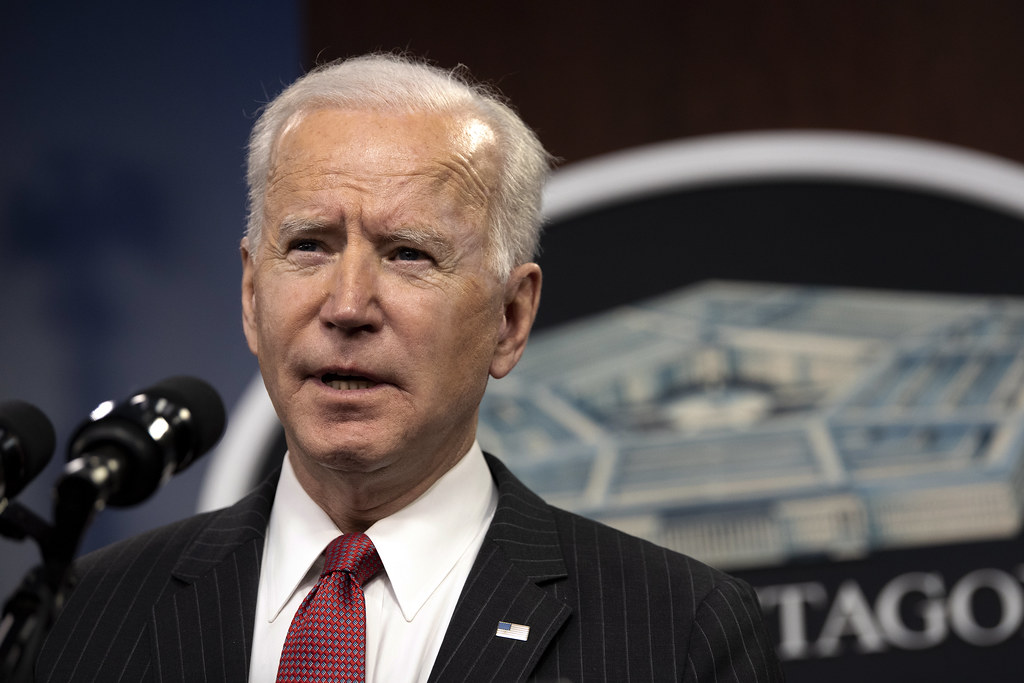

The Biden administration plans to use the Cold War-era Defense Production Act (DPA) to ramp up mining and processing for materials integral to batteries and renewable energy, like lithium, graphite, nickel, manganese and cobalt.

The DPA means the federal government will be authorised to support the production and processing of minerals and materials used for large-scale batteries for electric vehicles (EV) and stationary energy storage.

Details on what concrete measures will be taken are scant but industry bodies have said it is a strong signal that Biden is taking the supply shortage seriously.

According to some reports, the move should help companies access government funding for feasibility studies for projects that extract those materials or make existing facilities in the supply chain more productive. Support for feasibility studies is mentioned briefly in the announcement, which came in the form of a memorandum for the Secretary of Defense Lloyd Austin.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The Department of Energy has already made US$3 billion available during Q2 this year for the battery supply chain while a senior official recently said it had US$10 billion of loan applications for battery manufacturing plants in process.

In the memorandum, the President said: “It is the policy of my Administration that ensuring a robust, resilient, sustainable, and environmentally responsible domestic industrial base to meet the requirements of the clean energy economy, such as the production of large-capacity batteries, is essential to our national security and the development and preservation of domestic critical infrastructure.”

It added that the US currently depends on ‘unreliable foreign sources’ for many of the necessary materials and minerals, before saying:

“To promote the national defense, the United States must secure a reliable and sustainable supply of such strategic and critical materials. The United States shall, to the extent consistent with the promotion of the national defense, secure the supply of such materials through environmentally responsible domestic mining and processing; recycling and reuse; and recovery from unconventional and secondary sources, such as mine waste.”

Further down, the memorandum said that expanding domestic production of the materials and minerals was “…necessary to avert an industrial resource or critical technology item shortfall that would severely impair the national defense capability.”

The US has long been seeking to kickstart a US manufacturing base for lithium-ion batteries which are integral to the EV and energy storage sectors. The political desire culminated in large funding and focus on batteries in the historic Bipartisan Infrastructure Bill passed late last year.

Gigafactory announcement have paled in comparison to Europe, however, although a Clean Energy Associates report reckoned by 2030 the US would be close to Europe’s global market share in production of 16%.

A White House fact sheet adds that the President is also reviewing potential further uses of the DPA to secure safer, cleaner, and more resilient energy for America. The DPA was first enacted during the Korea war of 1950 and was last invoked in February last year to bolster vaccine production and boost supply of testing kits and PPE equipment to fight a large wave of Covid-19.