The repercussions of Texas’ Winter Storm events in February, may be felt for years. Scott Burger, Annie Baldwin, Jason Houck and Marco Ferrara at long-duration energy storage start-up Form Energy discuss how in-depth system modelling of current and future grids offers some early takeaways which might help prevent the next crisis and how multi-day energy storage could play a leading role.

The costs of the tragic convergence of events in Texas cannot be understated. What started as an energy crisis turned into a public health crisis accompanied by a financial crisis as dozens of Texans lost their lives and estimates of economic damage soared into the tens of billions of dollars. The repercussions will be long felt.

A full analytical retrospective of the crisis will be necessary to completely understand its drivers. Good preliminary assessments can be found here, here and here. However, our focus at Form Energy on in-depth system modelling of current and future grids, and the knowledge of the multi-day storage we are developing, gives us some insight into the early takeaways which might help prevent the next crisis.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

What we know about the Texas energy crisis

Many factors coincided to cause the crisis in Texas, but fundamentally the crisis was caused by electricity generation failing to meet demand. As a result, ERCOT began cutting power off at homes, businesses, and infrastructure.

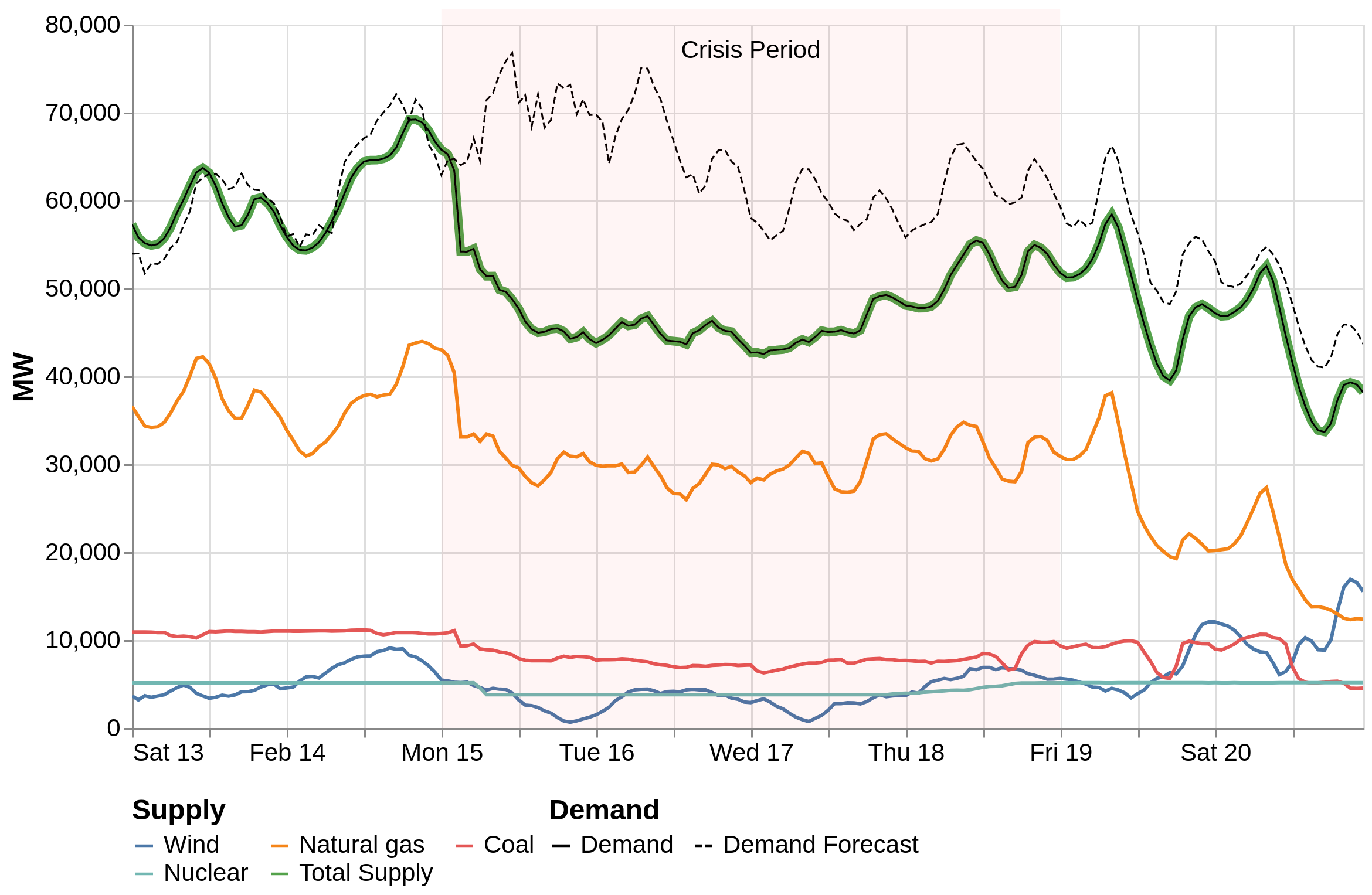

While some pundits have rushed to blame renewables, the reality is nearly all technologies underperformed expectations. Figure 1 below shows forecast (dotted line) and actual demand (solid line), as well as supply by various technologies before, during, and after the crisis. We see that, before and after the crisis, supply and demand tracked forecasted demand quite well. However, during the crisis, supply (and thus satisfied demand) fell far short of forecasted demand (that is, what consumers needed). We see that all generation types struggled to meet demand, with wind, coal, nuclear, and natural gas generators all experiencing outages during the crisis period. While natural gas generators saw the largest capacity of outages during the crisis, with nearly 10 gigawatts tripping offline in the early hours of 15 February, natural gas still provided the lion’s share of energy during the crisis.

Updating planning criteria to mitigate future crises

Texas’s ERCOT market has a unique and more laissez faire approach to planning than many geographies, leaving many grid- or asset-hardening and investment decisions to asset owners and developers. Nonetheless, updated approaches can increase preparedness for future events.

While scientists are still assessing whether polar vortexes are increasing in likelihood due to climate change, we know that climate change is dramatically changing weather patterns, and what used to be considered ‘non-standard’ meteorological years or events are increasingly ‘normal’. We have witnessed first-hand how unplanned extreme weather events, particularly those that last for multiple days, can result in cascading energy systems problems with enormous financial and human tolls.

Updating contingency planning for multi-day reliability challenges

States and ISOs predominantly plan grid reliability around needs to meet the largest single-day or single-hour peak load. This has led to a planning paradigm focused largely on ensuring a margin above peak demand; our own research shows that this paradigm fails to ensure reliability in renewables-heavy grids, and even as it turns out, in gas-heavy grids like ERCOT as well. Moving forward, planners must ask what system contingencies, like multi-day weather events in the wintertime, need to be incorporated, and what criteria beyond reserve margins might be needed to ensure reliability in these events.

Planners have started to revisit standards to better plan for weather events that impact an increasingly weather-powered grid. A common theme is that planners must ensure grids have enough energy – megawatt-hours – to power through multiple days of inclement or blazing weather. This is related to, but distinct from, the challenge of ensuring that grids have sufficient power – megawatts – to meet peak demand.

For example, in response to an August 2020 climate change-driven, multi-day heatwave, California grid operators and regulators are updating resource adequacy and planning standards to account for net peak demand across days; this effort follows updates to grid operations and investments authorised to prevent multi-day, wildfire-driven outages. The Midwest and the Northeast regularly grapple with multi-day cold snaps; in response, the regional grid operators have tightened weatherisation protocols and are investigating programmes designed to ensure the grid can operate reliably through multiple days of high winter demand and limited supply.

Updating reliability metrics for multi-day reliability challenges

Grid planners have historically focused on a 1-in-10 Loss of Load Expectation (LOLE) standard. LOLE (or its cousin, loss of load hours (LOLH)) captures the expected frequency, but not the duration or magnitude, of grid failures. What is clear from Texas is that the duration and magnitude of an outage is critical to understanding its impact.

Further, nearly all metrics rely on expected values – or averages – that don’t capture catastrophic but rare events like the one in Texas. Planners must update the metrics that govern system planning to capture the downside of catastrophic events.

Updating estimates of the value of reliability

Most reliability planning paradigms calculate the value of reliability investments using metrics based on the costs of short (one to eight hour) outages. These metrics do not capture the financial and human toll of multi-day outages like those in Texas and like those that could occur in energy constrained grids. Planners must update these metrics to value investments in building more resilient systems, and some grid planners like the ISO-NE are already gamely attempting to assess the likelihood and severity of these events and design markets accordingly.

Ensuring resource firmness across multi-day weather events

A common theme in detailed modeling of future grids is the need for ‘firm’ electricity capacity – that is, capacity that is available on demand and can power systems through multiple days of tight supply/ demand conditions. Study after study has highlighted how zero carbon firm resources lower the costs and increase the reliability of zero carbon grids.

Historically, studies of firm resources have focused on firm generation such as geothermal, nuclear, or carbon capture and sequestration. However, with a wave of funding driving innovation in hydrogen and multi-day storage like Form Energy’s technology, planners need to broaden their horizons. What is clear from the events in Texas – and underscored by Figure 1 – is that storage technologies need to be able to power grids through three or more days of scarcity to fully replace the function of today’s gas (or coal) plants. Properly incorporating this new class of firm, multi-day storage resources into planning practices will require updating incumbent planning models.

Planners will also need to re-evaluate market mechanisms to ensure that markets incentivise investment in clean, firm resources: today’s market practices can bias investments towards more polluting options.

Once these investments are on the grid, the last task is to ensure that the resources are available when called upon. ERCOT was counting on gas generators that couldn’t deliver at the time of need, to devastating ends. This will require a mix of incentives and standards, grounded in the reliability metrics and planning discussed above.

The events that took place in mid-February in ERCOT – against the backdrop of an inexorably changing climate – underscore that historical planning paradigms no longer suffice. Grid planners must question old assumptions, use new and appropriate planning tools, and prepare for new types of weather events to ensure a reliable clean energy transition.

Cover Image: The Texas National Guard assists stranded motorists during the 2021 Winter Storm. Image: The National Guard via Flickr.