Energy-Storage.news Premium hears from Giovanni Damato, President of organic flow battery company CMBlu Energy, Inc., on changes to FEOC and Section 301 tariffs.

US restrictions on foreign entities of concern (FEOC) and the planned Section 301 tariff hike to 25% on Chinese-origin battery energy storage systems (BESS) took effect on 1 January.

Justin Johnson, COO of renewable energy developer-operator Arevon Energy and Tom Cornell, CEO and President of Prevalon Energy, previously spoke with ESN Premium on this topic, both giving unique, though similar insights on the price of Chinese-manufactured BESS, especially those using lithium-ion (Li-ion) cells.

Johnson observed that Chinese-manufactured BESS remains the most affordable choice in the industry, although only slightly. He also noted that customers are prepared to pay a premium to avoid the risk of tariff fluctuations.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Meanwhile, Cornell said, “On a narrow, equipment-only basis, Chinese-manufactured systems can still appear cheaper. However, that gap has narrowed significantly.”

He continued, “When tariffs, FEOC restrictions, potential loss of tax credits, financing impacts, and long-term service considerations are included, the economics are far closer than they were even a year ago. For many projects, compliant systems with clearer regulatory standing now pencil similarly—or better—on a total cost and risk-adjusted basis.”

Giovanni Damato provides insights into how CMBlu and other companies using non-lithium electrochemical battery technologies view the situation.

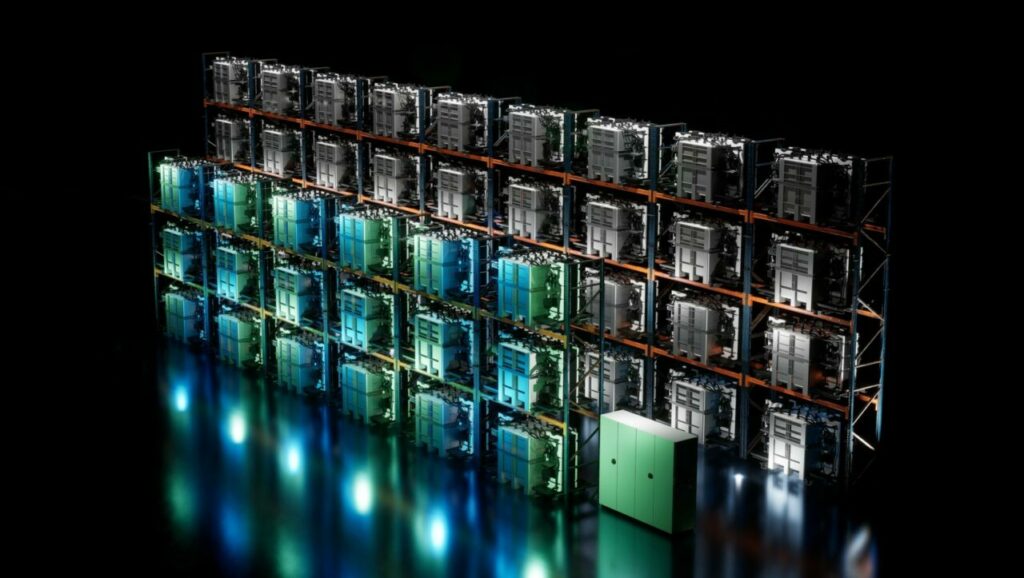

CMBlu’s approach to flow batteries differs from traditional flow battery designs with its ‘Organic SolidFlow’ technology.

Previously speaking with ESN Premium, Damato explained of the technology, “At its core, the architecture is like a flow battery with two major twists that we think give us a strong competitive advantage.”

How has BESS procurement changed since 1 January, with active FEOC restrictions in place?

I wouldn’t characterise 1 January as a sharp inflexion point. This shift has been building steadily since the FEOC requirements became clear following the passage of the IRA [in 2022]. What has changed is the intensity of the conversation. Developers and OEMs are now far more focused on how to preserve tax credit eligibility while managing rising project costs tied to steel, cement, and other construction inputs.

FEOC restrictions introduced real procurement and compliance uncertainty, which initially slowed some decisions, but they’ve also accelerated demand for FEOC-safe supply chains and domestic manufacturing. That regulatory tension has become one of the single biggest factors shaping project timing and sourcing strategy.

For CMBlu, we’re seeing growing interest precisely because our technology does not carry FEOC concerns, and because we can ramp US manufacturing quickly—from active material supply chains through module assembly.

At the same time, the market is clearly pushing toward non-lithium alternatives, and that shift is reinforcing long-term confidence in solutions like ours that align with both policy and supply-chain resilience.

How has BESS procurement changed since 1 January with regard to Section 301 tariffs?

From our perspective, the impact of Section 301 tariffs – particularly the higher tariffs on imports from countries like China – is becoming more visible in procurement decisions. In the near term, those tariffs are putting upward pressure on project costs and prompting developers with existing or near-term projects to actively look for alternative technologies and supply chains.

That dynamic has worked in CMBlu’s favour, for many of the same reasons tied to FEOC considerations. We offer a non-lithium solution and the ability to ramp US manufacturing across the supply chain, which materially reduces long-term tariff exposure.

That said, in the near term, we do have some tariff exposure related to demonstration and pilot projects, as our initial pilot production facility is located in Germany, which carries its own tariff considerations. Longer term, however, the shift toward domestic manufacturing and diversified supply chains is clearly accelerating, and that aligns well with our strategy and growth trajectory.

Are Chinese-manufactured BESS still the most cost-effective option?

Lithium-ion – particularly from Chinese manufacturers – has effectively set the price benchmark in the battery market, especially for short-duration applications. For use cases in the 1-hour to 4-hour range, lithium-ion can still make sense, but we’re clearly seeing a shift across utilities, hyperscalers, and commercial and industrial customers toward longer-duration needs.

That’s where non-lithium technologies gain a meaningful advantage. For applications above four hours, CMBlu Energy’s Organic SolidFlow battery is already cost-competitive with lithium-ion today, and as duration extends to six, eight, or even ten hours, our technology becomes increasingly more economical, while also avoiding the supply-chain and geopolitical risks associated with lithium-ion.

What have you done prior to the active restrictions and increased tariffs to secure BESS?

Our situation is somewhat different because, as an OEM, CMBlu Energy does not face FEOC constraints due to our localised supply chain. Anticipating tighter trade and regulatory conditions, we’ve focused on accelerating manufacturing localisation in the United States.

This allows us not only to clearly differentiate ourselves as FEOC-safe, but also to fully leverage US policy incentives, particularly the Section 45X advanced manufacturing tax credit and the domestic content ITC adder. Together, those incentives can drive up to a 40% ITC benefit, strengthening project economics while ensuring secure, compliant battery supply for our customers.

How will these changes impact the industry over the next year?

We expect a period of real disruption across the industry as utilities manage unprecedented load growth while simultaneously transitioning their generation portfolios, retiring older coal assets and rapidly adding solar and wind. At the same time, hyperscalers are under intense pressure to site and power AI-driven data centres as quickly as possible, and the fastest path forward is pairing renewables with energy storage and firm generation.

Over the next year, this dynamic will drive even greater focus on alternatives like long-duration, non-lithium storage solutions that are not constrained by FEOC rules, have reduced tariff exposure through domestic supply chains, and help mitigate geopolitical risk in an increasingly uncertain global environment.

How do you expect your company to be impacted over the next year?

We expect the impact to be largely positive for CMBlu Energy. As the industry increasingly looks for alternatives to lithium-ion batteries, demand for non-lithium, FEOC-safe solutions like ours continues to grow.

At the same time, market and policy dynamics are accelerating the need to deploy projects and scale manufacturing capacity in the US. Over the next year, that pressure supports our strategy to ramp domestic production while expanding project activity, positioning CMBlu well as customers seek reliable, long-duration storage solutions with resilient supply chains.

To what extent is domestically manufactured BESS increasing and available for new projects?

Domestic BESS manufacturing is clearly increasing, driven by strong market pressure from utilities, hyperscalers, and developers who need energy solutions available today with minimal geopolitical and regulatory risk. CMBlu is a good example of that shift, as our pricing is already competitive with lithium-ion, and our localised supply chain, from active chemistry through full module manufacturing, allows us to scale US production quickly.

At the same time, the market is moving beyond a lithium-only future. Supply chains are diversifying, technology options are broadening, and investors are re-pricing risk around traceability, safety, and resilience. Longer term, this supports a more secure and flexible energy system built around modular, dispatchable storage assets that reduce reliance on conflict materials, mitigate thermal runaway risks, and better match the growing demand for longer-duration energy storage.

The Energy Storage Summit USA will be held from 24-25 March 2026, in Dallas, TX. It features keynote speeches and panel discussions on topics like FEOC challenges, power demand forecasting, and managing the BESS supply chain. ESN Premium subscribers can get an exclusive discount on ticket prices. For complete information, visit the Energy Storage Summit USA website.