The world’s largest lithium-ion battery company, CATL, has completed its secondary listing on the Hong Kong Stock Exchange (HKEX), raising US$4.5 billion, a few weeks after launching its latest grid-scale BESS product.

The initial public offering (IPO) comprised 135 million CATL shares (before a greenshoe option) at a price of HKD 263 (US$33.58) each, with the price on the first day of trading (20 May) reaching HKD 296 per share, a 12.55% increase from the offer price. CATL is already listed on the Shenzhen exchange.

Financial outlets and analysts have said this shows that appetite remains among international investors for Chinese manufacturing stocks despite trade tensions between Beijing and Washington, including increased tariffs and other policy moves to curtail the use of foreign technologies in clean energy projects.

CATL sells its lithium-ion batteries to electric vehicle (EV) manufacturers, battery energy storage system (BESS) manufacturers and system integrators, as well as via its own BESS products, which are supplied to either system integrators or engineering, procurement and construction (EPC) firms.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Dr. Robin Zeng, chairman and CEO of CATL, said: “This listing signifies our deeper integration into the global capital markets and marks a new milestone in our mission to drive the global zero-carbon economy.”

We recently interviewed executives from the company at the ees Europe trade show in Germany (Premium access) as the company launched its latest grid-scale BESS, the Tener Stack.

CATL prospectus

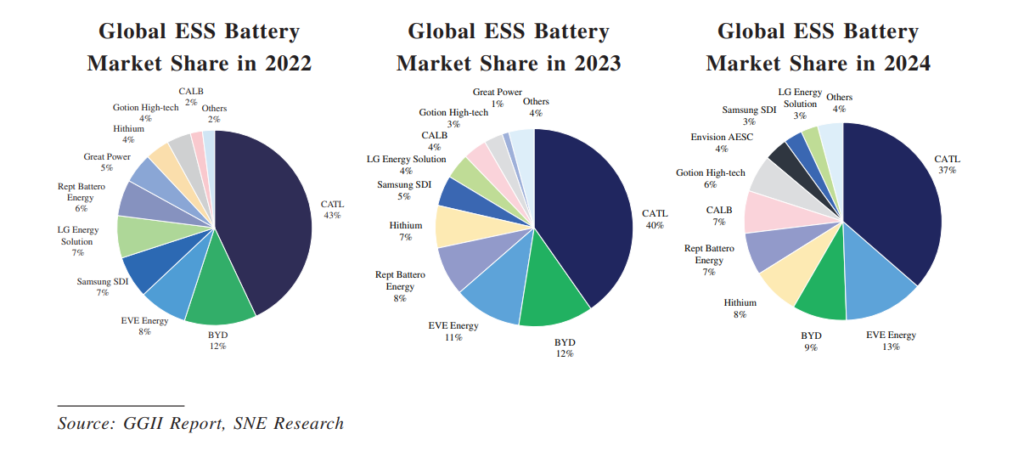

The company is by far the largest lithium-ion manufacturer globally, with a market share of energy storage system (ESS) battery shipments of 37% in 2024, three times the next-largest, and a similar figure for EVs.

Note that its share for ESS has been falling slightly each year, perhaps related to more competition in the market. The charts below are taken from its Hong Kong IPO prospectus.

The prospectus showed that 30.5% of CATL’s 2024 revenue was generated from overseas markets, of which a large but undisclosed portion will have been the US. A year-on-year ESS segment revenue fall of 15.3% in Q1 2024 was attributed to falls in market prices. Indeed, Trump’s substantial ‘Liberation Day’ tariffs came in on 2 April, though two separate 10% increases were announced during Q1 which may have affected some orders.

The company said that numerous factors are driving energy storage industry growth, including electricity demand growth, policy support, renewables growth, data centres and increasing cost-competitiveness of lithium-ion BESS.

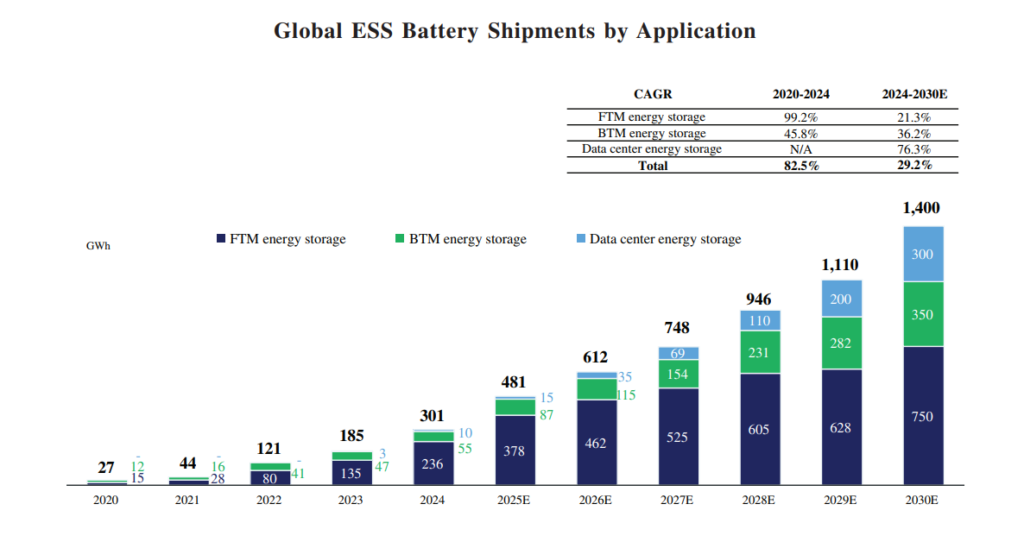

Interestingly, its prospectus cited research showing that over 2024-2030 the data centre-tied BESS segment will grow three times faster than the front-of-meter (FTM) segment and twice as fast as the behind-the-meter (BTM) segment, to become almost as large as the overall BTM market, as shown in the graph below. From 2020 to 2024, FTM was by far the fastest grower.