The national Renewable Energy Association has taken aim at a British government proposal to hike up tax rates attached to some energy saving equipment purchases, including solar and battery storage.

A consultation launched by the government department responsible for tax, HM Revenue & Customs closed late last week, proposing an increase in the VAT (value-added tax, the UK's sales tax mechanism) attached to these energy saving materials from 5% to 20%, essentially eliminating a discount that had been applied to those products.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

It is not the first time that solar PV has been threatened with a higher rate of VAT. In 2015 the European Court of Justice ruled that the UK’s application of a discounted rate was illegal and, despite attempting to fight it, the government eventually conceded that the increase could not be averted.

An increase to 20% – the default rate of VAT for goods and services – was initially expected in the 2016 Budget. However HMRC’s consultation response was absent, and later it emerged that a cross-party group of MPs had voiced their concerns over the plans.

Just a few weeks later, the ECJ published its VAT action plan with no comment on the solar decision, instead electing to “modernise and reboot” Europe’s taxation framework.

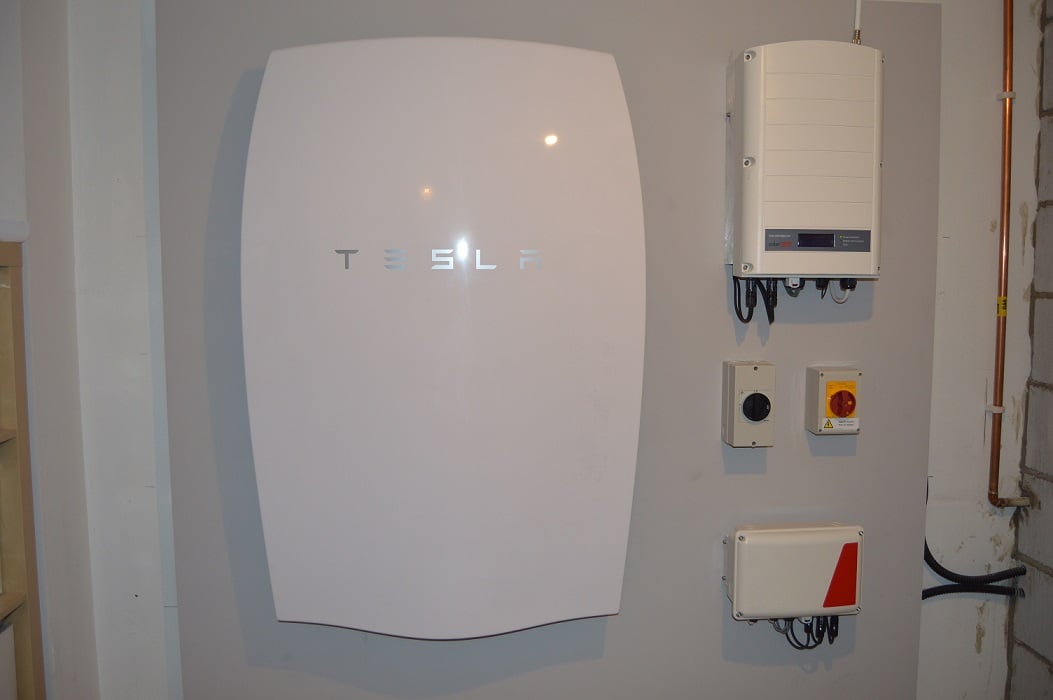

Since then the government has remained coy, however the storage market secured a partial victory in late 2017 when HMRC said that domestic battery storage systems could also enjoy the 5% VAT rate as long as they were installed alongside solar systems.

The new consultation seeks to amend the discounted rate so that a full 20% rate of VAT is applied to the machinery costs should they be above 60% of a total installation fee. Labour costs will still benefit from the reduce rate.

There is also a carve out for homeowners who are aged 60 or above and those receiving particular benefits, and housing associations will also be eligible for the reduced rate still. The new rates are proposed to come into effect from 1 October 2019.

But the REA said the increase risks putting the UK market at a “strategic disadvantage” for attracting investment in smart domestic energy systems, and were particularly surprising given how an accompanying impact assessment concluded that the impact on HMRC’s receipts would be “negligible”.

Frank Gordon, head of policy at the REA, said the proposed hike would hit the country’s small-scale renewable sector hard “during an already difficult landscape”.

“This change risks setting back the UK decarbonisation of homes and businesses in the UK by a number of years.

“Despite recent mass climate-related protests and the UK parliament declaring a ‘climate emergency’, the government is again erecting a barrier to cutting emissions and increasing the costs for households who want to help. They are also failing to recognise the cumulative impact of withdrawing as many as 18 policy mechanisms that supported renewable energy deployment since 2015, which could leave the UK trailing behind on decarbonisation and clean growth.”