The recent introduction of 15-minute settlement periods across European power markets could result in significantly higher profits for battery storage asset operators.

New research from Rystad Energy highlights how the change to allow bids for every quarter of an hour in the EPEX SPOT day-ahead market, implemented at the end of September, could enable battery energy storage system (BESS) operators to earn more.

The increase in the number of trading intervals from 24 per day (hourly) to 96 is designed to allow markets to adapt to the inherent characteristics of variable renewable energy (VRE) generation. The change followed an earlier move this year to introduce 15-minute periods to the intraday market.

This means that solar PV plant operators no longer need to only sell their power in hourly blocks, despite variations in generation throughout the bid periods. BESS operators, meanwhile, now have greater arbitrage opportunities to buy electricity when it is cheap and sell at a higher price later.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

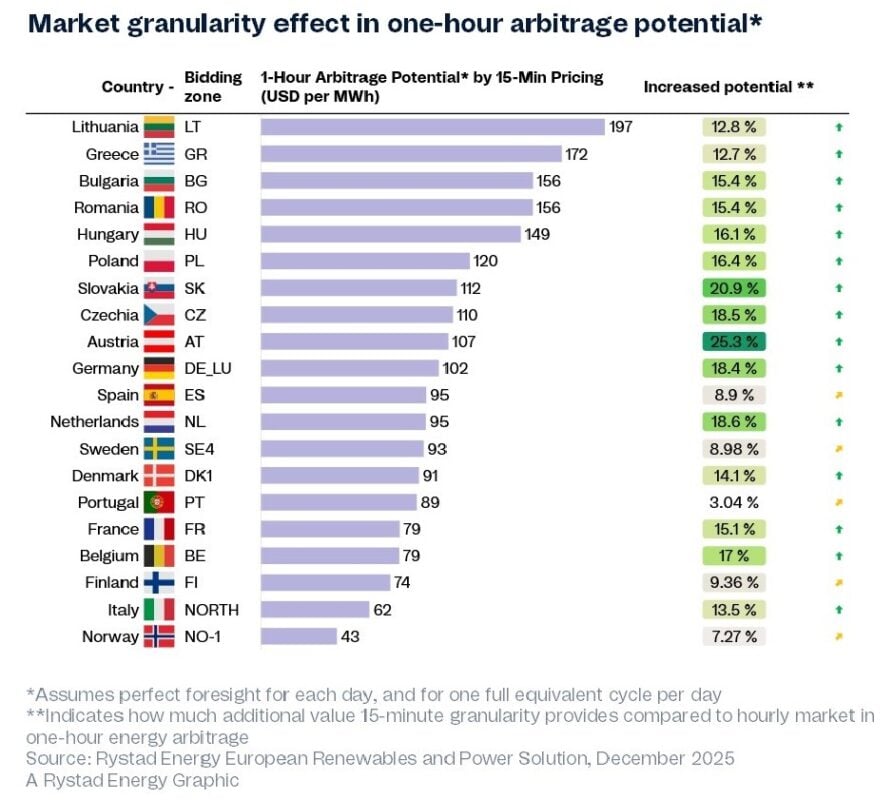

While Rystad Energy does not expect arbitrage margins at today’s levels of roughly US$150/MWh on average to persist long-term and considers US$60/MWh a more realistic long-term average, in some countries, potential arbitrage profits could rise by 15%-25%, according to work by the firm’s senior energy storage analyst Sepehr Soltani.

Some markets will see less benefit and on average Rystad says the average increase in arbitrage potential is around 14%.

While Portugal would only see a 3% uplift, for example, and BESS operators in the Iberian country could expect around US$89/MWh in current arbitrage revenues, BESS operators in Austria now have a more than 25% increase in potential earnings and—assuming perfect foresight and one equivalent full cycle per day—could earn US$107/MWh.

“In countries with less flexibility in power generation and consumption, [a] high share of intermittent renewables can cause large price swings. Rapid changes in wind or solar generation mean electricity prices can shift noticeably even within a single hour,” Rystad analyst Soltani said.

“Shorter 15-minute trading intervals capture these quick shifts, creating more opportunities for flexible assets. In contrast, in places with a flexible electricity supply, such as Norway with hydropower and Portugal with hydropower and gas, prices are more stable over an hour. As a result, the difference between profits from 15-minute and hourly trading is much smaller.”

5-Minute Settlement in Australia has ‘consistently increased arbitrage profits’

Soltani drew a parallel with the National Electricity Market (NEM) in Australia, which in 2021 went from 30-minute intervals to a new structure for wholesale electricity market price setting, Five-Minute Settlement (5MS).

In the NEM-connected state of New South Wales (NSW), yearly arbitrage revenues have increased by 20% since the introduction of 5MS. In neighbouring Victoria, the increase in revenue for 1-hour arbitrage has been about 15%.

The “finer time intervals have consistently increased arbitrage profits,” in Australia, Soltani said.

A team at German utility Next Kraftwerke wrote in September on the company’s corporate blog that the introduction of 15-minute trading periods, called 15-minute Market Time Units (MTUs), “represents a significant step toward greater flexibility and efficiency in electricity trading.”

“Especially in an energy system increasingly driven by renewables, this change promises substantial improvements by enabling more efficient compensation for short-term fluctuations.”

The Next-Kraftwerke blog noted that while the daily auction opens for 15-minute bids at 12pm CET, market participants still have the flexibility to enter 30-minute and 60-minute products as well, depending on their nominated electricity market operator (NEMO).

Again, while there is a big variation between countries and bidding zones, assuming a 20% increase in annual BESS asset earnings for 15-minute MTUs versus 60-minute, total return on investment could increase by about 3% over 20 years, according to Rystad’s analysis.

However, analyst Soltani added another major caveat: day-ahead market arbitrage values could be lower depending on factors that include efficiency losses, BESS asset availability, market liquidity and hedging strategies that mitigate reliance on one-off price spikes.

Taking the example of Australia once more, Sahand Karimi, co-founder and CEO of BESS optimisation specialist OptiGrid told ESN Premium in an October interview that the increased granularity of 5MS means human traders are unable to respond quickly enough to capitalise on volatility events.

“Fundamentally, intelligent bidding means considering a range of scenarios that might unfold in upcoming intervals and placing volume bids across different markets to achieve the optimal outcomes while minimising the risk of dispatch under less-ideal scenarios,” Karimi said.

Energy-Storage.news’ publisher Solar Media will host the 11th annual Energy Storage Summit EU in London, 24-25 February 2026. The event brings together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.