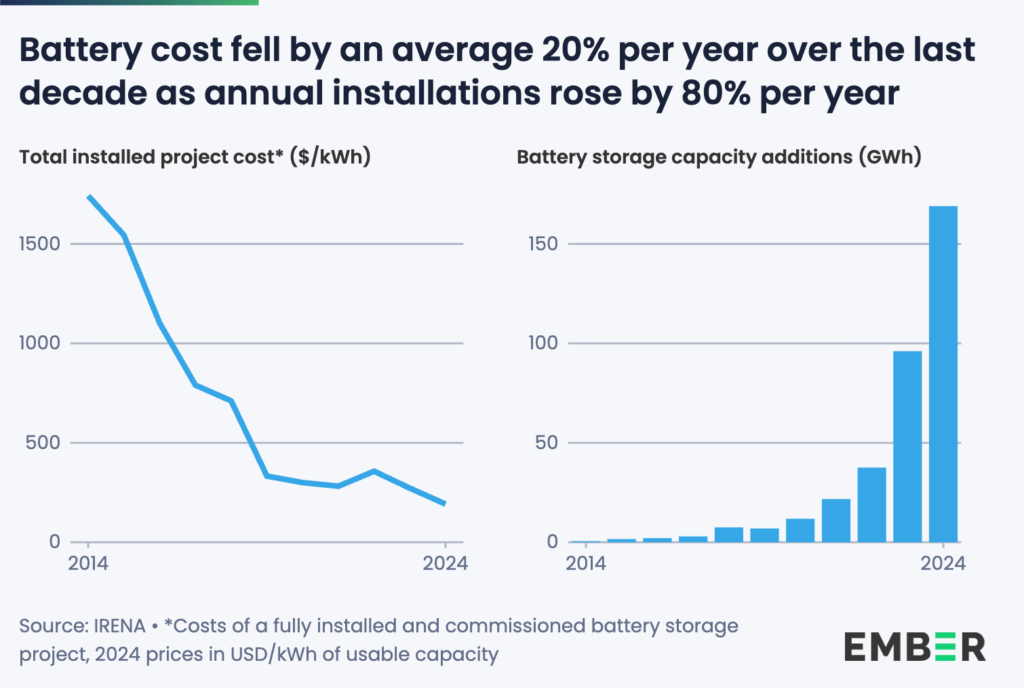

Global average prices for turnkey battery storage systems fell by almost a third year-over-year, with sharp cost declines expected to continue.

In 2025, the global average price of a turnkey battery energy storage system (BESS) is US$117/kWh, according to the Energy Storage Systems Cost Survey 2025 from BloombergNEF (BNEF), published last week (10 December).

That was a 31% decline from 2024 numbers. Although the annual survey last year found a global average of US$165/kWh, which would imply a 29% difference, BNEF is understood to adjust figures for inflation and revised its 2024 number to US$169/kWh.

Prices are now at their lowest since the market research and analysis group began its survey in 2017, although an even sharper 40% drop was recorded from 2023 to 2024.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

BNEF collected system costs and project data from 596 unique submissions, finding global averages for 2-hour duration systems at US$124/kWh and US$110/kWh for 4-hour duration systems.

Unsurprisingly, turnkey system prices in China continue to be the lowest in the world by far, with an average of US$73/kWh this year versus US$177/kWh in Europe or US$219/kWh in the US.

The survey’s publication closely follows the 2025 edition of BNEF’s Lithium-Ion Battery Price Survey, which found a smaller 8% year-over-year decline in the average cost of lithium-ion (Li-ion) battery packs from 2024 to 2025, arriving at a global average of US$108/kWh.

That survey encompasses batteries used for a range of e-mobility applications as well as stationary energy storage. BNEF found that, due in part to a widespread shift to lower-cost lithium iron phosphate (LFP) battery cells, stationary energy storage pack prices were the lowest of any market segment in 2025, at just US$70/kWh globally on average.

‘Batteries now cheap enough to make solar dispatchable’

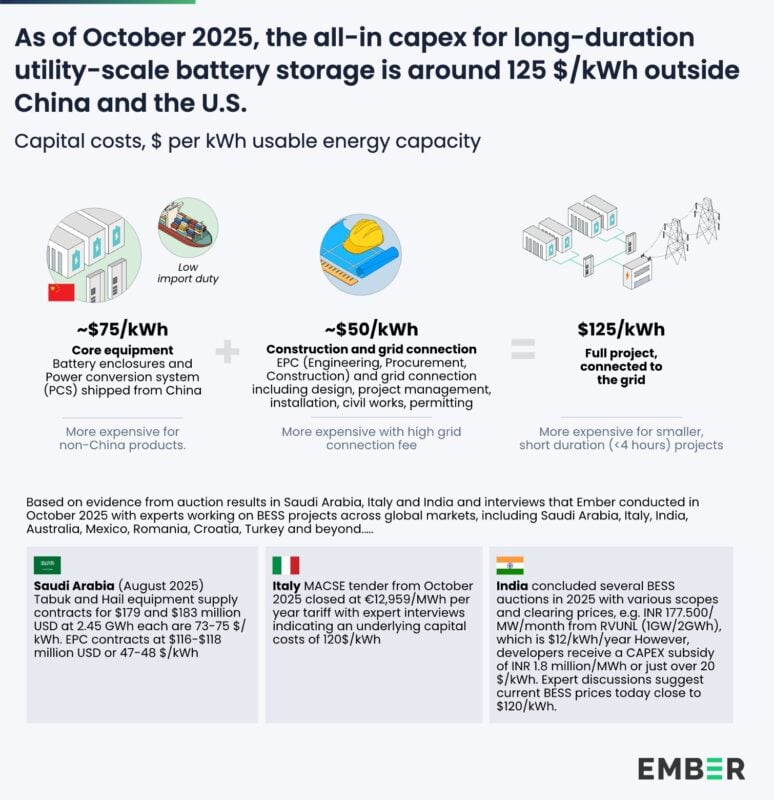

Also, last week (11 December), climate solutions think tank Ember released new analysis assessing the all-inclusive BESS capex required for a 4-hour+ duration project across all global markets, excluding China and the US, to be at an average of US$125/kWh as of October 2025.

Ember’s figure is not far off from BNEF’s and was arrived at by examining recent auction results in Italy, India, and Saudi Arabia, as well as insights fed in from expert interviews.

The think tank said around US$75/kWh of the cost is for core equipment shipped from China (including BESS enclosure, PCS and EMS) and the remaining US$50/kWh is the installation and connection cost. Meanwhile, the levelised cost of storage (LCOS) with battery storage is US$65/MWh, according to its research.

Ember claimed this brings the cost of storage down to a point where dispatchable solar PV becomes economically feasible.

“Solar is no longer just cheap daytime electricity, now it’s anytime dispatchable electricity. This is a game-changer for countries with fast-growing demand and strong solar resources,” Ember global electricity analyst Kostantsa Rangelova said.

Ember calculated that storing 50% of a day’s solar generation, which can be used during evening peaks and nighttime hours, adds US$33/MWh to the total cost of solar PV. Factoring in an assumed global average price of solar energy of US$43/MWh in 2024, this means an asset could be made dispatchable to output electricity on demand for a total electricity cost of US$76/MWh.

There are, however, big variations in prices from market to market, even excluding China as Ember did. The think tank said core equipment costs can be higher by US$100/kWh or more in markets that have higher tariffs, stricter standards or local content requirements.

The cost of installation and grid connection—particularly the latter—can also vary, with grid connection fees ranging from US$30/kWh in some cases to US$100/kWh in others.

Ember also noted that the expected cost would be higher for shorter-duration systems by about 10% to 15% due to several components being sized to power (MW) rather than energy (MWh).

Nonetheless, Ember said that dispatchable solar at US$76/MWh is cheaper and can be built more quickly than equivalent capacity using natural gas generation. At the same time, even if core equipment is imported from China (until such time that countries build their own or alternative non-China supply chains), approximately 40% of the total project value remains local, in terms of engineering, civil works, grid connection, and other EPC activities.

Ember has created an online calculator app for estimating the US$/kWh levelised cost of storage based on Capex, Opex, expected lifetime and degradation rate, utilisation, efficiency and any application discount rate.

Energy density, manufacturing efficiency among factors driving costs down

While Ember’s report, How Cheap is Battery Storage? does not attempt to quantify year-over-year changes, Rangelova said it was clear, based on available data, including research from BNEF, that battery equipment costs are “on track for another major fall in 2025.”

BNEF said in its Energy Storage Systems Cost Survey 2025 that, as with last year’s findings, bigger battery cells and more energy-dense BESS enclosures continue to support reductions in cost. This year, DC-side systems that used 300Ah or larger cells were found to be 50% cheaper than systems with smaller cells.

At container level, larger DC blocks with 4MWh capacity or more were found to be 39% cheaper than 2MWh to 4MWh configurations.

Driven by these factors and others such as advances in system integration and manufacturing efficiency, BNEF said cost reductions are expected to continue and by 2035, the firm has forecast US$41/kWh average prices for 4-hour turnkey systems in China, US$101/kWh in Europe and US$108/kWh for systems in the US that use Chinese batteries.

In the past year, Europe saw a sharper year-on-year decline in system costs (37%) than China did (29%), which BNEF said was due to overcapacity from Chinese suppliers hitting the European market in response to domestic market saturation in China and US policy changes. This was also echoed in the recent Li-ion pack price survey’s findings.

US import tariffs on Chinese batteries are due to increase, and rule changes to the investment tax credit (ITC) and production tax credit (PTC) incentives are locking out projects that benefit from material assistance from foreign entity of concern (FEOC) countries, including China.

However, BNEF still believes BESS prices in the US market will continue to decline even with Chinese imports, although projects using batteries made within the US or from non-FEOC producers in Southeast Asia, for example, will have the advantage of still being able to avail of tax credits.