Lennart Hinrichs, executive VP and general manager Americas at TWAICE, discusses how the industry’s approach to battery analytics is changing, as part of our annual Year in Review series.

The past three or four years have seen battery data analytics come into the spotlight across the energy storage industry, giving battery energy storage system (BESS) operators more visibility and therefore more decision-making power on the necessary trade-offs between protecting asset health and earning revenues.

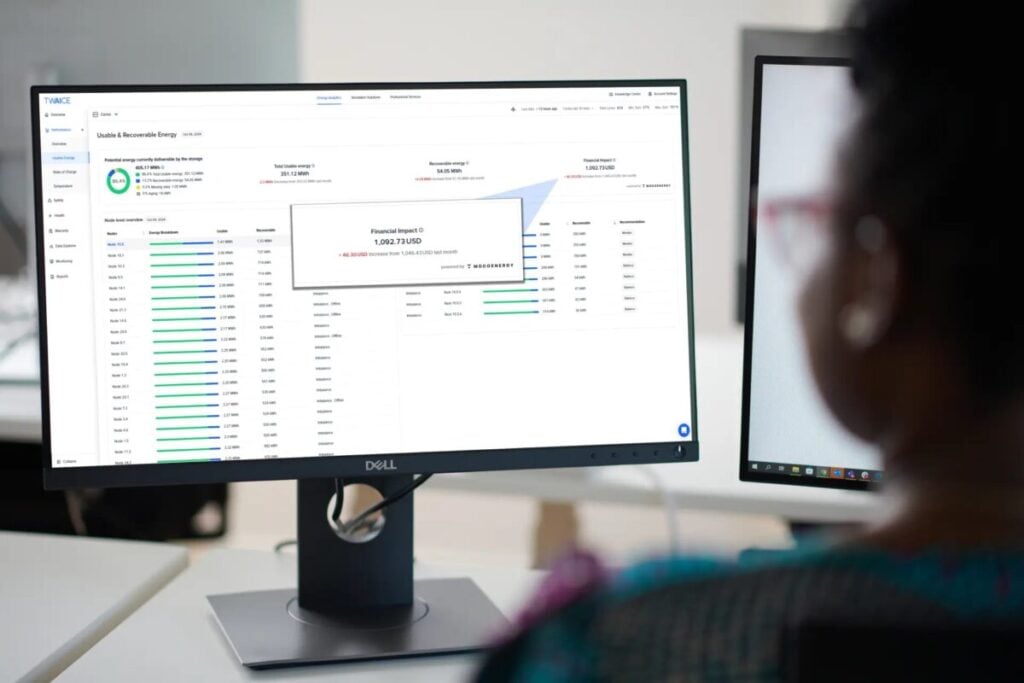

Cloud-based analytics software solutions, whether from third-party providers like TWAICE or created in-house, are helping BESS projects and portfolios enhance safety, get improved terms on insurance and financing, match cycle life to the business case and ultimately optimise performance.

For example, on that latter point, TWAICE partnered with market intelligence platform Modo Energy in the ERCOT, Texas, market in the Spring of last year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The two companies will offer customers in ERCOT an integrated offering that combines TWAICE’s insights into performance, safety, and lifecycle with Modo Energy’s market data on BESS asset performance. This offering aims to enable more accurate, asset-specific data calculation of revenues at the exact settlement point.

Hinrichs tells Energy-Storage.news that legislative and financial constraints faced by the US energy storage industry in 2025 were a “wake-up call,” highlighting the need to leverage data insights and for projects to be as coordinated and efficient as possible, all while maximising revenue-generating activities.

What did 2025 mean for the industry?

2025 saw record solar and storage deployment as developers rushed to qualify projects ahead of major rule changes in the United States. At the same time, higher interest rates, shifting tariffs, and new laws made projects more expensive and harder to finance. While the ‘One, Big, Beautiful Bill Act’ (‘OBBBA’) preserved incentives for battery storage, it also shifted the goalposts for them with more restrictive tax credits and foreign-entity rules.

That combination didn’t just slow deals: it changed what success looks like for the BESS industry.

What do you think 2026 will hold, in terms of both things to look forward to and in terms of challenges ahead?

The positives are that the industry is maturing, with operators no longer relying on crude and self-made tools to optimise dispatch and identify stranded capacity. Operators who ‘get’ data right can turn their growing BESS portfolios into success stories. Solutions will focus on operational outcomes, versus project delivery alone.

The challenges, on the other hand, are as follows:

- Scaling problems could get worse as portfolios grow — multiple integrators, differing data connections and cell chemistries break pilot workflows.

- State of charge (SOC) accuracy and imbalance detection remain challenging.

- Derating (when parts of a site can’t deliver promised power) leads to penalties.

- Contractual disputes over responsibility become more common.

Is there a growing awareness of the role of data analytics, and what do you think are the next steps for analytics providers?

Absolutely. With tougher operating economics and growing portfolios, operators are paying more attention to data and analytics.

As providers, we must focus on system-level analytics. While cell-level data is important, the most relevant metric for owners is what occurs at the point of interconnection (POI); analytics should therefore monitor the entire chain, including modules, racks, power conversion system (PCS), and transformers, to account for round-trip efficiency (RTE) and grid delivery requirements.

We also need to provide a ‘single pane of glass’ at fleet scale. As asset owners scale from pilot projects to gigawatt-hour portfolios, analytics tools must be able to handle billions of data points daily across diverse technologies and multiple integrators and present workflows, for both engineers and financial asset managers.

Analytics providers must move from reactive to proactive operations. Analytics should move away from merely alerting to automated, prescriptive actions that prevent downtime and penalties, translate failure modes into dollar impact (e.g., US$/MWh, avoided fines), and provide audit-ready evidence for lenders, insurers, and warranty claims.

What are the most challenging questions BESS developers need analytics to answer?

To give you a list:

- Why is this site derating and when will it happen?

- When should we rebalance or recalibrate SOC versus accept a temporary performance hit?

- Which exact module, cell or component caused a failure so we can file warranty claims?

- How much usable energy actually reaches the grid meter (not just DC-side numbers)?

- Can analytics not only identify the root cause but also recommend and prioritize the right remediation steps?

We heard in the 2025 BESS Pros Survey from TWAICE that the role of analytics is shifting from a primary one of delivering safe operations to actively monetising storage assets. What does that really mean, and how can the industry best support this shift?

It means operators want assets that consistently earn revenue, not just assets that avoid incidents. To support that shift, you need: reliable, enriched telemetry; analytics that convert health and availability into dollars (expected revenue, avoided penalties); data ownership and a clean database to prove underperformance or support warranty claims; and cross-functional teams (ops, trading, finance) who share one source of truth.

What should the industry prioritise in 2026 and beyond?

Last year’s legislative and financing constraints were a wake-up call. Projects are now judged on predictable revenue and bankability, not just cost or speed.

This year, the industry must turn BESS data into a strategic advantage for proactive management of fleet-scale operations. To make that shift, the industry should focus on operationalising its data.

Operationalising data requires three steps. The first is to own the data, by ensuring reliable access to POI, system, and component telemetry across integrators and vendors.

The second is to create a single source of truth: normalising and centralising operational data so teams see a single, consistent view across sites and chemistries. The third and last is to turn high-volume data into a decision engine, in other words, converting standardised operational data into predictive KPIs, automated alerts and prescriptive workflows, so teams act proactively to prevent deratings, reduce safety risks, and maximise revenue.

The Energy Storage Summit USA will be held from 24-25 March 2026, in Dallas, TX. It features keynote speeches and panel discussions on topics like FEOC challenges, power demand forecasting, and managing the BESS supply chain. For complete information, visit the Energy Storage Summit USA website.

Energy-Storage.news publisher Solar Media is hosting the Energy Storage Summit EU 2026 in London, UK, on 24-25 February 2026 at the InterContinental London – The O2. See the official website for more details, including agenda and speaker lists.