The dynamics of balancing electricity supply and demand on the grid have been deeply affected by the coronavirus pandemic, but it's certainly not the only reason why the UK's electricity system operator is introducing a new service called Dynamic Containment. What is it and why is the UK already replacing its firm frequency response (FFR) and other ancillary services? Alex Done, lead data scientist and market analyst for energy transition specialists Modo Energy explains.

If COVID-19 has taught us anything about the future of the energy system, it's that we're in for a bumpy ride. With record high balancing costs, the rapid introduction of new services like Optional Downward Flexibility Management (ODFM) – which offers commercial-scale renewables generators remuneration for switching off – and problems with voltage, inertia and frequency, the UK’s electricity system operator National Grid ESO (NGESO) has faced many challenges over the summer that foreshadow the low carbon world of tomorrow.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

As the electricity system transitions into a low carbon system, with renewables replacing large thermal generation, system inertia is set to fall. Lower system inertia causes system frequency to deviate from its usual 50Hz much quicker than before, (sometimes called ROCOF or rate of change of frequency) and NGESO needs new tools to operate effectively, and ultimately keep the lights on.

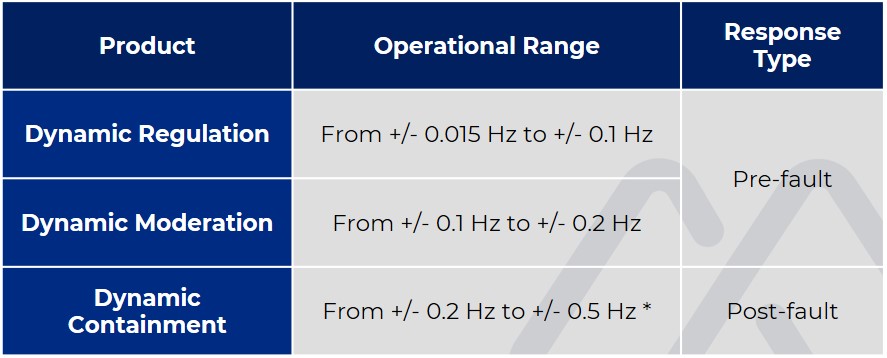

As part of this transition, existing services (such as Firm Frequency Response – FFR) will be replaced by newer, faster acting products, the latest of which is Dynamic Containment (DC). DC is the flagship product of a new suite of ancillary services (see Table 1) and is the first that NGESO plan to release, launching October 2020.

This piece intends to explore:

- The new Dynamic Containment (DC) product

- How the service will launch

- The impact on battery energy storage assets

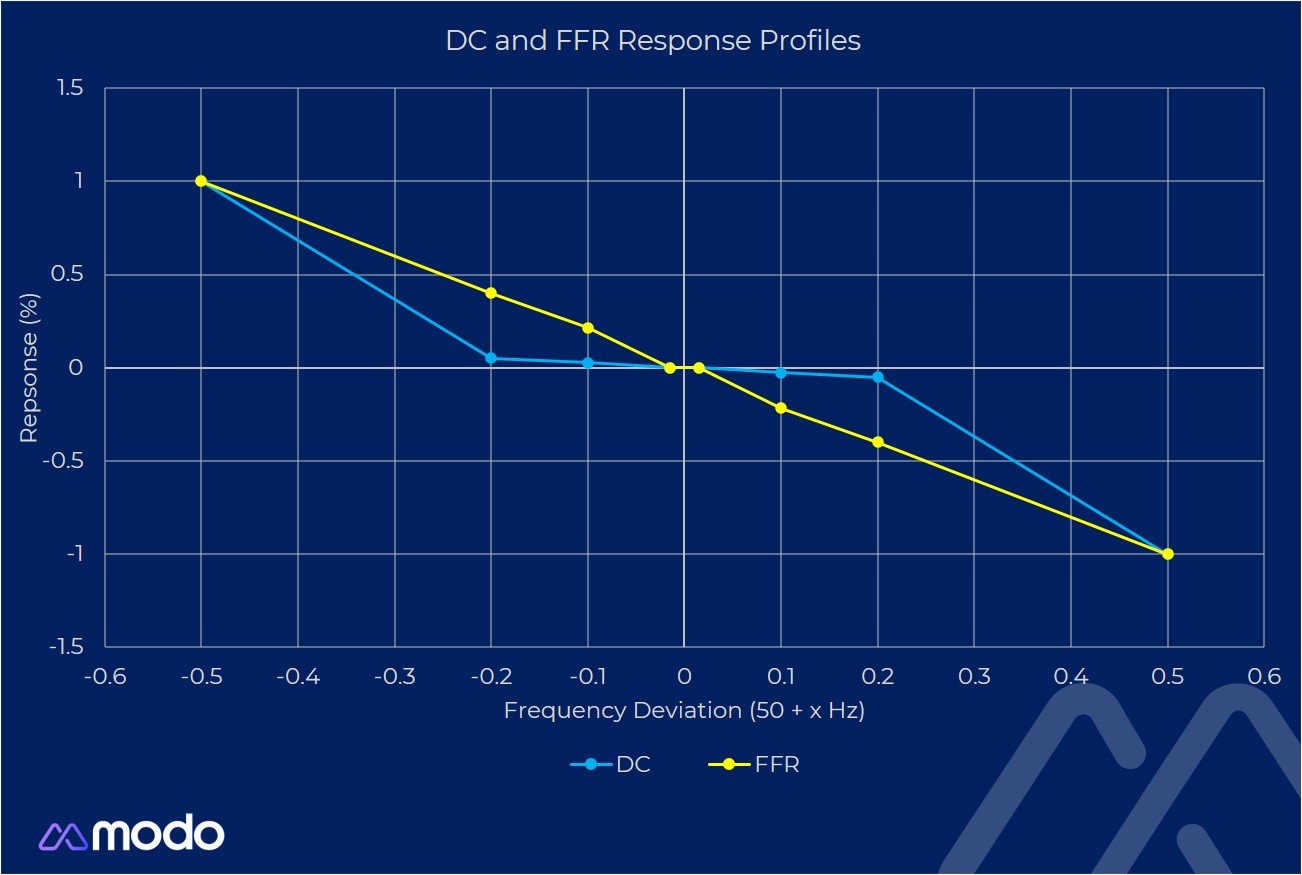

DC provides frequency response 'post-fault' i.e. after frequency breaches specific upper/lower limits, however a small response is also required inside those limits. Comparing DC to the existing FFR product, the response profile for DC effectively extends the existing FFR boundaries for which (little or) no response is required, whilst decreasing the response time required from assets. (see Figure 1 for a comparison of response profiles).

Launch brings new 500MW capacity auction and closer to real time procurement

Having initially been delayed in the face of COVID 19, Dynamic Containment will commence on October 1st, 2020 as part of a 'soft launch', with the full rollout of the service expected in 2021. So, what can we expect on 1st October and beyond?

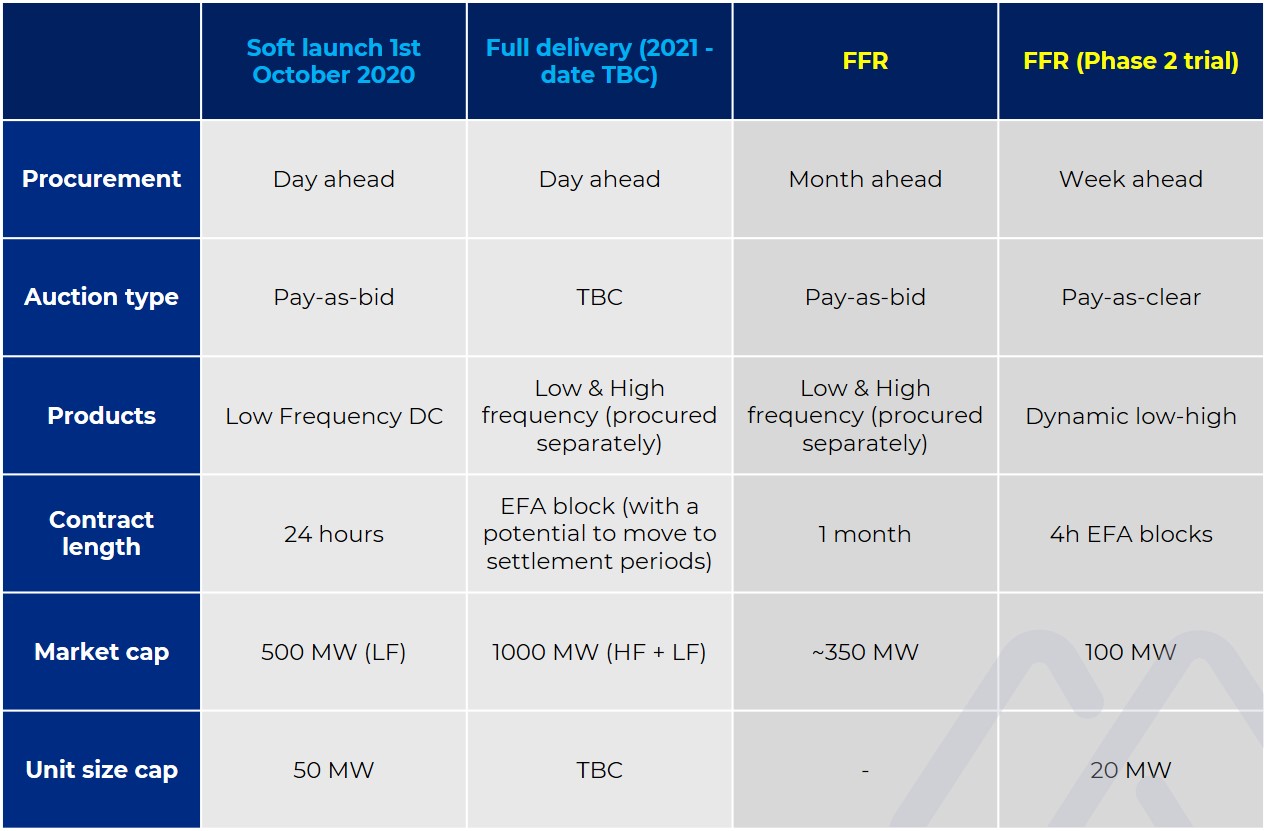

At launch, DC will be procured in 24-hour blocks on a day-ahead basis, compared to the week-ahead and month-ahead procurement of FFR. This demonstrates NGESO's commitment to moving closer to the real-time procurement of ancillary services. Initially, NGESO will only procure low frequency response with the aim to introduce high frequency response later.

To begin with NGESO will procure up to 500MW of low frequency DC. With similarities between DC and FFR markets, and the eventual replacement of FFR with DC, there have been questions regarding whether the volume in (weekly and monthly) FFR markets will be reduced. NGESO has confirmed the FFR procurement targets will NOT be affected by DC procurement initially.

In fact, the monthly auction recently saw an increase of 100 MW from September to October.

The details of the launch are summarised in Table 2, with a comparison to the existing FFR services and the full release of DC (expected in 2021).

Factors to consider on the opening day – and the all-important questions surrounding price.

DC will undoubtedly interact with the weekly and monthly FFR auctions, playing a significant role in the procurement of DC. Now with a choice of 3 frequency response auctions, the question of which markets assets enter gets more complicated. The shorter contract lengths and nominations for individual EFA blocks in the weekly FFR auctions, offer participants more optionality and allow assets to move into DC at shorter notice. With this in mind, we may see an increase in the number of assets participating in the weekly FFR auction, potentially causing further depression in prices.

Additionally, with a market cap of 500MW in DC, and procurement targets of 550 MW in FFR (100MW in weekly and 450MW in monthly), if the full 500MW is to be filled in DC scarcity pricing may come into effect. While there appears to be sufficient rejected capacity in the monthly tenders to absorb the additional 100 MW of demand, the same cannot be said for an additional 500 MW of DC.

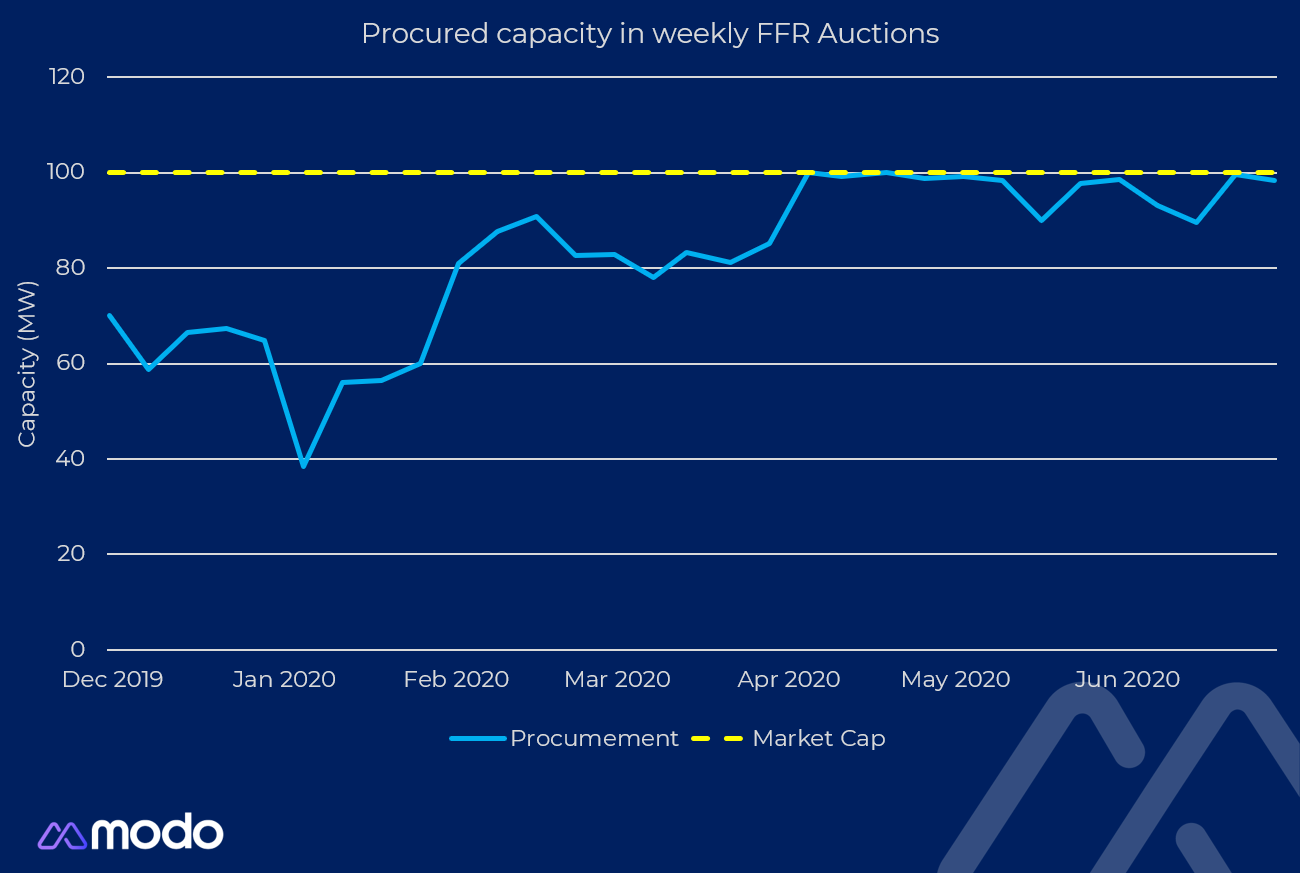

This is not the first new frequency response market that NGESO has established in the past 18 months, so what can we learn from the weekly auction trial introduced in Dec 2019?

Despite the 100MW market, only 60MW of assets secured contracts in the first week and it took around 5 months for the weekly market to reach saturation (see Figure 2). If this represents the caution of asset owners regarding changing revenue streams it could be the case that uptake of DC faces a similarly slow start. Moreover, considering the new daily procurement schedule, asset owners/operators will need to be a lot more active when participating in ancillary services auctions, which could cause people to stay in the more familiar territory of the weekly/monthly FFR auctions.

Impact of Dynamic Containment on battery cycles, cell degradation and losses

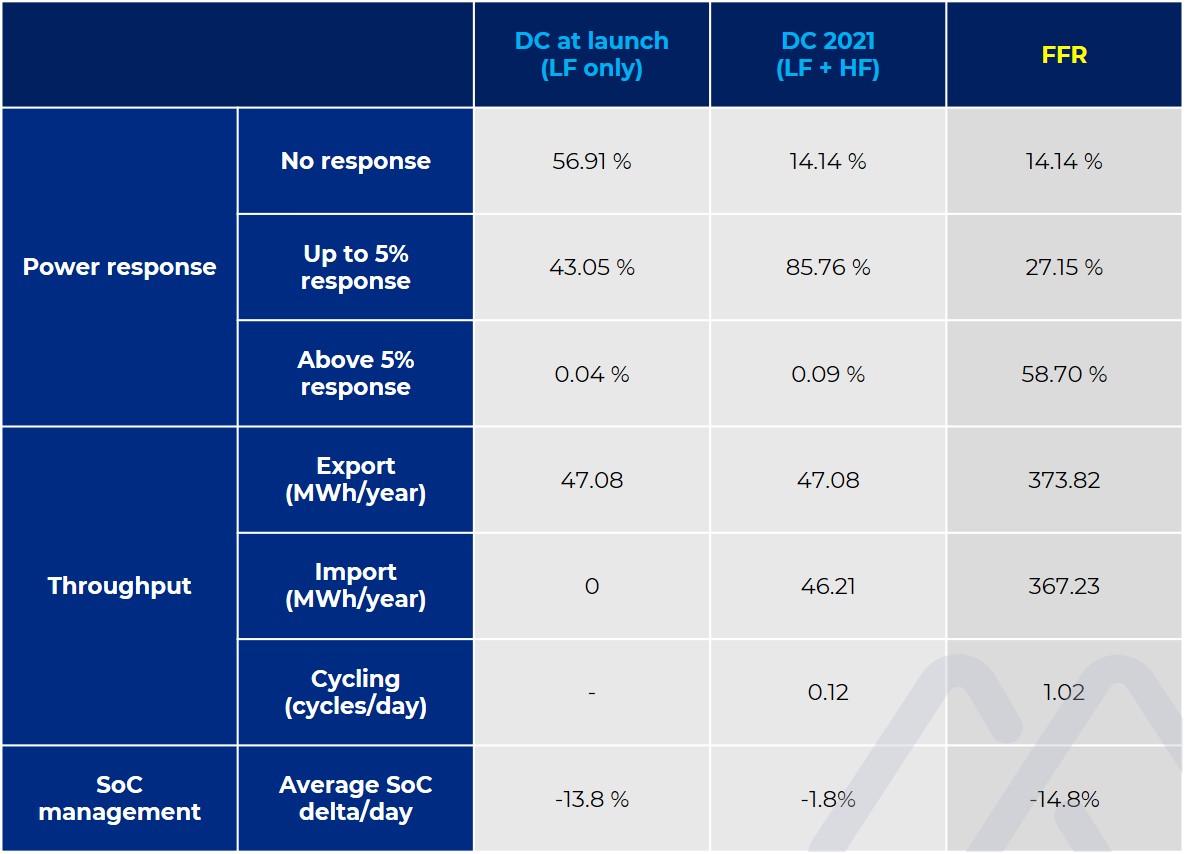

At Modo, one of our research areas is modelling how the system frequency impacts the delivery of frequency response products. Here are some of the headlines (for more details see Table 3):

- Delivered volumes (MWh) for DC are 90% lower than FFR, causing assets in DC to cycle around 10 times less than in FFR.

- Response above 5% of contracted volume is only required 0.04% of the time.

- State of Charge (SoC) losses due to efficiency (for a symmetric DC service) would require no SoC management for roughly 45 days (when starting from a full charge).

Assumptions: 1MW/1MWh (1h system), 88% efficiency (RTE), 2019 historical frequency data.

Modo estimates that at launch, DC providers will only move into the steeper section of the response profile 0.04% of the time with little to no delivery for the remaining 99.96% of the time. This increases slightly with the introduction of the symmetric service, but only to 0.09%.

The (relatively) small response required from DC has a knock-on effect on throughput and state of charge management. FFR throughput is around 10 times that expected under Dynamic Containment (assuming a symmetric service). For batteries this means less degradation, and less money lost to system inefficiencies. Moreover, the smaller throughput means SoC losses due to inefficiency are significantly reduced and SoC management for DC is a much smaller consideration relative to FFR.

With up to 36 frequency response auctions a month, batteries undoubtedly face a new challenge as the lines between the merchant and ancillary services revenue models begin to blur. With changes expected as the new service matures, the markets equilibrate, and participants get more comfortable with the new services, this is set to be a challenging time for the energy storage community.

Will dyanmic containment be the service to bolster the energy storage investment case, or will asset owners stick with more familiar revenue streams? At Modo, we're excited to watch how these markets develop, but ultimately we will have to wait and see what the market thinks at the start of October.

Cover Image: Rock Farm, a UK battery asset that has thus far earned some of its revenues through the FFR market. Image: Anesco.