The government of Queensland seeks input on its battery industry strategy, while an engineering provider has been appointed for a large-scale battery gigafactory in Victoria.

Queensland’s state government has promised to develop and publish its official Battery industry Strategy by mid-2023, following the September announcement of an Energy and Jobs Plan, which commits the Australian state to getting 70% of its energy from renewable sources by 2032.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

As part of the Energy and Jobs Plan, State Premier Annastacia Palaszczuk announced that AU$500 million (US$348.72 million) from a AU$4.5 billion Renewable Energy and Hydrogen Jobs Fund would be given to state-owned companies for investment into large-scale and community-level battery storage deployments.

Queensland also holds reserves of important raw materials for lithium-ion and flow battery technologies and the government aims to stimulate activity in the upstream segment of the battery market.

With Palaszczuk currently in the final week of a three-week leave of absence, Acting Premier Steven Miles hosted the launch yesterday of a discussion paper identifying the opportunities and challenges ahead in pursuing that goal.

The paper, produced by consultancy firm Accenture for the government, said Queensland’s battery industry could create up to AU$1.3 billion economic activity and more than 9,000 jobs by 2030. Accenture predicted that Australian demand for batteries will reach 90GWh by that time, with 26GWh in Queensland.

Globally, stationary energy storage for the grid is forecast to be the fastest growing segment of the battery market, experiencing around 37% growth annually, versus 17% for passenger electric vehicles (EVs).

While EVs will be the much bigger global market overall at US$82 billion forecasted value by 2030, compared with US$12 billion for grid-connected storage, within Queensland itself, Accenture forecasted a 14GWh potential market size for grid storage and 27GWh total in Australia, making it the single biggest market opportunity.

Alongside that grid-scale stationary storage, there could be as much as 7GWh behind-the-meter storage in Queensland and 14GWh across Australia, with about 1GWh additional battery demand for off-grid applications in the state and 5GWh in the country.

Steven Miles was speaking at an event in Maryborough, the Queensland city where Energy Storage Industries- Asia Pacific (ESI) is building a factory making flow batteries with technology licensed from US company ESS Inc – the holder of proprietary IP for a type of flow battery using iron and saltwater electrolytes.

Lithium-ion batteries will likely be the dominant battery technology for the near future, and Queensland has some opportunities to assemble lithium devices and participate in the value chain via R&D and other activities.

However, while lithium is the overall more valuable market, it could be in other more niche technologies, like flow batteries, that the state may hold the most competitive advantages. Queensland holds significant vanadium reserves, around 30% of the world’s supply and end-to-end vanadium redox flow battery (VRFB) making would mean capturing maximum value from that.

Materials for ESI’s iron flow batteries too can be sourced within the state, with the company developing a 400MW per year factory.

With the discussion paper now out, the government has invited public comments as the Battery Industry Strategy takes shape. The comment period closes at the end of March 2023 and the discussion paper can be viewed here (1.9mb PDF).

Accenture appointed for 30GWh factory’s engineering design

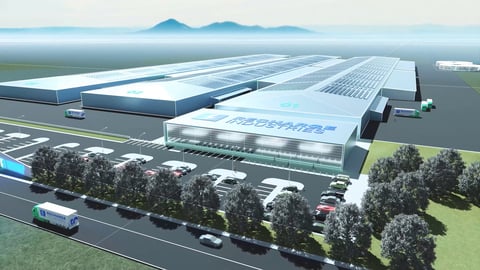

Meanwhile, in Victoria, Accenture (again) has been appointed to work on the detailed engineering phase of a battery gigafactory scheduled for construction to begin during 2023.

New York-headquartered manufacturer Recharge Industries has established a regional HQ in Geelong and has secured key equipment, to be delivered by the middle of this year.

The gigafactory will be able to make 2GWh of batteries at a site in the Victorian city annually by 2024. Recharge then wants to ramp up the factory to 4GWh annual production capacity and eventually as much as 30GWh, targeting both stationary battery energy storage system (BESS) and electric mobility markets.

“Establishing a sovereign manufacturing capability to produce state-of-the-art lithium-ion battery cells is critical to Australia’s renewable energy economy – meeting national demand, generating export income and securing supply chains,” Recharge Industries CEO Rob Fitzpatrick said.

Meanwhile Accenture group digital engineering and manufacturing consultancy Industry X’s managing director Soeren Schrader said the global transition to clean energy is being hampered by supply chain challenges.

The Geelong gigafactory will “go a long way” to help Australian industry to tackle those challenges, Schrader said.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Asia, 11-12 July 2023 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.