California is embracing energy storage as a reliability solution for an electrical grid that’s adopting more renewable, intermittent generation. Public agencies such as the Los Angeles Department of Water and Power have set ambitious energy storage targets while companies across the state are developing cutting edge storage technologies such as zinc-air batteries and renewable hydrogen. The goal is to ensure a dependable energy supply for the state as it races toward its target of 100% carbon-free energy by 2045.

For more than two decades, California has overcome a series of unforeseen challenges that have threatened to derail the state’s transformation to clean, reliable energy. Whether it was cheap natural gas challenging the economics of renewables or California’s push to implement the country’s toughest auto emissions standards, state policymakers have untangled regulatory and economic clean energy knots years before other states or countries were even aware of them. In doing so, California reduced carbon dioxide emissions by 13% from 2004 to 2016 while its economy grew by 63%.

With the ramp-up of renewable energy generation, one of the trickiest challenges bedevilling state policymakers has been how to supply reliable energy to consumers despite the intermittent nature of solar, wind and other forms of renewable generation.

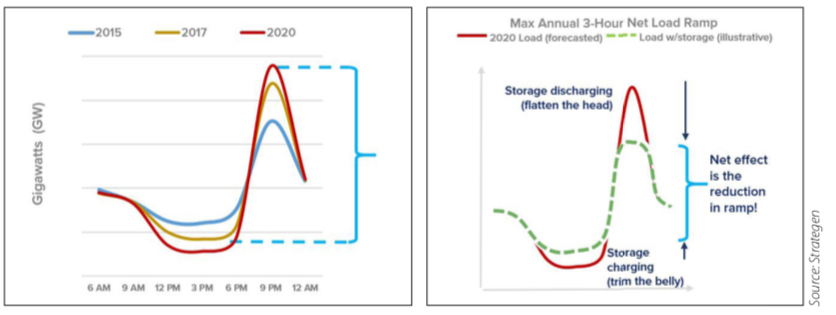

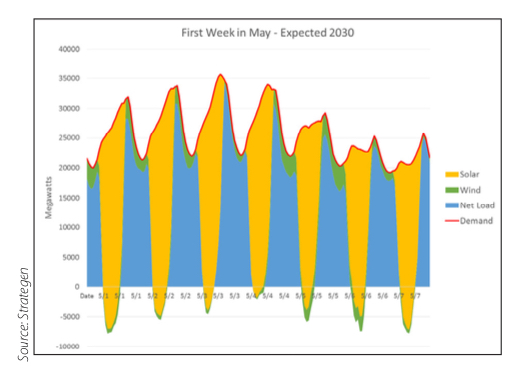

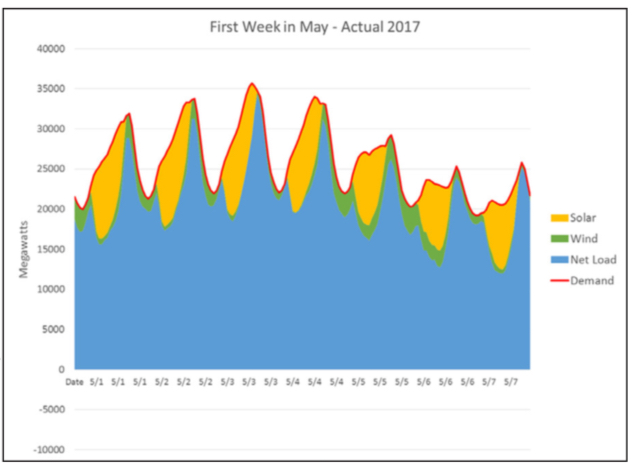

The California Independent System Operator, CAISO, christened this pattern the “the Duck Curve” to describe the net electricity demand they must serve after netting out daily solar and wind energy generation. The resulting net load has a regularly recurring daily dip and rise that looks like a duck. The addition of 20,000 megawatts of new renewable generation over the past nine years in the state has exacerbated that curve by steepening its slope over the course of the day as ever more solar energy floods into the market and then retreats. Visually, instead of the smooth, almost lazy “U” of diminishing and rising demand, the state now rides a daily roller coaster as millions of solar cells begin to generate power in the morning and then taper off production in the late afternoon – just as households turn on their TVs, washing machines and other appliances.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Viewed on a weekly or monthly scale, the dramatic peaks and valleys of this peaking power profile appear something like multiple stalagmites rising from a cavern floor.

At the leading edge – of a complex problem

The addition of thousands of megawatts of solar energy has not only made the grid harder to manage, it has increased reliability on expensive, inefficient and polluting natural gas peaker plants to meet the ramp, which has hampered greenhouse gas reduction efforts.

So California once again finds itself at the leading edge of a complex energy problem, and its success or failure is likely to impact the renewable energy efforts of other states and regions around the world. That transition to a smoother energy profile requires storage because of its core ability to take energy from one period and dispatch it when needed in another period, freeing the grid from the constraints of renewables ramping up or down.

Leaders in both the state’s public and private sectors have recognised that promise and have already created promising new storage technologies as well as a successful regulatory framework for enabling energy storage in all its diverse forms. Storage is transforming California’s power sector while helping the state achieve its ambitious clean energy policy goals.

We at Strategen present here a shortlist of public and private energy storage initiatives in California that we believe have a good shot at bringing more reliability to the grid. Taken as a whole, efforts of both state agencies and companies are working with lots of creativity and daring to make widespread energy storage a reality:

Public Initiatives

In 2018, Sacramento lawmakers went all-in on clean energy by passing Senate Bill 100, which requires 100% of the state’s energy come from carbon-free sources by the end of 2045. That legislation has spurred cities across the state to incorporate storage in their energy plans, the most notable example coming from the Los Angeles Department of Water and Power’s Green New Deal. L.A.’s ambitious initiative calls for increasing cumulative energy storage by 18% to as much as 1,524MW. It also identifies and prioritises solar and microgrid backup power projects at municipal facilities, streamlines permitting and interconnection processes for energy storage projects and launches pilot technology for dispatchable and customer-side storage.

Additionally, the state has launched a variety of incentive and pilot projects supporting energy storage.

SGIP

By the end of 2017, the California Public Utilities Commission’s Self-Generation Incentive Program had funded 1,768 projects representing over 568MW of rebated capacity and supporting technologies such as advanced energy storage and fuel cells. Known as SGIP and introduced to primarily support solar generation equipment purchases, the programme paid more than US$845 million in incentives for completed projects.

EPIC

The California Energy Commission has already spent more than US$5 million and earmarked an additional US$30 million to support commercialisation of the next generation of energy storage technologies. Focusing on diverse battery chemistries, innovative energy management software, as well as thermal and mechanical storage technologies, the CEC aims to deploy storage that will meet a variety of use cases. Additionally, this past April, the commission awarded US$11 million to four energy storage technology research projects in its latest round of its BRIDGE, or Bringing Rapid Innovation Development to Green Energy, project. The commission funding supported an electric vehicle charging and energy storage programme from Natron Energy, a zinc battery storage project from Eos Energy Storage, a large-scale sulphur thermal battery demonstration project from Element 16 Technologies and a redox flow battery from UniEnergy Technologies.

Private sector

Companies across California are tackling the storage challenge with the same type of scrappy start-up spirit that has reshaped the technology sector, and by extension, the world. The research and development action is happening at more established companies as well such as the Malta molten salt energy storage project launched at Google X, the tech giant’s “Moonshot factory.” Paired with forward-thinking policy coming out of Sacramento, the conditions are right for real storage breakthroughs.

Hydrogen

Hydrogen fuel cells are already powering thousands of buses and cars all over California, so much so that the technology is often linked principally to transportation. That’s changing, however, as hydrogen is increasingly considered a potential long-duration, multi-day and multi-energy storage solution that can help flatten daily load. Companies are experimenting with new ways to produce hydrogen such as through the thermal conversion of garbage. Another big opportunity is to convert water to hydrogen gas and oxygen through electrolysis by harnessing solar and wind energy. As prices for solar and wind continue to plummet, this cheap, abundant and clean electricity could produce climate neutral (non-GHG) hydrogen gas at scales large enough to eventually displace natural gas in some cases and even serve as a peaker resource. Renewable hydrogen could also come from Mitsubishi-manufactured turbines that run on a blend of gas and hydrogen, with the goal of running on 100% hydrogen within a few years. Such technology used at scale could repurpose for renewable hydrogen existing infrastructure such as gas pipelines and interconnections. If the falling price trajectory of solar and wind energy is any indication, renewable hydrogen has the potential to become economically competitive with natural gas-derived hydrogen.

That means renewable hydrogen could displace gas use in industrial, electric generation, agriculture, long haul transportation fuels and other applications. To push the hydrogen ball along, the state’s Public Utilities Commission is considering a new docket that will analyse the feasibility of hydrogen injection in the natural gas pipeline and further define renewable hydrogen and its potential use as a storage as well as a natural gas substitute. The California Fuel Cell Partnership, a public-private group, argues that the state can leverage its 60-plus hydrogen fuel stations in operation or in development to help transform the fuel source as a high volume and seasonal storage medium. The state already requires that at least a third of the hydrogen sold at California stations be renewable. Building out that infrastructure at the needed scale, however, is seen as a potential challenge to hydrogen playing a viable role in any state-wide storage solution.

Long-duration energy storage

More renewable energy coming online will mean a growing need for long-duration storage that can even out the intermittency of solar and wind generation and bring reliability to a renewables-dominated grid. For grid operators, long-duration storage offers more flexibility in integrating wind and solar energy generated during different times of the day. That’s especially important as gas-fired generation makes up a smaller portion of state-wide generation and capacity.

Zinc-air batteries have received attention as a long-duration storage alternative with the high-profile growth of El Segundo-based NantEnergy and its leadership under chairman Patrick Soon-Shiong, the billionaire owner of the Los Angeles Times. NantEnergy touts rechargeable zinc-air battery storage systems as cheaper than lithium-ion systems – about US$100 per kilowatt hour versus as much as US$500 per kilowatt hour for lithium-ion batteries. NantEnergy is already installing its battery systems in dozens of rural communities in Africa and Latin America as a proof of concept. The company has already raised more than US$200 million in funding.

The systems are often installed along with solar panel-powered microgrids run by advanced monitoring systems that help users analyse and adjust generation and load profiles in real time to better meet demand. The batteries use solar-generated electricity to separate zinc oxide into zinc and oxygen, with the zinc later combining with air when needed to produce energy. For zinc-air boosters, the best argument in their favour is that companies are already producing the units, the technology has been deployed around the world and it has shown itself to be a viable long-duration storage option.

Google X spinoff Malta Inc is exploring another long-duration storage pathway with its pioneering use of heat-trapping molten salt. The Malta process uses renewable electricity to power heat pumps that store heat in molten salt and cold in chilled liquid. When needed, a heat engine converts the temperature difference between the stored heat and cold back into electricity. The company says the technology can store energy for more than six hours and be charged thousands of time before its performance degrades. The simplicity of its materials – salt, steel, anti-freeze and air – gives the system an estimated 20-year product lifetime. Malta CEO Ramya Swaminathan and principal engineer Raj Apte are scheduled to deliver keynote addresses at ESNA on the future of long-duration energy storage.

Other forms of long-duration storage such as pumped hydro and compressed air require millions of dollars in infrastructure investment to operationalise, but that hasn’t stopped California utilities from jumping in. Pacific Gas & Electric (PG&E), the state’s biggest utility, is studying building a compressed-air storage facility in the agricultural San Joaquin Valley that would use energy during low demand periods to inject air into sand deposits or other porous rock formations. That air is then tapped to spin turbines and generate electricity when demand is highest.

Further south, the Los Angeles Department of Water and Power is already operating a pumped hydro system in the Los Padres National Forest above the L.A. basin that pumps water from Castaic Lake 7.5 miles uphill to Pyramid Lake during low demand times. When the electricity is needed, the system releases the water back into Castaic Lake where turbines await. The department is looking at implementing a similar storage system at the Hoover Dam.

Electric vehicles

With more auto manufacturers shifting to the electric vehicle market, successfully integrating all those Teslas, Bolts and Leafs into a dispatchable grid promises enormous benefits. As usual, California is leading the way, having already set a goal of putting 5 million zero-emission vehicles on the road by 2030 and installing 250,000 electric vehicle charging stations by 2025. The state’s utilities have also been mandated to develop targeted EV plans establishing clear guidelines for charging by residential, commercial and industrial vehicles. As a result, the state’s three main investor-owned utilities – Pacific Gas & Electric, Southern California Edison and San Diego Gas & Electric – have taken the lead nationwide in developing rate structures specifically to help electric vehicles charge when electricity is cheapest as well as to help pay for electrical upgrades at residential homes installing electric vehicle charging infrastructure.

Beyond charging, state planners are studying electric vehicles as load-management and energy storage resources especially as the state’s EV fleet balloons. For example, smartly charging EVs system-wide during low energy-use periods alone could save the state US$1.45 billion to US$1.75 billion in stationary storage investments that would otherwise be needed to meet California’s clean energy goals. The next step will be to encourage V2G, or Vehicle-to-Grid, policies and infrastructure that can help EVs send power back into the grid. System-wide V2G balancing capabilities would help the state avoid an estimated US$12.8 billion to US$15.4 billion in stationary storage investments. San Diego-based Nuuve is already selling its patented V2G bidirectional AC and DC charging stations that ensure vehicles have enough charge to complete trips and also let them sell energy back to the grid if the price is right. Nuuve is collaborating with auto giant Honda to demonstrate the viability of such vehicle grid integration.

Household appliances

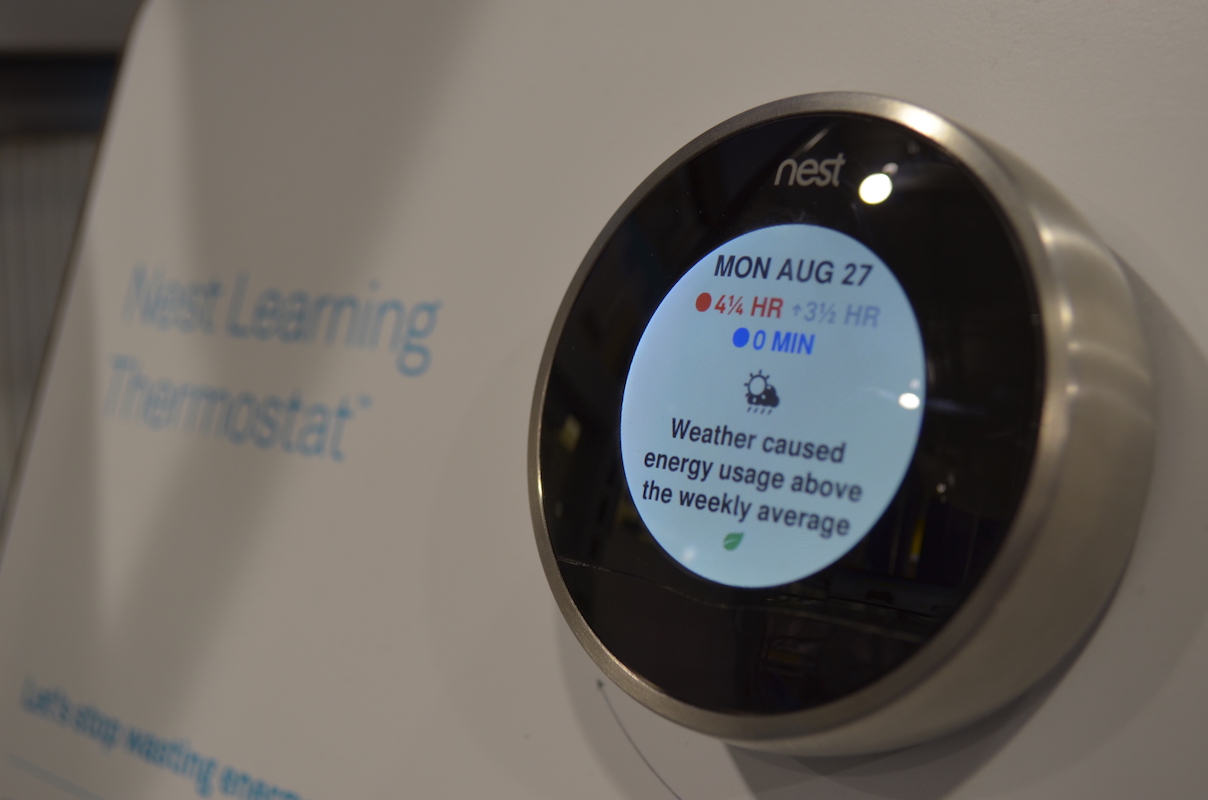

Taken individually, a water heater or a home thermostat doesn’t make a big impact on total energy load. Together, however, millions of residential devices switching on or off in unison could be a real game changer. That’s the idea behind moves both in the public and private sectors across California to get thermostats, heaters and other appliances into the storage and demand response game.

For example, California lawmakers are trying to transform millions of electric water heaters across the state into both mini-energy storage devices and replacements for natural gas-generated heat. Last year, the state Legislature passed State Bill 1477, which dedicated US$200 million over four years to help advance low-carbon space and water heating technologies. The big-picture goal is to decarbonise residences across the state by weaning them off natural gas and have them use electric appliances instead. Electric water and space heaters tapping an increasingly clean grid are seen as the linchpin to creating carbon-free households. On top of that, heat pump technology, when fitted with software that matches heating times with dips in energy prices, also make for excellent energy storage devices that can store hot water for later use.

In July of this year, Google-owned Nest announced it was pairing up with Leap, a San Francisco-based firm that runs a universal distributed energy exchange. Nest’s smart thermostats will deploy energy to meet demand response capacity on Leap’s exchange. Already, some 2,500 thermostats across the state are turning on and off in response to energy price signals sent from the Leap exchange. Multiply those thermostats’ numbers many times over and those stalagmites of energy demand will really start shrinking.

Forward movement with clean energy

With these initiatives, California is tackling the challenges of building a more integrated, reliable electrical grid that makes full use of renewable genera- tion and energy storage. Public agencies are creating the incentives and regulatory framework that can inspire private companies to invest in and develop the latest solutions to long-duration storage, demand management and other pieces of the reliability puzzle.

Many of these programmes and technologies will be on display at Energy Storage North America Conference & Expo (ESNA) in San Diego on November 5 to 7, 2019. In its 7th year, the event is celebrating innovation in energy storage alongside government leaders of California and Germany, two of the world’s most clean energy-forward places, as it hosts the California-Germany Bilateral Energy Conference.

This article first appeared in PV Tech Power, Vol20, which is available now to download for free, here.