data centres.

Dunn, at UCS, also notes the importance of ITCs and other incentives for project development, saying, “The transition to renewables is going to happen regardless of whether there are tax incentives, but the incentives determine the rate at which that happens.”

Dunn is also concerned that without these incentives and without the “demand signals” seen over the last 10 years, developers will start to withdraw, and the US will not be a global competitor in the energy transition.

Wicks argues that the FEOC restrictions might pose less of a barrier to renewable energy development than it initially appears, stating:

“While currently insufficient to meet today’s demand, storage developers are already starting to rely on domestic lithium-ion (Li-ion) battery system manufacturing capacity, which is growing quickly, and projected to scale up to a level capable of meeting the majority of domestic battery energy storage demand by 2030.”

While it is still unclear if domestic Li-ion battery manufacturing will be able to scale up to meet demand in the short term, it is clear that eliminating ITCs and other incentives will negatively impact energy storage development.

This is also without considering the impact of tariffs, which disrupted the industry in Q2.

Wicks says of potential future tariff policies:

“With this growing reliance on BESS to meet reliability and national security interests, the battery energy storage industry needs tariff policies that enable projects that are already under development to continue forward during this critical time of increasing electric demand and not be set back due to uncertainty leading to project disruptions.”

“We support US-based manufacturing, but we also know that it will take some years to ramp up US manufacturing, so providing a fair runway to that day is essential. Without relief on tariffs, demand will go away, and therefore, the onshoring may not happen.”

Wood Mackenzie also notes in its Q2 2025 US Energy Storage Monitor report that the reconciliation bill will potentially reduce energy storage installations by 29.5GW over the next five years, including a 16GW reduction in its forecasted utility-scale deployment figures if tax credits are eliminated and the tariff situation becomes more challenging.

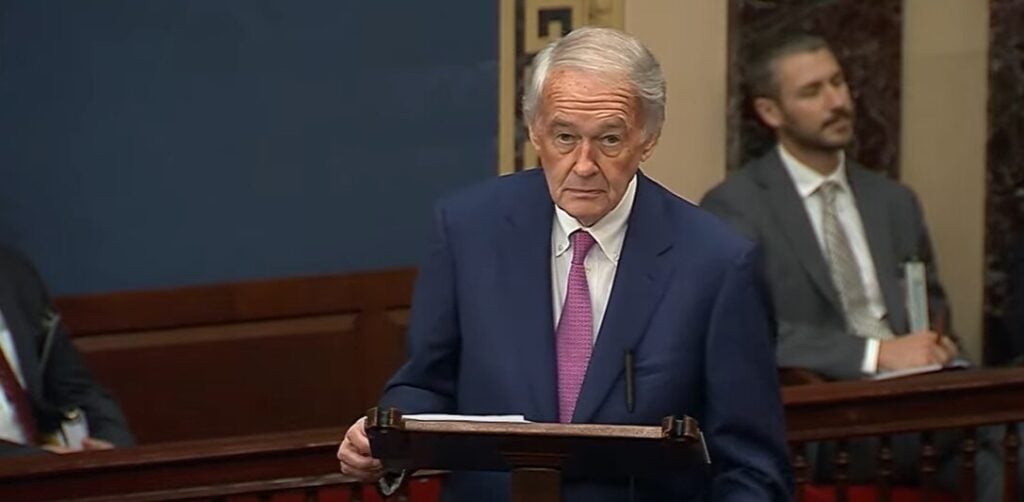

Senate Democrats are using a strategy of filing as many amendments as possible during the “vote-a-rama” to delay the bill’s voting process.

Dunn emphasises that the passage of the bill would put many jobs at risk, especially those in red states, where many factories are located.

Wicks says that despite challenges, esVolta remains flexible and prepared to continue supporting the growth of the electric sector.