The Australian Energy Market Operator (AEMO) has revealed that battery energy storage system (BESS) output in Q1 2025 increased 86% in the National Electricity Market (NEM) from the same period of last year.

According to the organisation’s latest Quarterly Energy Dynamics report released today (7 May), BESS generation output reached a new all-time high this quarter, increasing to an average of 98MW, spurred by new capacity entering the market.

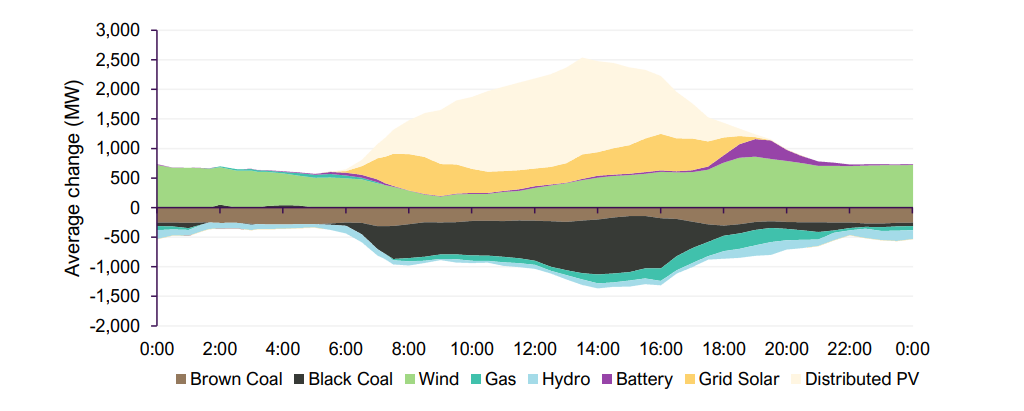

This BESS output was concentrated strongly in the evening peak period, often when solar PV generation begins to decrease. This typically begins at around 17:00 and ends around 21:00. You can find a breakdown below.

The amount BESS contributed to the overall electricity mix remained minimal, standing at 0.4% for Q1 2025. However, this was still a 50% increase on the previous year, when it stood at 0.2%.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

As noted, the increase in BESS output has been attributed to the increase in large-scale systems reaching full operation or undergoing commissioning since Q1 2024.

This includes the 255MW/510MWh Western Downs BESS in Queensland, the 850MW/1,680MWh Waratah Super Battery in New South Wales, the 200MW/400MWh Blyth BESS in South Australia, and Rangebank, a 200MW/400MWh system in Victoria.

AEMO also noted that during Q1 2025, several new major BESS units were registered in the NEM or commenced commissioning. These include the 200MW/400MWh Greenbank BESS, the 300MW/600MWh 2-hour duration Tarong BESS in Queensland, the 460MW/1,073MWh first stage of the Eraring BESS in New South Wales and Koorangie, a 185MW/370MWh system in Victoria.

Not only is there a growing number of BESS in Australia entering the commissioning phase and reaching full output, but the overall capacity of systems seeking connection approval has increased year-on-year from 11GW to 20.5GW, an 86% rise.

Utility-scale solar PV generation and BESS are leading the applications for the financial year to date. However, despite seeing a rise in announced solar-plus-storage projects in Australia in recent months, these are still minimal and have not been shared across most states, focusing more on New South Wales and Victoria.

Violette Mouchaileh, the executive general manager of Policy and Corporate Affairs at AEMO, said that the expansion of renewable energy and BESS capacity in the NEM is leading to higher contributions. Meanwhile, the availability of black and brown coal-fired generators has reached record lows for the first quarter.

“The impact of the transitioning electricity system was also seen, with a 5.1% decline in total emissions, due to the combination of lower coal and gas-fired generation and higher renewable energy output,” Mouchaileh said.

“The higher renewable energy and battery generation combined with lower coal-fired power output resulted in a Q1 record low in emissions intensity, which was 5.7% below the same period last year.”

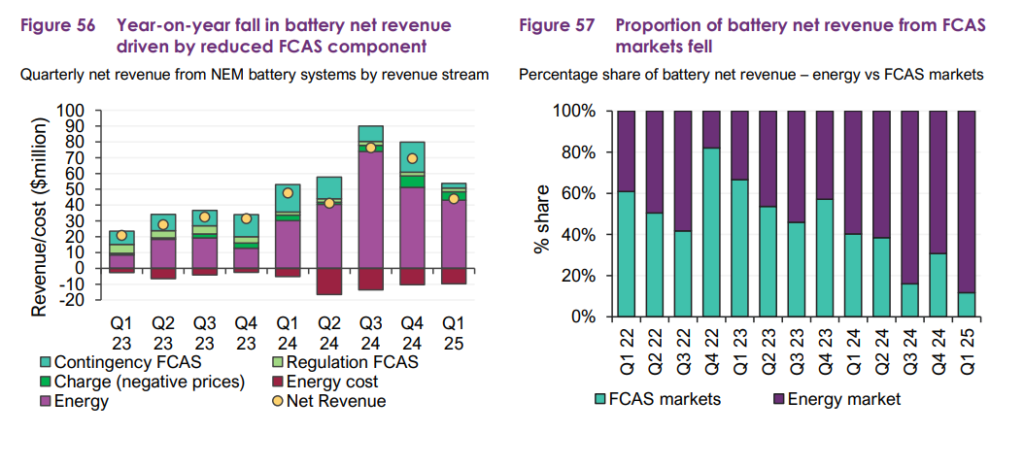

Net revenue for BESS totals AU$44 million in Q1 2025

In the first quarter of 2025, the estimated net revenue for NEM grid-scale BESS, which includes both energy services and frequency control ancillary services (FCAS) markets, totalled AU$44 million (US$28 million). This amount is AU$3.7 million lower than the estimated revenue for the first quarter of 2024.

Net revenue from the energy market increased by AU$14.7 million, a 44% increase, reaching a total of AU$48.5 million. This amount represents 88% of the total estimated net revenue. The growth was mainly driven by an AU$12.8 million (42%) rise in revenue from energy generation.

Additionally, charging during periods of negative prices contributed an extra AU$1.9 million, raising the total revenue from this source to AU$5.4 million. Meanwhile, energy costs rose by AU$4.5 million (87%) compared to the previous year.

While the net revenue from energy market arbitrage increased year-on-year, revenue from Frequency Control Ancillary Services (FCAS) fell by AU$13.9 million, a decline of 72%, bringing the total to AU$5.3 million for the quarter. This decrease in FCAS revenue was primarily due to lower FCAS prices, which resulted from an increased availability of FCAS capability, especially from BESS, as well as a limited number of market events during the quarter.

The increase in net revenue from energy arbitrage across the NEM in Q1 2025 was driven by a significant growth in BESS capacity compared to the previous year. BESS availability in the NEM rose by 46%, from 819MW in Q1 2024 to 1,193MW in Q1 2025.

Additionally, the average price spread for BESS across the NEM was AU$183/MWh, down from AU$248/MWh in Q1 2024, indicating a decrease in price volatility year-on-year.

Reduced price volatility sees BESS revenue decrease

In an exclusive interview with Modo Energy data analyst Hatta Misra last month, ESN Premium heard that BESS revenue decreased by 40% in Australia’s NEM in March 2025 from the previous month.

Misra said: “The headline figure is that battery revenue decreased by 40%. That’s mainly because of lower price volatility as the country moves out of summer.”

February 2025 experienced a surge in BESS revenue within Australia’s NEM, primarily influenced by market price volatility. Across the month, NEM-wide battery revenues averaged AU$107,000 (US$67,000) per MW/year, reflecting a 2% increase from January.

Misra explained: “In February, there were three days where energy prices went up over AU$10,000. That means a lot of ability for batteries and other peaking resources like gas to make money.”

Optimisation and battery revenue streams will be some of the key topics covered at the upcoming Battery Asset Management Summit Australia 2025, which Solar Media, our publisher, will host on 26-27 August in Sydney.