A report by American Clean Power Association (ACP) and Aurora Energy Research states that the MISO service area will need a 500% rise in battery storage by 2035.

The clean energy trade organisation ACP commissioned a study from Aurora Energy Research, showing a substantial opportunity to enhance grid reliability and reduce energy system costs by deploying large-scale energy storage across MISO.

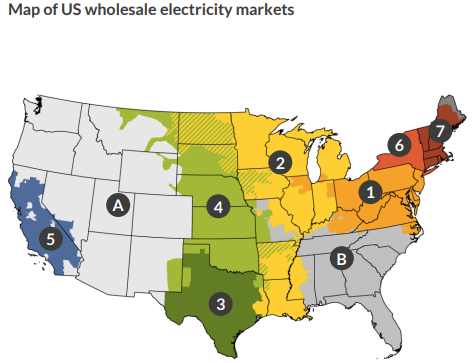

MISO is the biggest regional transmission organisation (RTO) in the US, covering Arkansas, Illinois, Indiana, Iowa, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Montana, North Dakota, South Dakota, Texas, Wisconsin, and the Canadian province of Manitoba.

According to the report, the RTO is facing a growing load demand that its ageing energy generation resources are not equipped to handle.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Because the large area covered by MISO also has limited transmission infrastructure, there is typically a significant variation in the price of electricity.

The report notes that this summer, MISO saw its capacity prices jump over 2,000%. Without adding energy storage, modelling shows peak electricity prices for consumers will continue to rise and become less reliable over time.

“Without battery storage, modelling shows that peak electricity prices during high-demand hours would be up to US$159 per MWh or higher by 2035. The analysis also estimates that greater reliance on one type of legacy energy infrastructure could add US$493 million in electricity costs. In a future without energy storage, the daily electricity price could spike almost three times higher than if the region builds out energy storage capacity.”

Currently, 126.5MW of batteries are operational in MISO. Aurora’s report expects 980MW will be online by next spring.

The interconnection queue currently contains 351GW of capacity across all technologies. More than 25GW of batteries entered the interconnection queue in 2024.

The total capacity entering the 2023 interconnection queue is 115GW, which is 31% lower than in 2022. Aurora and ACP attribute this decline to queue reforms that raised entry barriers, including higher milestone payments and stricter withdrawal penalties, to discourage speculative projects.

Deploying over 10,000MW of energy storage from 2025 to 2035 will guarantee reliable power for Midwestern and Central US states, especially as the economy expands and electricity demand increases.

The report says this could help the region save more than US$4.5 billion by 2035 and generate more than US$25 billion in energy cost savings over the next two decades.

However, the report highlights several key policy changes that would be necessary to bring these energy storage projects to fruition.

First, there needs to be updates to electricity market rules to fairly value flexible energy storage resources.

Additionally, the interconnection process can be accelerated to eliminate unnecessary delays in connecting new energy storage resources to the grid.

The report states that streamlining and clarifying permitting at the state and local levels is necessary to ensure that new energy infrastructure can be built safely, responsibly and quickly.

Finally, Aurora emphasises the importance of advancing state targets and procurements that show a commitment to developing new energy infrastructure, such as energy storage.

In April of this year, in a report based on findings from the Brattle Group, ACP highlighted reforms that US grid operators needed to implement, including in MISO.

The report said that MISO, in particular, needed to reform its Direct Loss of Load (DLOL) methodology and Loss of Load Expectation (LOLE) modelling. Reforms to the DLOL methodology seek to incorporate a probabilistic analysis that assesses resource performance specifically during high-risk periods instead of averaging risks over the entire year.

The report also argued that the LOLE metric fails to fully reflect the effects of weather-related variability, renewable energy sources and changes in demand.

According to a study from the Minnesota-based nonprofit Great Plains Institute, batteries in MISO have historically made more money by participating in the frequency regulation market rather than the capacity market. This could remain the case until transmission infrastructure in the region is upgraded and added.

In June, the North American Electric Reliability Corporation’s (NERC’s) 2025 State of Reliability report found that in Texas, there were multiple instances of batteries providing 100% of the total capacity for frequency regulation services in 2024.

ACP and Aurora’s report also noted this as an example of how batteries can help restore normal grid frequency and prevent load shed.