New wholesale electricity market rules have been introduced in Ireland, designed to allow battery storage assets to participate directly.

From 11 November, the Scheduling and Dispatch Programme (SDP) was launched. The major grid modernisation and flexibility initiative has been led by the two transmission system operators (TSOs) on the island of Ireland, EirGrid and System Operator of Northern Ireland (SONI).

“The number of battery units operating in Ireland has increased over recent years, with more continuing to connect to the power system,” Ireland’s minister for climate, energy and the environment, Darragh O’Brien, said.

“These units will grow in importance as more variable renewable energy is brought onto the system. I welcome this update to increase the value and efficient utilisation of these battery units, supporting the transition to a low-carbon future by making the grid more flexible, efficient, and sustainable.”

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The Irish electricity market enters a “new era” with this change, which represents a “major milestone” in the transition to a low-carbon energy system, while opening up commercial opportunities for energy storage asset operators, Yayu Yang, product manager at GridBeyond wrote in a Guest Blog for our UK & Ireland-focused sister site Solar Power Portal.

GridBeyond is a technology platform for managing distributed and flexible energy resources, including the trading and optimisation of battery storage assets. Headquartered in Dublin, GridBeyond is active in markets including the UK, Ireland, the two big US markets in Texas (ERCOT) and California (CAISO) and in Australia.

Published a day ahead of the SDP launch, Yang’s blog explained how limited access to the wholesale market has long been viewed as a “key barrier to financial viability” for energy storage developers in both the Republic of Ireland and Northern Ireland.

Change to ‘more complex’ active trading strategies required

The two countries share the Single Electricity Market (SEM), overseen by the Single Electricity Market Operator (SEMO). EirGrid and SONI manage the physical grid infrastructure in their respective regions.

EirGrid, SONI and SEMO said the initiative, the second stage of the SDP’s rollout, enables battery units, or Energy Storage Power Stations (ESPS) as defined in the programme, to be fully integrated into the real-time electricity market.

According to data from our colleagues at Solar Media Market Research, Ireland currently has a fleet of around 1.4GWh of operational BESS assets across 30 sites, around double the capacity of a year ago.

In August this year, around 34.9% of all electricity on the Irish grid came from renewables, according to EirGrid’s data.

EirGrid said in a release that previously, grid-scale battery energy storage systems (BESS) supported the system through stability services, such as frequency regulation. Under the new SDP-02 rules, BESS assets will be able to trade energy “more actively.” This means the ability to charge from the grid during periods of abundant renewable energy generation and discharge to supply power during times of high demand.

Operators will be able to signal their preferences for charging and discharging times, which EriGrid claimed will help grid managers make smarter decisions.

Trade association Energy Storage Ireland published a whitepaper in 2023 that highlighted the limitations of TSO market systems as they were. As Yayu Yang pointed out in the Guest Blog, the limitations have now been unblocked, enabling access to Day-Ahead, Intraday and Balancing Markets.

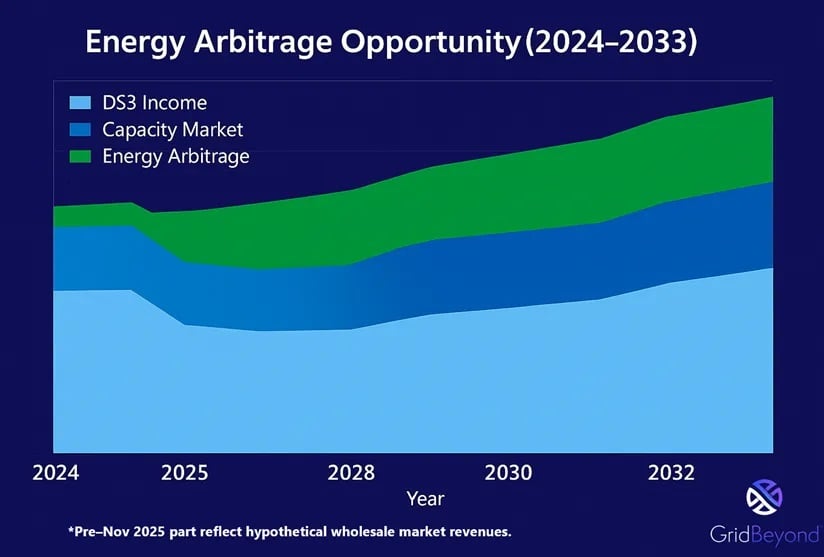

Ireland’s energy storage deployments to date have largely been driven by the business case for providing grid services through the Delivering a Secure, Sustainable Electricity System (DS3) programme. DS3 procured fast frequency and reserve services to help stabilise the grid over short-term fluctuations in wind and solar PV generation.

However, while GridBeyond’s modelling shows that a 10MW, 2-hour duration (20MWh) BESS unit operating under the new structure could see 12-37% higher annual revenue than it would solely from DS3 participation, accessing the market opportunities successfully will require smart trading strategies, Yang claimed.

The DS3 framework, for the most part, required only a “set and forget” business model, with committed capacity and fixed payments. The change to active trading means “a new level of market interaction,” Yang wrote, one which will demand “continuous analytics and automation to forecast price spreads, track state-of-charge, and optimise performance.”

The significant market update comes as TSO EirGrid hosts a consultation on a proposed procurement mechanism for long-duration energy storage (LDES).