The business models and technologies underpinning the development of stationary energy storage markets are evolving rapidly. Dr. Kai-Philipp Kairies, Jan Figgener and David Haberschusz of RWTH Aachen University look at some of the key trends driving the sector forwards, in a paper which first appeared in PV Tech Power’s Energy Storage Special Report 2019.

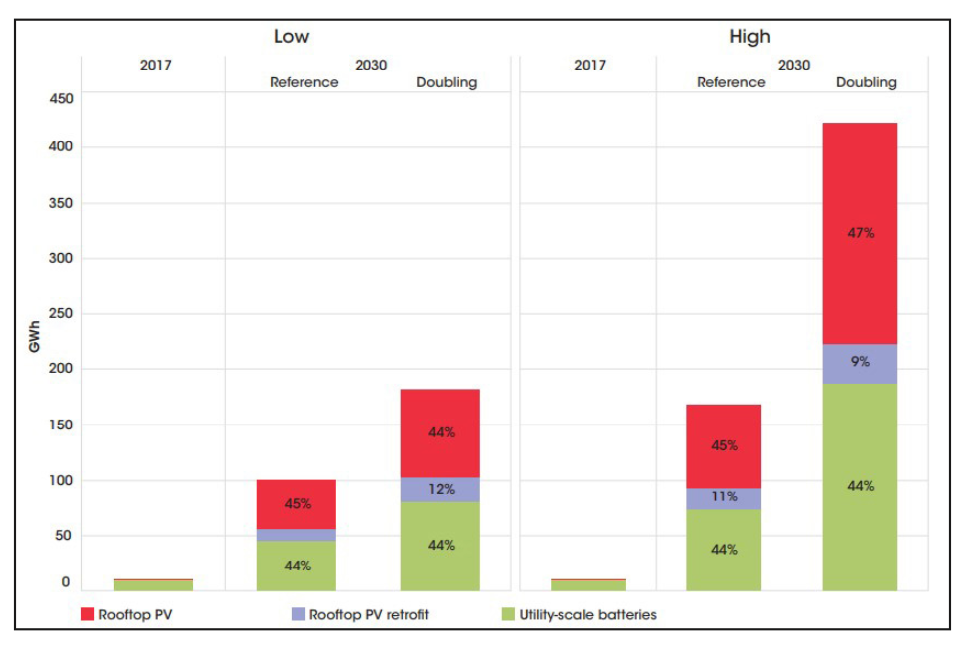

The international market for stationary battery storage systems (BSS) is growing rapidly. Within less than a decade, grid-connected BSS have evolved from a niche product to a mass market in which today international energy and automotive companies are competing for market shares. According to a recent study by BloombergNEF, almost 4GW of new battery storage systems went online in 2018 worldwide – and the market researchers expect this number to double by 2020 [1]. Accordingly, the International Renewable Energy Agency (IRENA) predicts that a total storage capacity of up to 420GWh will be installed by 2030 (see Figure 1).

Grid-connected storage systems today are used for a multitude of purposes, ranging from small-scale applications, such as residential home storage systems, to multi-megawatt batteries that provide balancing services and mitigate grid congestion problems on all voltage levels.

In this article, we will cover the three main market segments of stationary storage systems in Europe – private households, commercial buildings and storage for balancing services – and shed some light on the business models and profitability of these systems.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Home storage systems

Over the last five years, more and more households have adopted battery storage in combination with photovoltaic systems. These so-called home storage systems (HSS) store excess solar energy during the day and make it available for self-consumption in the evening and at night. They provide a twofold benefit for the battery operator and the distribution grid: on the one hand, the operator of a HSS decreases the amount of electricity bought from the grid, thereby reducing his electricity bill. On the other hand, HSS can stabilise power grids with high amounts of renewable energy generation. By storing PV power during peak generation periods, local problems with voltage stability or thermal overloading of electric equipment can be mitigated. Several studies have shown that the use of HSS can reliably limit the maximum feed-in of PV installations to just 40% of their rated power without curtailing undue amounts of renewable energy [3]. This means that HSS can increase the maximum PV penetration of a given distribution grid by a factor of up to 2.5 without having to upgrade the electrical equipment. In some cases, HSS can also benefit from time-of-use schemes by offsetting higher tariffs at night and thus generate additional revenues.

The market for HSS has seen a massive growth in countries like California, Australia, Italy and Germany. Japan could also emerge as a new, important market for HSS as rooftop PV installations become increasingly popular while electricity rates are comparably high. The German market for HSS is unique in a way that a research team of Aachen University, one of Europe’s largest technical universities, closely monitored its development from the very beginning. In the scope of a scientific monitoring programme, datasets of more than 23,000 individual HSS were collected that allow a deep insight into the mechanics of this emerging market. Some of the key findings of this ongoing evaluation are presented below.

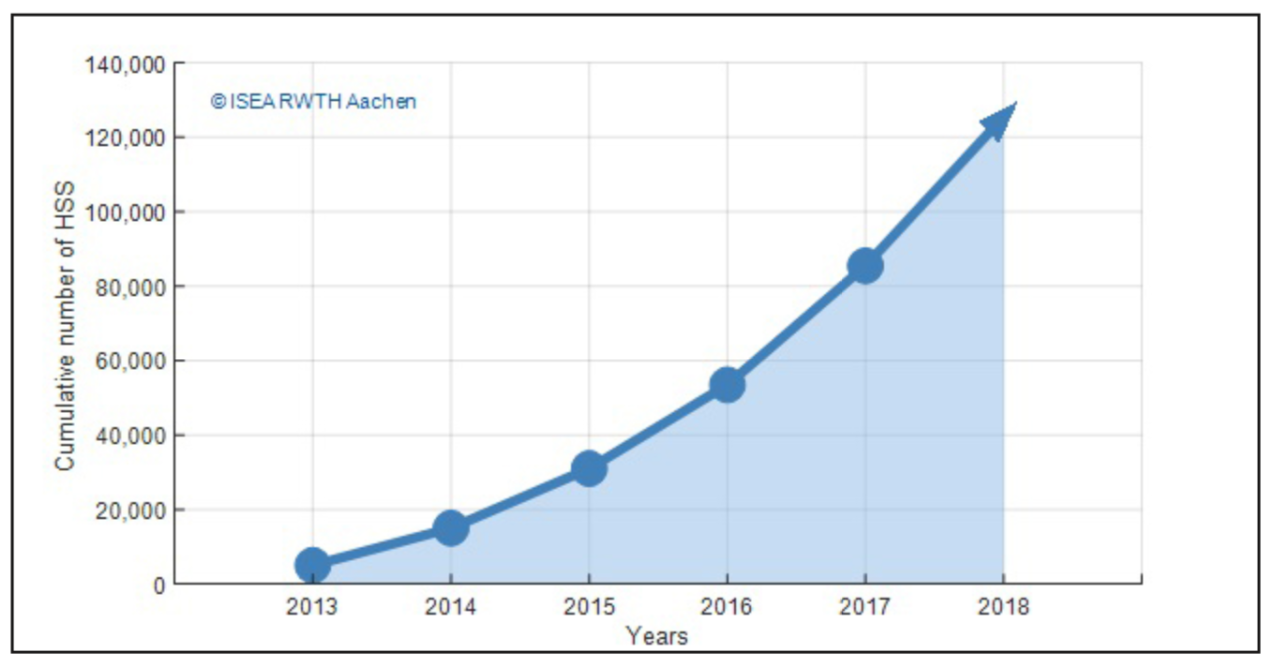

Since 2017, every second new residential PV installation in Germany has been accompanied with a battery pack. In some federal states, it is more than two out of three. In total, about 150,000 HSS with an estimated capacity of about 1GWh and a nominal power of 400MW are installed in Germany today (see Figure 2). These impressive growth rates also make HSS increasingly relevant to German utility companies and grid operators. Accordingly, a vast number of research projects focusing on the grid effects and the potential use of decentralised batteries in virtual power plants was initiated over the last years, making it one of the hottest topics in energy research.

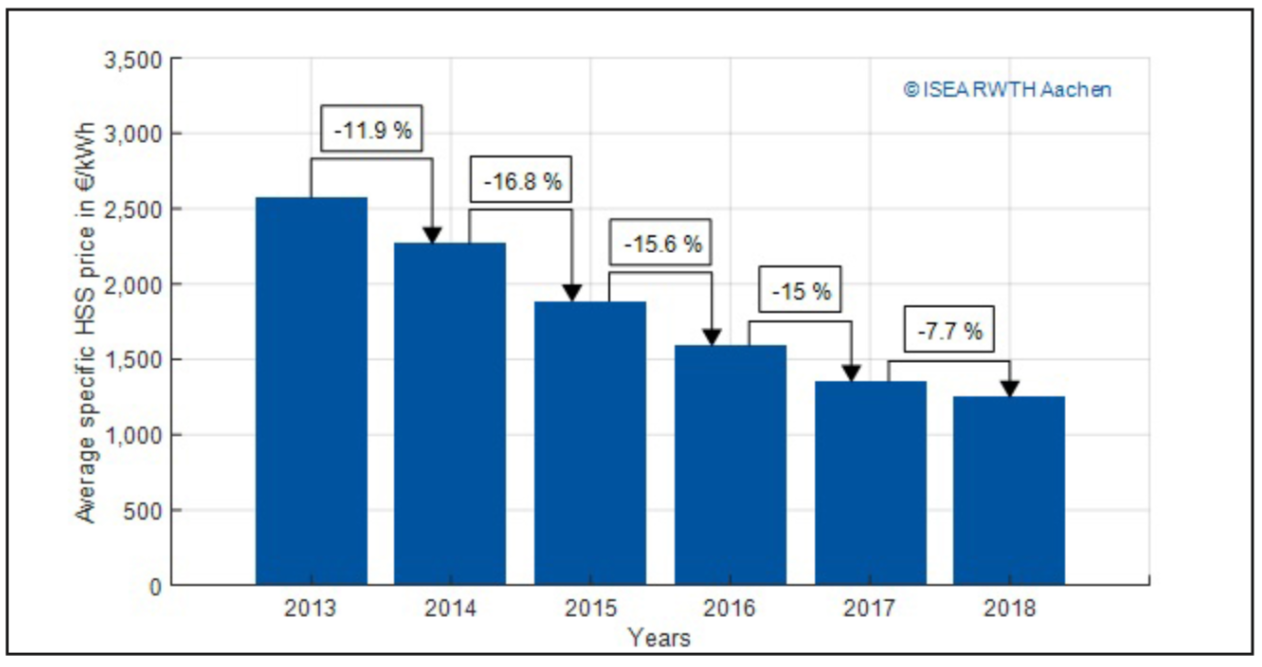

Much has changed since the commercial success of HSS began in 2013. One major technical development was the battery of choice. While in the early days of the market, more than six out of 10 HSS were using traditional lead-acid batteries as their storage technology, lithium-ion batteries quickly gained market share. Since 2017, they account for more than 99% of all newly installed HSS. The reasons for this remarkable success of lithium-ion over lead-acid batteries are diverse: technically, lithium-ion batteries offer a maintenance-free operation, promise longer lifetimes and feature better roundtrip efficiencies. However, from a customer’s point of view, two main advantages seem to outweigh all other aspects. Firstly, due to their very high energy densities, lithium-ion HSS are much more compact and can be mounted to walls, which allows a more efficient use of space and is sometimes perceived to be visually more appealing. The second reason is pricing. Between 2013 and 2018, the average retail price for HSS with lithium-ion batteries fell by more than 50%, whereas prices for lead-acid batteries decreased only slightly [4]. The plummeting costs of lithium-ion batteries not only bolstered their market share, but also helped to push the whole HSS market segment into the mainstream.

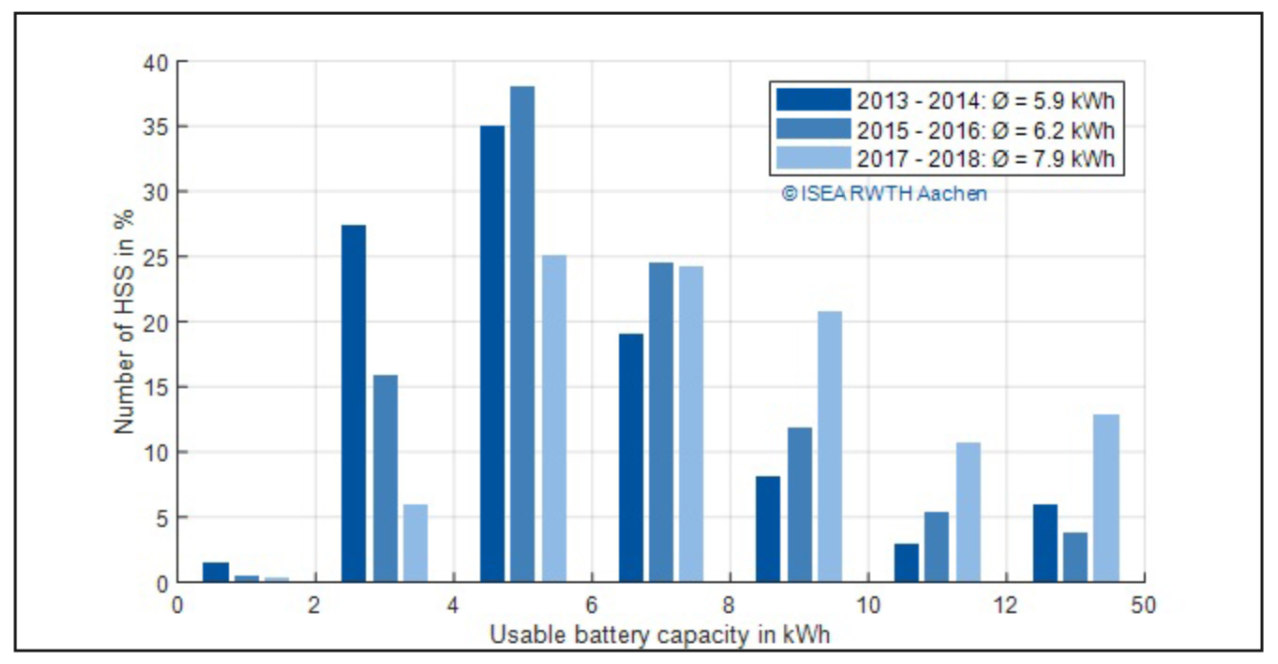

Interestingly, while system prices per kWh have been cut in half since the start of the scientific evaluation, the average system expenses of HSS remained virtually unchanged at roughly €10,000 (incl. VAT ) over the entire period. The reason for this can be found in a constant increase in battery capacity since 2014. Simply put, customers seem to have invested every Euro saved due to cheaper batteries into larger storage capacities. The increase in capacities of lithium-ion batteries from around 6kWh in 2015 to over 8kWh in 2018 are depicted in Figure 4.

A recurring question is the reason for the ongoing HSS boom and one natural answer seems to be their economic benefit. By increasing self-sufficiency and thereby reducing the monthly electricity bills, the investment into a solar battery should pay off within a few years. However, while HSS are often promoted to be a financially attractive investment, the reality is more complex. With average investment costs exceeding €1,000/kWh and typical annual usages of less than 250 cycles, payback times for HSS today are in the range of 20 years for most households – a timespan that exceeds the expected lifetime of typical lithium-ion batteries by about one third. Even taking public financial incentives into account, most solar batteries today fall short of a break-even.

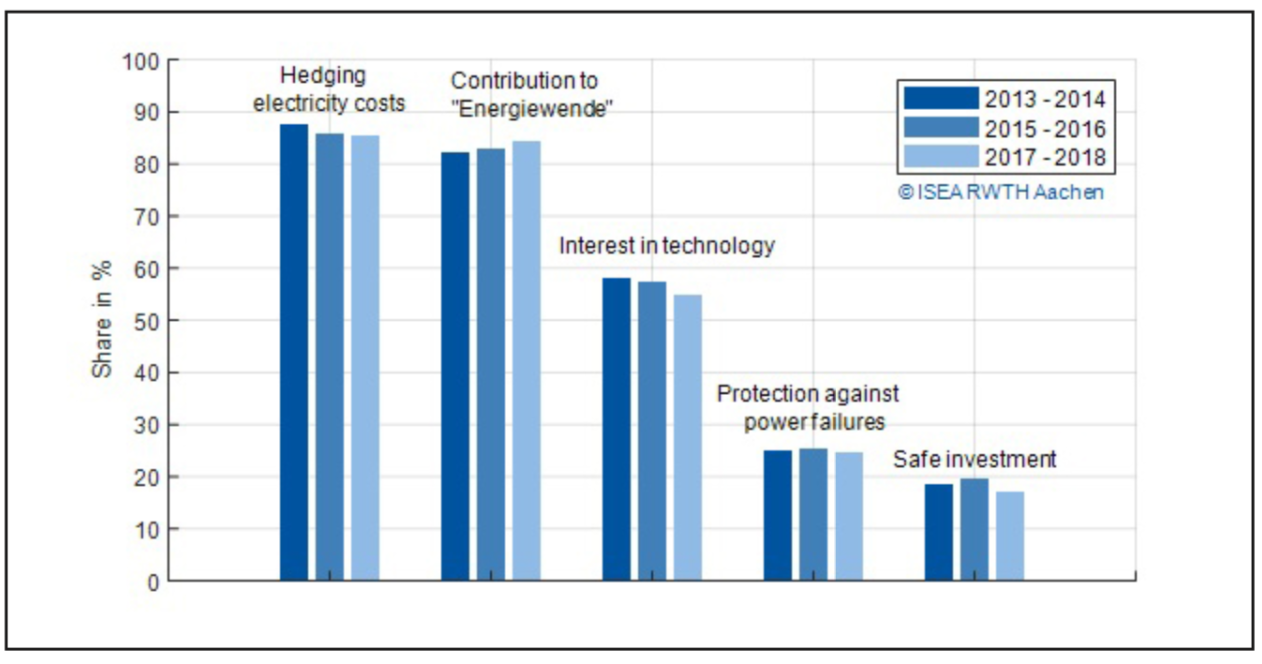

Then, why are consumers still so excited about it? To get a better understanding of the market mechanisms behind the HSS boom, participants in the scientific monitoring programme were asked a couple of yes-no-questions regarding their purchase motivation (see Figure 5). More than 80% of the respondents in Germany stated that the main reasons for investing into a home storage system are hedging against future increases in electricity prices and the desire to proactively participate in the transitions towards renewable energies (“Energiewende”). In addition, a “general interest” in the technology was a major purchase argument for more than 55% of the home storage operators. By contrast, only 20-25 % stated that the wish to make a safe financial investment or securing against power outages was decisive for their purchase. The data suggests that the largest proportion of HSS operators today fall into the category of “innovators” or “early adopters”. These population groups tend to be well educated, wealthy and interested in new technologies, paying less attention to the profitability of an investment and showing a high interest in the details of the technology. An additional factor for the rapid growth of the HSS market can be attributed to the sluggish PV market over the past years. A solar technician can double his sales by selling a battery in conjunction with solar panels, so many installers have pushed batteries to make up for the drop in solar PV orders. For many, storage has become essential for survival in this extremely regulation-driven market.

Battery storage for commercial buildings

While HSS can be seen as a typical “emotional” B2C product, where profitability often is not a priority, business leaders need to make economically sensible decisions when investing into BSS. However, the diversity of possible applications and the complexity of the individual business models make it difficult to make general statements about the profitability of BSS in commercial and industrial environments. To allow a first understanding of the potentials and challenges of this market segment, two examples are briefly outlined in the following.

Increasing solar self-consumption The combination of PV and battery storage is also an option for commercial buildings with suitable roof surface areas. Depending on the system sizing and the individual load profile, up to 50% of the electricity consumption can be provided through decentralised clean generation. However, complete self-sufficiency from the grid is usually not feasible due to the low irradiation values in the autumn and winter months. In addition, the payback periods of these systems usually greatly exceed the expected service life of the battery storage systems. Nevertheless, many large international corporations are working intensively on this use-case as part of their efforts to increase the use of sustainable energies and reach their self-set CO2 reduction goals. Furthermore, large solar batteries can also be used as a means to mitigate blackouts or reduction in supply quality (so-called “brownouts”). Especially for manufacturing companies even a temporary drop in grid voltage can lead to considerable follow-up costs. In paper mills, for example, a brownout can lead to multi-day production stoppages, as the machines need to be cleaned after an unscheduled interruption. Compared to the potential financial damage of such an event, the investment in a battery storage system is often the more cost-effective option.

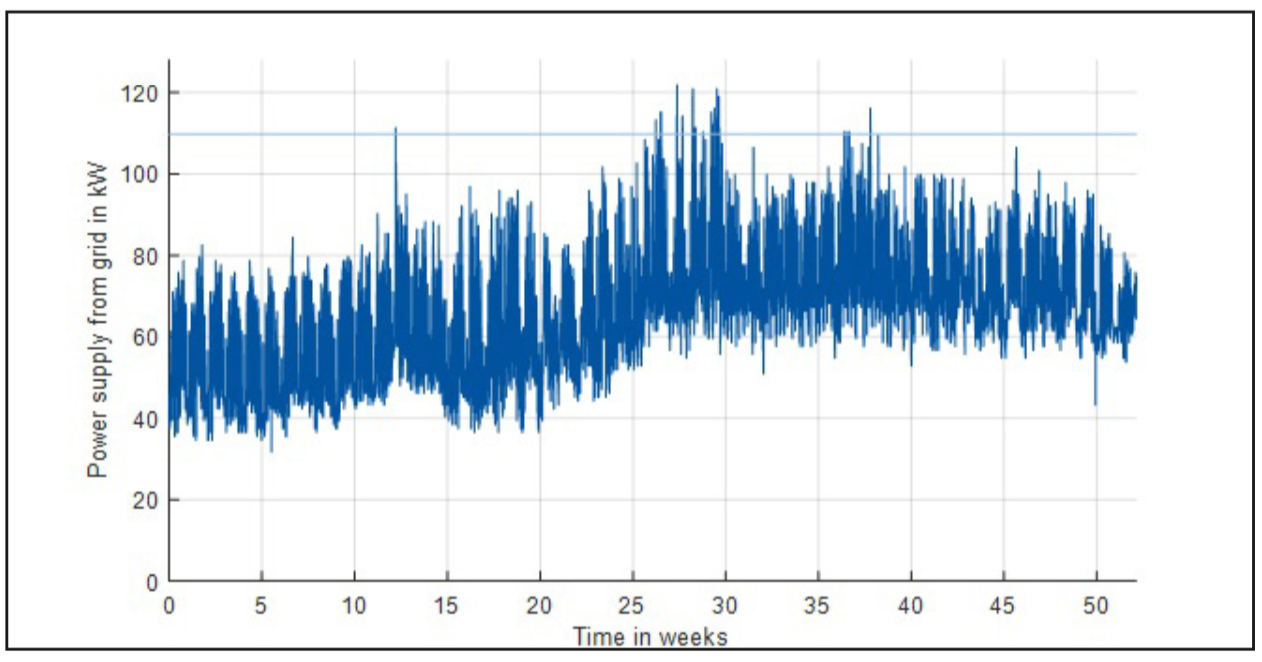

Reduction of peak loads Due to their extremely fast response times and good scalability, BSS are ideal for reducing peak electricity demand. This use-case can be particularly interesting if the company’s electricity price has a significant power component or if new loads are added that cannot be covered by the existing grid connection. As an example, Figure 7 shows the load profile of a small data centre located in the German state of North Rhine-Westphalia. The data centre is connected to the medium-voltage grid and has an annual peak load of 122kW and an annual electricity consumption of 581MWh. According to the grid operators cost tables, annual savings of more than €1,000can be achieved by reducing the company’s peak load by 12kW (blue line in Figure 7). Using a holistic simulation of different energy storage systems it can be shown that a lithium-ion battery of only 8-12kWh would be sufficient to realise these savings, allowing an amortisation period of about six years. Because the battery is only used a few hours of the year, additional revenue streams, such as providing balancing power to the grid, can be tapped (so-called multi-use or value-stacking). By operating flexibly in different business models, BSS can optimise their revenue streams and further reduce their amortisation time.

Battery storage for balancing services

For a stable operation of our power grids, the generation and consumption of electricity must be in balance at all times. Yet, this balance is regularly upset: failures of power plants and transmission lines

or forecasting errors of renewable power generation can lead to a sudden over or undersupply of electricity. In such cases, balancing services such as frequency control or reactive power management come into play to keep the grid frequency and voltage within a given range until the regular operation is restored. Traditionally, large generators such as coal-fired power plants performed these services. However, decreasing numbers of fossil-fueled power plants in our grids spark the demand for new suppliers. BSS are promising assets for providing balancing services due to their extremely fast response, good scalability and quick deployment time. Although often considered a new and upcoming application, utility-scale BSS for grid services are nothing new. In 1986, a 17MW lead-acid battery plant was installed in Steglitz, Germany, to supply frequency control to the then isolated (and notoriously unstable) electricity grid of West Berlin. What is new are the scales and timelines of such BSS projects. In 2017, Tesla built a 100MW/130 MWh containerised lithium-ion storage system in Australia within just three months. Compared to the long planning horizons of transmission grids, this is almost unimaginably fast.

The most important markets for utility-scale BSS in Europe today are Germany and the UK. In Germany, more than 450MW of large-scale BSS went online over the last five years. Most of these projects are in the range of 5-15MW with storage durations of about 1.5 hours and operate in the market for primary control power (“Primärregelleistung”). Primary control power is the fastest balancing service in the UCTE grid and similar to the (dynamic) firm frequency response in the UK. Together with a handful of other countries, Germany is responsible for supplying about 750MW of primary control power to the grid. The service is auctioned in daily tenders of 1MW increments at the energy exchange (EEX) in Leipzig. In order to participate, market players need to be able to ramp

up to their nominal power in less than 30s and sustain a constant power output for 15 minutes, requirements easily met by modern lithium-ion batteries.

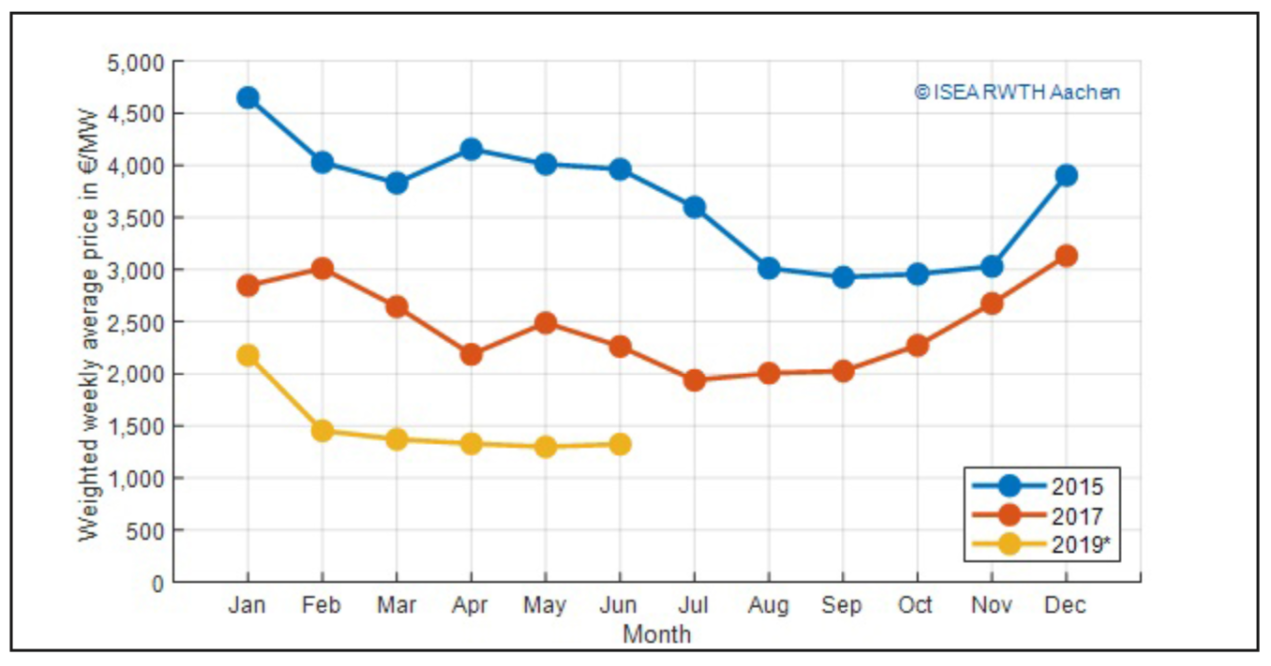

Still, BSS might have been just too successful too quickly. The entry of large numbers of BSS into the market for primary control power since 2013 turned the energy sector upside down and eventually diminished their own business case. The rapid increase in new market participants flooded the market with cheap biddings. Between 2013 and 2017, the number of weekly bids for supplying primary control power increased by 1,400%. At the same time, prices were cut in half, making the business case successively less attractive.

In the first half of 2019, weekly volume-weighted prices fell to an all-time low of €1,300/MW per week. As other potential revenue sources for utility-scale BSS with short discharge times, such as providing black start capability or reactive power to the grid, are not established in the market yet, many new projects for this market segment of BSS have been shelved. One major obstacle to the development of

new business cases for utility-scale BSS is regulation. Today, battery storage systems are considered electricity consumers when in charging mode, and generators when discharging, forcing them to pay some levies twice. While the government has promised to rectify this issue soon, many legal and operational questions remain open.

As an island grid, the UK’s energy system has a higher demand for balancing services than other countries. While Germany is well connected to its neighbours, with roughly 40GW of cross-border trade capacity at 80GW peak demand, the energy exchange between the UK and its neighbours is limited. With higher shares of renewable power generation, new flexibility options are needed to compen- sate the lack of transport capacities. The system operator of the UK, National Grid, calculated that, in order to reach the UK’s carbon reduction targets, more than 6GW of electricity storage are required until 2026 to support the grid integration of renewable energies [6]. But even today system stability can already become an issue: due to a sudden shutdown of a gas-fired power plant and a large wind park in Wales, lights went out for almost 1 million households in early August (see p*). Increasing amounts of utility-scale BSS can prevent, or at least mitigate, the effects of such events by bridging the power gap until new generation units go online. Accordingly, the UK already introduced a new ultra-fast balancing service in 2016. The so-called Enhanced Frequency Response (EFR) requires service providers to ramp up to their nominal power in less than one second, the most demanding conditions for a balancing service, worldwide. The national grid operator accepted eight tenders totaling 201MW of capacity at a committed cost of £66 million over four years with batteries winning contracts hands down. National grid expects to return an economic benefit of £244 million in avoided costs over the duration of the contracts [7].

In addition to providing balancing services, plummeting costs of lithium-ion batteries open up new use cases for stationary storage system. One particularly interesting market segment lies in BSS with a duration of about four hours. Combinations of such storage systems with renewable energies, especially PV, are increasingly used to replace gas-fired power plants to meet the peak demand. Another potential use case for multi-megawatt battery storage systems might be evaluated in Germany soon. In just a few years, massive BSSs with nominal powers of up to 500MW could be installed in Germany to support the transmission grids and enable the faster expansion of renewable energies while at the same time phasing out coal and nuclear power generation. Three of the four German transmission grid operators have submitted applications to the German grid regulator to test so-called grid boosters, battery storage systems with a total capacity of 1.3GW. These battery systems – shortly speaking – add an extra layer of security to the transmission grids and allow a higher utilisation of existing power lines. Thereby, transmission capacities can be increased by more than 30% in some cases. In the event of a failing substation, for instance, BSS can take over until the grid operator completes a redispatch. At the same time, however, the use of grid boosters presents grid operators with new challenges, as it requires a more complex network automation. In the event of a component failure, numerous switching operations must be coordinated in the shortest possible time.

Summary

Stationary BSSs are at the edge of profitability in many market segments today and will play a crucial role in enabling the next phase of the international transition towards renewable energies. The practical insights into the operation of grid-connected battery systems gained today will also help us to manage growing quantities of electric vehicles in our grids. We can be curious to see which innovative applications BSS will open up in the coming years.

References

[1] BloombergNEF, “Energy Storage Outlook 2019” (2019)

[2] International Renewable Energy Agency, “Electricity Storage and Renewables. Costs and Markets to 2030” (2017)

[3] J. Moshövel et al, Analysis of the maximal possible grid relief from PV-peak-power impacts by using storage systems for increased self-consumption, Applied Energy, 137, 567-575

[4] K.-P. Kairies et al: “Market and technology development of PV home storage systems in Germany”, Journal of Energy Storage, 23, 416-424

[5] Regelleistung.net – platform for the auction of control reserve, (online)

[6] National Grid, “Future Energy Scenarios” (2018)

[7] National Grid, “Enhanced frequency response (EFR)”, (online)

Authored by Dr Kai-Philipp Kairies, Head of technical consulting [], co-authored by Jan Figgener and David Haberschusz, research assistants in the research group “Grid Integration and Storage System Analysis” at RWTH Aachen University.

This article first appeared in PV Tech Power, Vol20, which is available now to download for free, here.

Cover image: ENGIE Deutschland.