LG Energy Solution (LG ES) will nearly double the production capacity of battery cells for energy storage systems (ESS) at its Michigan, US, factory by the end of 2026.

The South Korean company said the recently opened lithium iron phosphate (LFP) production lines would ramp up to 17GWh annual production capacity by the end of 2025, as previously announced, and then increase to more than 30GWh by the end of next year, in an earnings call presentation to explain recent financial results.

The company reported quarter-on-quarter increases in profits despite a fall in revenue for the second quarter of 2025. Quarterly operating profits, at KRW492.2 billion (US$355.9 million), were up 31.4% from KRW375 billion in Q1.

Operating profit margin increased year-on-year from 3.2% in Q2 2024 to 8.8%. Meanwhile, revenue fell 11.2% quarter-on-quarter, from KRW6.27 trillion to KRW5.6 trillion.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“In the second quarter, we secured stable EV battery sales and also started production at our new ESS battery facility in North America,” Chang-Sil Lee, CFO for LG ES, said.

“However, constrained customer purchase sentiment, coupled with the reflection of metal price decline to our average selling price (ASP) affected our quarterly revenue.”

Almost all the profits (US$491 million) came from production incentives in North America and LG Energy Solution emphasised the start of production earlier this year, with an official opening held 24 June, as a key achievement in the quarter.

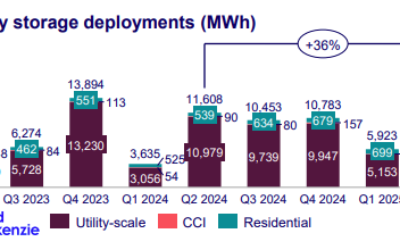

While a slowdown in growth in the electric vehicle (EV) market continues—although LG Energy Solution (LG ES) said sales were “stable” in the second quarter—the company said it expects demand for energy storage to continue to increase, with rising renewable energy adoption and AI data centres as the main drivers.

The company also noted the likelihood that new restrictions on the eligibility of energy storage projects that use foreign entity of concern (FEOC) Chinese equipment to qualify for investment tax credit (ITC) incentives would benefit non-Chinese players.

LG ES, which listed on the Korea Exchange (KRX) in early 2022 through a US$10.8 billion IPO, does not break out its financials between EV and ESS division numbers.

The company has been rebalancing production capacity utilisation between those two segments of its business.

It decided to retool EV cell lines at its existing production complex in Holland, Michigan, rather than proceed with an all-new gigafactory complex in Arizona, investing US$1.4 billion into the four new ESS cell production lines. In March, ESN Premium discussed the Holland plant’s repurposing and the parent company’s manufacturing strategy in the US with Jaehong Park, CEO of LG ES Vertech, the battery maker’s battery energy storage system (BESS) integrator arm.

Park claimed at the time that the full capacity output of the lines was fully booked for the next three to five years by large-scale project developers, and added that the ability to switch from EV to ESS cell production gave LG ES an early-to-market advantage over rivals’ greenfield developments.

“When it comes to timing, if a company builds a factory from scratch, from a greenfield facility, it takes a minimum of three to four years because it requires permitting, it requires water and utilities, and it requires road access,” Park said, while adding that the cost of building from scratch has risen significantly since the COVID-19 pandemic.

While LG ES is hoping the availability of existing EV cell production lines for conversion to ESS applications will give it a competitive edge in the US, market intelligence firm Clean Energy Associates recently highlighted that nearly 21GWh of new stationary storage battery cell manufacturing capacity planned to come online in the country by 2028 has been cancelled since the beginning of this year. Those are represented by three companies: KORE Power (9.8GWh), FREYR Battery (now know as T1 Energy and looking to manufacture solar PV instead, 10.2GWh) and IMENY (0.8GWh).

Meanwhile, close to the same amount (19.2GWh) has been postponed from Our Next Energy (1GWh), Kontromatik (3GWh), Microvast and Gotion (4GWh each) and American Battery Factory (7.2GWh).

Although EVs look set to remain the much bigger overall market, in the short term, LG ES identified recent policy changes that presented uncertainties, including the phaseout of the consumer EV subsidy in the US by the end of September and import tariffs creating cost pressures for OEMs.

For the rest of 2025, its investment activities in the EV space are more R&D-focused. The company hopes to develop EV batteries that can be charged in under ten minutes and lithium manganese-rich (LMR) batteries with 30% higher energy density than LFP to be used in next-generation EV models by a “strategic customer” by 2028.

LG ES said it would adjust, scale down, and postpone existing investment plans this year, curtail investment in new production lines, and continue reallocating resources to increase cost efficiency. It had announced the scaling back of expansion plans back in its Q3 2024 results as it wrestled with declining battery prices and dampened EV demand.