The Ontario Independent Electricity System Operator (IESO) has officially launched its latest procurement scheme, publishing documents pertaining to its Long-Term 2 (LT2) RFP.

The long-awaited LT2 RFP follows on from the Ontario system operator’s hugely popular Long-Term 1 (LT1) RFP, which resulted in the single biggest procurement of battery storage capacity in Canada’s history. Documents were published by the IESO at the end of last month.

Despite being deemed by some as a huge success, this latest procurement will work slightly differently to its predecessor, with the IESO hoping to avoid previously encountered teething issues.

Energy and capacity procurement streams

The IESO kicked off its inaugural LT1 procurement through an expedited process in 2023. The system operator awarded over 850MW of battery storage capacity contracts across two tranches during May and June of that year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Following on from this expedited process and as part of LT1’s main procurement round, the IESO signed contracts with an additional 10 battery storage projects with a cumulative 1.75GW of capacity, representing Canada’s largest ever single BESS procurement.

Unlike LT1, which only sought capacity, LT2 will lean heavily on renewable energy generation this time around. The IESO is targeting a huge 14TWh of renewable energy procurement over the next four years. In comparison, the IESO targets 1.6GW of new capacity resources during the same timeframe.

Between 2025-2028, the IESO will hold annual and separate procurement rounds for capacity and energy generation, with each stream having a predetermined target. For example, as part of LT2’s upcoming 2025 procurement window, the IESO is targeting 3TWh of energy generation, alongside 600MW of new capacity resources.

These lucrative capacity contracts are likely to be just as popular this time around, with Ontario’s Director of the Canadian Renewable Energy Association (CanREA), Eric Muller, describing the LT2 procurement as a “high priority item” for its members.

“We’re excited that these first in a series of annual RfPs have now been issued, building momentum and consistent investment opportunities for renewable and storage projects in Ontario over the coming years,” added Muller in a statement from CanREA welcoming the scheme.

Decisions due by June 2026

Alongside publication of the scheme’s final documentation, the IESO has also opened a comment/question period for developers seeking further clarification on any part of LT2.

For the capacity stream, the comment period closes on 21 August 2025, with developers wanting to submit projects to 2025’s allocation round needing to register their interest by 3 October 2025.

Although the IESO has stressed these dates are subject to change, the deadline for proposal submissions on the capacity stream closes on 18 December 2025, with the IESO planning to notify successful applicants by 16 June 2026.

Mandatory municipal support

Although not mandatory in LT1, the IESO had encouraged developers to obtain preliminary municipal support for projects in the form of a Municipal Support Resolution (MSR).

In deciding who ultimately received capacity contracts, the IESO ranked projects based on a series of predetermined weighted criteria.

With the awarding of an MSR being one of these scoring criteria, planning authorities in Ontario were flooded with presentations towards the back end of 2023 prior to LT1’s submission deadline.

Some local municipalities chose to assess each project on an individual basis, with others choosing to issue blanket support for any projects proposed in the area. Of the 15 projects to receive an LT1 capacity contract from IESO, only one didn’t receive an MSR.

Despite Ottawa City Council refusing to support the project prior to proposal submission, developer Evolugen still received a capacity contract for its 250MW Fitzroy BESS project. As reported by Energy-Storage.news, after months of uncertainty and planning amendments, Evolugen only just recently received support for the project.

Under the terms of agreement, Evolugen had until next January to obtain support from the City Council, or risk losing the contract.

Receiving preliminary support from local municipalities is mandatory this time around, in an apparent attempt to avoid this happening as part of LT2.

Developers prepare submissions

With support from municipalities being compulsory this time around and with the IESO only procuring 1.6GW of storage capacity, developers are already preparing project submissions for this year’s allocation round.

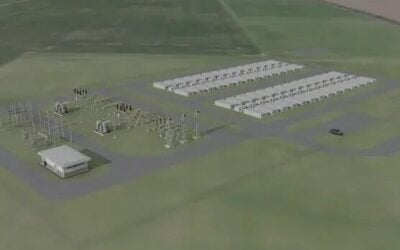

One of these hopefuls is Oakville, Ontario-headquartered developer Atura Power, who is laying the groundwork for three new BESS projects which it plans to submit to the IESO as part of the upcoming allocation round.

Details of the three projects are as follows:

- Buffalo Ranch BESS (200MW/1,600MWh) located in the City of Dryden.

- Nanticoke BESS (300MW/2,400MWh) located in Haldimand County.

- Napanee BESS Phase 2 (300MW/2,400MWh) located in the Town of Greater Napanee.

Atura Power has already held public engagement meetings for its Nanticoke and Napanee proposals, with one for Buffalo Ranch scheduled for next week.

The 300MW addition to its Napanee site would build upon the first 250MW phase, which was one of the projects to receive a contract as part of LT1. As reported by Energy-Storage.news, Atura Power is developing the first phase of Napanee in a joint venture with renewable energy and energy efficiency solutions provider Ameresco.