Battery energy storage system (BESS) integrator and technology provider Powin is at risk of shutting down its business within weeks.

The US company filed a notice last week (29 May) with state and local officials in Oregon, where it is incorporated and has its headquarters, regarding the potential cessation of business operations.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

In a letter addressed to Michael Welter, rapid response coordinator at Oregon’s Higher Education Coordinating Commission (HECC), and the mayors of Portland and Tualatin, where its operations are based, Powin said it faces the possibility of having to close and lay off 250 staff.

“If Powin LLC’s present business circumstances do not improve, it is currently anticipated that a layoff will occur on or before 28 July 2025,” the letter, signed by Powin’s VP for human resources, Scott Getman, read.

In accordance with Oregon’s Worker Adjustment and Retraining Notification (WARN) act, companies with 100 or more workers must give 60 days’ notice to affected workers of closures and layoffs.

Powin’s notification to the state listed the roles of all staff affected, including its chief executives. According to the letter, if cessation of business operations occurs, “it is presently contemplated that the affected employees will be permanently terminated.”

Powin announcement comes amid atmosphere of uncertainty for US BESS industry

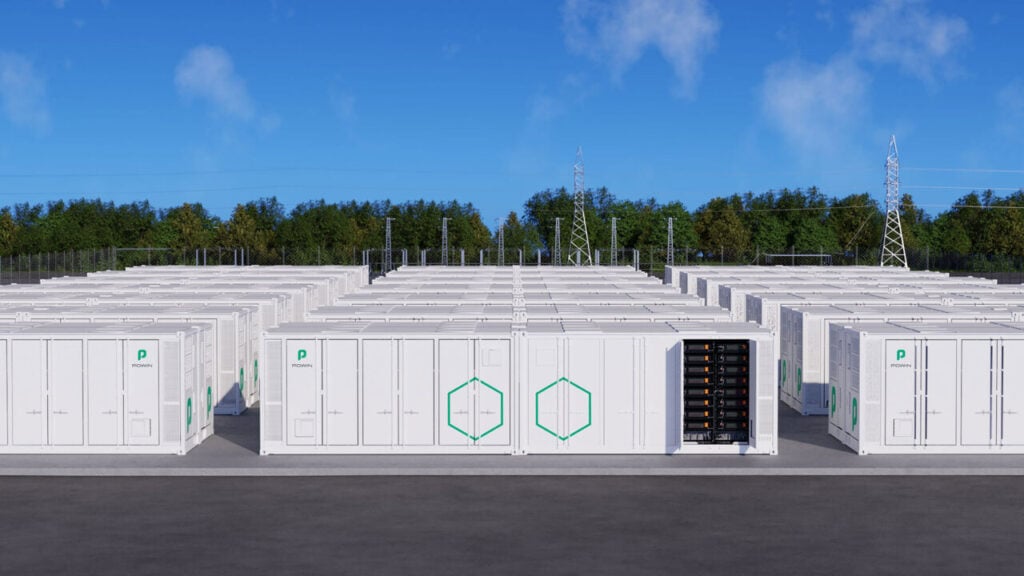

The system integrator provides BESS hardware based on its modular Powin Pod liquid-cooled 5MWh lithium-ion (Li-ion) solution in a standard 20-foot container, driven by its StackOS energy management system (EMS) platform.

Powin has supplied more than 11GWh of operational projects worldwide and is currently working on more than 6GWh of projects in construction, according to its website.

The company works with a variety of battery vendors and was among the first integrators outside China to launch a BESS solution with 5MWh capacity within the 20-foot container form factor.

This, company executive VP Danny Lu told ESN Premium, was to enable Powin to compete with Chinese integrators on energy density and high power output. As Chinese integrators upped their system energy densities, so too did Powin, with its 6.26MWh Pod Max product, launched just a few weeks ago.

Although the company raised US$200 million financing through a credit facility with influential US investment firm Kohlberg Kravis Roberts & Co (KKR) as recently as Q3 of last year, Powin cited “unforeseen business circumstances” impacting its performance in its notice letter last week.

Late last year, one of Powin’s battery suppliers, CATL, filed a complaint in a US court for alleged non-payment for battery cells supplied during 2023. The Chinese battery manufacturer claimed the US integrator had not paid for two shipments of cells, worth CNY310 million (US$44 million).

Though the company has pushed into international markets including Australia, Europe and Latin America, Powin’s announcement comes amid a backdrop of uncertainty for the US battery storage industry, driven by US federal policy announcements including tariffs and the possible repeal of tax credit incentives for clean energy manufacturing and deployment via the budget reconciliation bill.