Western Australia’s Economic Regulation Authority (ERA) has proposed a Benchmark Reserve Capacity Price of AU$491,700/MW (US$342,928/MW) per year for the 2028-29 capacity year.

This represents a 36% increase from the current AU$360,700/MW rate as the state transitions to larger battery energy storage system (BESS) specifications.

The draft determination, released by the ERA, establishes pricing for both Peak and Flexible Reserve Capacity based on a hypothetical 200MW/1,200MWh lithium-ion battery storage system connected to the South-West Interconnected System (SWIS).

Readers of Energy-Storage.news are likely aware that the SWIS is Western Australia’s main, geographically isolated electricity network, serving over 1.1 million customers across Perth, as well as Kalbarri, Albany and Kalgoorlie. Western Power operates it.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The benchmark technology specifications reflect a 50% increase in storage duration from the previous 800MWh requirement, driving significant cost implications for the capacity market mechanism.

The Reserve Capacity Mechanism ensures adequate generation and storage capacity remains available within Western Australia’s primary electricity grid to meet consumer demand.

ERA’s benchmark prices provide economic signals to encourage investment in new capacity while establishing the revenue framework for existing capacity providers holding Peak or Flexible Capacity Credits through the Australian Energy Market Operator (AEMO).

Storage duration expansion drives cost increases

The ERA’s analysis identifies three primary factors contributing to the substantial price increase.

Indeed, the expanded battery storage requirement from 800MWh to 1,200MWh has been noted as the most significant driver, reflecting Western Australia’s evolving grid requirements for longer-duration energy storage (LDES).

This aligns with the state government’s aims for the energy storage industry, which has prioritised long-duration energy storage in recent clean energy funding rounds, recognising the technology’s role in managing challenges of renewable energy integration.

Rising input costs across freight, materials and labour have compounded the impact of storage expansion. In contrast, increased transmission connection costs associated with the Fixed Capital Charge further upwardly pressure the benchmark determination.

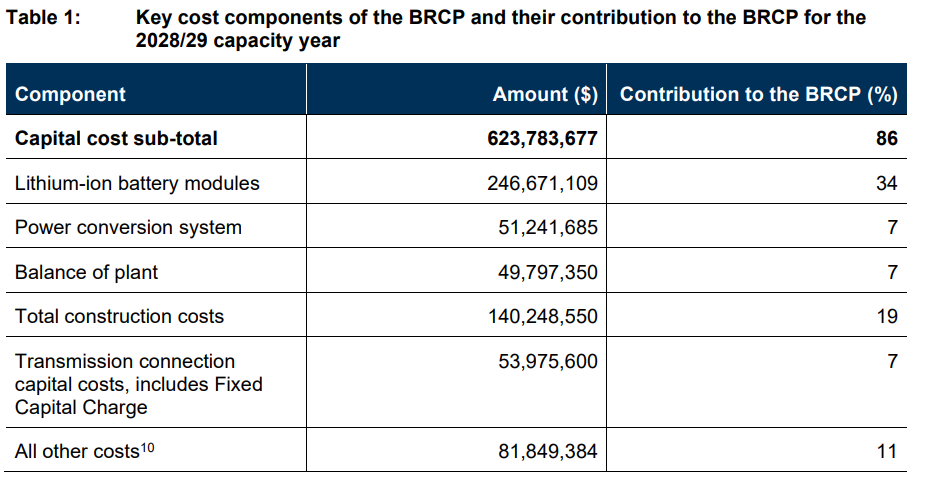

The cost breakdown (pictured) shows lithium-ion battery modules accounting for 34% of total capital costs at AU$246.7 million, making battery technology the largest single component within the AU$623.8 million capital cost subtotal.

Total construction costs account for 19% of the benchmark at AU$140.2 million, while transmission connection capital costs, including the Fixed Capital Charge, contribute 7% at AU$54 million.

This pricing development continues Western Australia’s capacity market evolution, building on previous adjustments that have prioritised battery storage systems over traditional gas-fired generation

ERA said the benchmark specification assumes a 15-year operational life with fixed operational and maintenance costs totalling AU$14.1 million annually, representing 14% of the total benchmark price.

ERA’s determination methodology follows the Benchmark Reserve Capacity Prices Wholesale Electricity Market Procedure, incorporating data and analysis from consultant GHD Advisory, Western Power and Landgate.

Market implications for storage investment

The proposed AU$491,700/MW price establishes the revenue foundation for capacity providers participating in Western Australia’s reserve capacity market during the 2028-29 capacity year, which operates from October 2028 to October 2029.

All capacity credit holders, including battery storage systems and demand response programmes, receive capacity payments based on their certified capacity contributions.

The pricing mechanism aims to deliver sufficient revenue to encourage capacity investments while maintaining system reliability for electricity consumers, who ultimately fund the Reserve Capacity Mechanism through electricity bills.

Western Australia’s energy storage market has demonstrated significant activity across multiple technologies, including vanadium redox flow battery projects such as the 500MWh Kalgoorlie installation proposed and currently being solicited for by the state government, with an emphasis on local supply chain development.

ERA is seeking stakeholder feedback on the draft determination through a consultation process that will inform the final benchmark price determination. Submissions are due by 16:00 WST, 13 February 2026.

The Energy Storage Summit Australia 2026 will be returning to Sydney on 18-19 March. It features keynote speeches and panel discussions on topics such as the Capacity Investment Scheme, long-duration energy storage, and BESS revenue streams. ESN Premium subscribers receive an exclusive discount on ticket prices.

To secure your tickets and learn more about the event, please visit the official website.