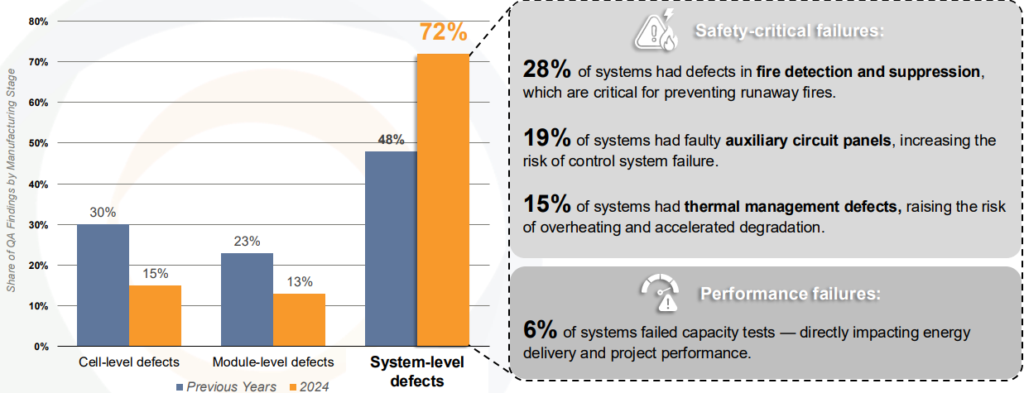

Percentage incidences of defects at cell, module and system levels in 2024, compared to previous years. Image: Clean Energy Associates

Reliable battery energy storage projects depend on the reliability of fully integrated systems, not just high-quality battery cells, writes Jeff Zwijack, associate director, energy storage at Clean Energy Associates.

Clean Energy Associates (CEA) has conducted more than 700 energy storage system integration inspections. We’ve found that most defects appear during final integration, not cell production. If these system-level flaws are not found before shipment, they often cause commissioning delays, rework costs, and operational losses.

Why integration defects persist

Battery cell and module manufacturing today benefits from years of process maturity and automation. In contrast, container integration remains highly manual, involving wiring, piping, and fire system assembly by hand.

Many newer factories ramp up capacity quickly, so their team may lack deep experience managing labour consistency and process controls. When schedules tighten, this results in human errors, process drift, and inadequate final inspections.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Some integration factories still do not fully verify critical steps like wiring polarity, fire detection loop continuity, or system grounding before shipment — areas that CEA always inspects and frequently uncovers issues during audits.

Moreover, many integrators rely on third-party contractors to assemble their battery cabinets, which can result in a lack of direct accountability. Unlike integrators, these contractors may have minimal long-term accountability for the performance and longevity of the systems they assemble, reducing their incentive to adhere rigorously to best practices.

Major system-level defect categories found in 2024

The following are the most frequent system-level problems CEA uncovered for its BESS Quality Risks report:

- Fire detection and suppression — 28% percent of systems inspected

Frequent issues include reversed or misconnected smoke detectors, temperature sensors wired to incorrect control loops, and abort buttons missing redundant triggers. Such defects can disable emergency suppression systems or cause false activations, which can lead to unnecessary downtime and costly equipment damage. - Thermal management — 15%

Common problems involve leaking coolant hoses, overtightened pipe joints during manual fitting, and compressor control boards with faulty solder joints, causing short circuits. Poor thermal management can accelerate battery degradation, compromise battery health, and even lead to thermal runaway. - Auxiliary circuit panels — 19%

Issues such as poor cable routing, unsecured terminations, and loose terminals frequently cause intermittent loss of power to sensors and control relays, creating hidden risks that become apparent only under high-load operations. - Enclosure issues — 30%

Weak panel welds, poorly sealed doors, and inconsistent protective coatings commonly lead to water ingress, corrosion, and compromised structural integrity. These enclosure defects can severely affect electrical safety, increasing insulation breakdown risks and reducing overall system lifespan. - Capacity test failures — 6%

System capacity failures often stem from high internal resistance due to defective busbar welds or unbalanced wiring runs. These hidden defects are typically discovered only during detailed final functional testing, highlighting the importance of thorough Factory Acceptance Tests (FAT).

How robust QA catches these defects

Third-party quality assurance (QA) identifies these problems at the factory level rather than post-delivery. Inspectors verify critical aspects such as wiring routing, terminal torque, fire system actuation circuits, pipe fittings, and enclosure finishes against established documented standards.

A robust QA process includes multiple inspection hold points during integration, along with rigorous final functional testing involving real power flow and comprehensive safety checks. Effective FAT replicates site conditions, thoroughly verifying thermal management and fire suppression under realistic loads.

CEA’s defect resolution protocol ensures rapid escalation, corrective action, and re-inspection of critical and major defects, significantly reducing the risk of defective units leaving the factory.

Documentation and traceability

A strong QA programme demands meticulous documentation and traceability. We often find incomplete torque logs, missing grounding checks, or generic sign-offs without supporting evidence such as photographs or detailed test data.

Developers should insist on comprehensive, verifiable inspection reports linked to each container’s serial number, detailed non-conformance logs including root cause analysis, and documented corrective actions. These records provide critical leverage when addressing future warranty claims or operational issues.

Receiving inspection and site checks

Even systems assembled to exacting standards can sustain damage during transit.

Upon arrival, procurement teams should carefully inspect containers for dents, broken cable trays, moisture ingress, and verify that protective packaging is intact. Shipment records must be cross-checked against factory test certificates to ensure nothing has been altered or substituted.

Early detection of transit-related issues can prevent significant commissioning delays.

How contracts make QA enforceable

Contracts must clearly translate technical QA requirements into enforceable supplier accountability. Essential contractual terms include explicit rights for third-party inspections, clearly defined FAT pass/fail thresholds, explicit defect rework obligations at supplier cost, and financial penalties for recurring non-conformances.

Scope language should clearly delineate ownership and responsibilities for subsystems such as fire panels, HVAC units, and control wiring to avoid disputes during integration and commissioning.

Contracts should also define clear off-ramps, providing actionable responses in case of significant tariff changes, force majeure events, or major project disruptions, protecting developers from unforeseen operational and financial risks.

No surprises, with the right oversight

Integration-stage defects represent the most frequent quality risks in battery energy storage projects.

Procurement managers can proactively identify and resolve defects early by combining rigorous quality assurance practices, detailed documentation, thorough FAT, and carefully structured contracts.

Effective oversight at each stage — from supplier selection through final commissioning — ensures system performance, protects project timelines, and safeguards long-term profitability.

About the Author

Jeff Zwijack is associate director for energy storage at Clean Energy Associates (CEA), a North American-owned solar PV, green hydrogen, and battery storage clean energy advisory company across the whole value chain, with offices in Denver, USA and Shanghai, China. Zwijack helps energy storage buyers choose the right suppliers and ensure product quality and safety. Before joining CEA, he started and grew the application engineering and sales team at IHI Terrasun Solutions.