Energy-Storage.news speaks with Jennifer Downing, senior advisor to the Loan Programs Office at the US Department of Energy (DOE) and author of a recent report into virtual power plant technology.

Virtual power plants (VPPs) have been in existence since the latter part of the 20th Century, as a form of demand response technology. Large energy users at industrial or commercial sites have been incentivised to turn down their electricity use at the request of utilities or grid operators during peaks, while in some cases, the use of other energy intensive equipment like water heaters has been managed to help mitigate peak demand.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

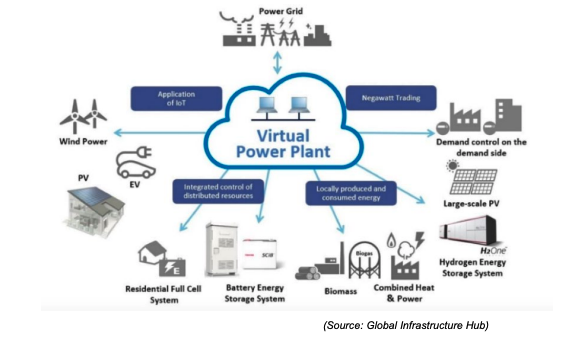

However, how we look at the term has changed radically in the past 10 years or so, as it has come to encompass different models of aggregated distributed energy resources (DER), pooling their capabilities to provide grid services or energy capacity.

In such a way, VPPs can disrupt the centralised model of electricity networks built around large-scale power plants. Customer-sited DERs, like rooftop solar PV, electric vehicle (EV) chargers, heat pumps and of course, battery storage systems, all have a role to play in today’s virtual power plants.

However, the potential use of VPPs as a grid flexibility resource is largely untapped. That led the DOE’s Loan Programs Office (LPO) to identify VPPs as a technology area which, like long-duration energy storage (LDES), green hydrogen and other emerging low carbon resources, could use some help in educating the market.

A September report in the DOE’s ‘Pathways to commercial liftoff’ series for emerging climate tech highlighted the potential of VPPs, as well as the challenges ahead. Report author Jennifer Downing told Energy-Storage.news a while back that battery storage is perhaps the most versatile resource available to VPP operators.

What follows is our conversation with LPO senior advisor Jennifer Downing, where we explore some other areas of the LPO’s research into the technology and the associated business models.

I’ve always found VPPs really interesting, but if I look back at some of the articles Energy-Storage.news has published all the way back to around 2015, it’s clear there have been a variety of factors holding the technologies back from widespread adoption. What were some of the reasons why the DOE identified this as an area to write about in the ‘Pathways to commercial liftoff’ series of reports?

From a high-level view, we are experiencing an increase in demand, at a pace and magnitude that we have not seen in decades, and that is, thanks to the electrification of vehicles, industry, heating, and data centres… it’s really increasing the peak demand on the grid that we need to solve for.

We think about this at the Department of Energy as really needing three pillars of investment.

One is more generation, two is grid-enhancing technologies that increase the capacity of the lines to deliver the electrons, and three: demand flexibility or virtual power plants that allow us to flex demand with the same level of dexterity as traditionally, we’ve only used to flex supply.

That is why we wanted to shine a light on virtual power plants, because they are so critical in meeting demand needs on the timescale that we need to electrify. If you look across those three pillars, VPPs can be among the fastest solutions.

If you have a customer-sited resource, you are not waiting in transmission interconnection queues for three, four or five years. If you look at the timeline to build a small modular reactor, it’s a lot longer than ramping up your capacity via solar and storage systems on commercial rooftops, for example.

We’re going to need ‘all of the above’, but we wanted to make sure that people weren’t discounting demand flexibility as we think about serving higher load. And really, it’s about using the infrastructure that we have more efficiently.

From time to time, I’ve heard people at conferences comment that you could build a single-site battery storage project that’s perhaps 100MW and that could be somewhere between 1-hour to 4-hour duration. Whereas to build that same amount of battery storage across residential or even commercial VPPs takes a lot of individually-sited systems. I guess their argument is that building large-scale is effectively cheaper than aggregating behind-the-meter systems, but what’s your take on that view?

It’s a couple of things. One is that customer-sited resources don’t require the same kind of land and construction. I also mentioned the need for speed, and if you have distributed energy resources on the distribution grid, you don’t face the same kind of transmission interconnection hurdles.

Then also when you’re looking at the cost of distributed versus utility-scale, you’re ignoring the fact that Americans are buying these resources for a different reason in most cases than doing grid services.

People are buying electric vehicles, because it’s a superior car, or they’re buying a smart electric water heater because it’s going to save them overall on their energy bill, or it’s going to decarbonise their home, and a lot of folks are buying behind-the-meter (BTM) batteries for backup power.

So the cost to the customer is kind of justified by the primary function of the DER. Then, we’re taking the fraction of the capacity that is flexible and using that for grid services. That’s where you get the cost-effectiveness. You kind of have to split the total cost of a distributed storage system, versus when you are comparing it to the cost of a utility-scale resource and compare that.

If you’re just looking at storage, if those behind-the-meter batteries were not used for that homeowner’s backup power at all, then maybe yes, you then add up the cost of every Powerwall and compare that to the cost of a utility-scale battery and that’s a relevant comparison. But people are buying these Powerwalls for their own backup power and so it’s unfair to count the whole cost of the behind-the-meter battery and compare that to a utility-scale battery.

Behind-the-meter resources can have a ‘double source of value’

So what we’re talking about there is recruiting people that would have installed DERs anyway. But I’m wondering how closely the need for VPPs will correlate with areas where people might already be buying battery systems, and conversely, we’ve seen virtual power plant programmes and pilots where customers in constrained load pockets are encouraged to buy battery systems that enroll into VPPs. Will scaling up VPPs be possible by enrolling customers who would’ve bought batteries anyway, or will it also require incentivising new customers as well?

The short answer to your question is that it will require both types of customers. A really good example is Swell Energy’s battery VPP in Hawaii, where they recruited people who had batteries already, and they offered them monthly payments, plus an export credit for the use of their batteries. They also expanded the capacity of the VPP by going to households and small businesses that didn’t have a battery before, and offered them somewhere between a couple of hundred dollars and US$1,000 per kilowatt of flexible capacity. The provider is always preserving 20% to 50% [of the stored energy], maybe depending on your needs, for your backup power.

They recognise that that flexible capacity is valuable for the grid and that’s why they’re offering that signup bonus payment. You see that too with Green Mountain Power, where they are offering these batteries at a low cost to the homeowner and, again, the homeowner is willing to pay that because they’re getting backup power.

Then Green Mountain Power has signed an agreement that says ‘We’re going to dispatch this when we need peaking capacity’. They’ve saved millions of dollars on peaking capacity, according to their organisation, by rolling out this battery programme, and they have a long waitlist of folks who want batteries.

Utilities should consider how they can do more to expand the capacity of their grid, and shore up their resource adequacy, through customer-sited resources that have that kind of double source of value: one, to the customer and two, to the grid.

There are some more forward-thinking utilities like Green Mountain Power, but some utilities don’t appear to be motivated or encouraged to look at non-traditional solutions like VPPs. What sort of pathways are there to get uptake of VPP solutions by perhaps more traditionally-minded utilities? Do they need to come on board more quickly, or is the participation of the progressives like GMP enough?

I think what would motivate utilities to make greater use of distributed energy resources and virtual power plants going forward would be change at two levels.

One is: how are we assessing the benefits of distributed energy resources? If you’re counting a kilowatt-hour from a distributed battery the same as a kilowatt-hour from a peaker plant in your system planning and you’re ignoring the fact that the electrons from the distributed battery don’t need to run over your distribution system, your feeders, substations, etc, or over transmission lines, which could potentially at sufficient scale, defer your investment to upgrade the capacity of those systems, that’s one benefit that you’re not counting in favour of the distributed battery.

Another one is the fact that it actually does give backup power to that household in a way that a peaker plant does not, if there’s a system outage somewhere in their neighbourhood. So the cost-benefit methodology in a lot of states is unfairly discounting the potential benefits of DERs. So that’s one thing: just how we are making investment decisions across the grid.

Then the second thing is how utilities are getting paid, because if you can imagine that a utility operating in an environment where a margin is only allowed for capital investment and deploying a virtual power plant requires software systems, new managers and engineers to design and operate the programme and the hard assets of the DERs aren’t counted towards your rate base, because they’re owned by the customer. There’s no profit motive for an investor-owned utility (IOU) to choose a virtual power plant over traditional resources [in that case].

What we would like to see is more utilities compensated for the outcomes of their work. Reliability, affordability, resilience of the grid, and overall the support for economic development in their regions.

There are utilities who are denying interconnection of new facilities that want to set up shop in their states or cities, because they just can’t handle it and that is deterring economic development in their area.

Ultimately, we need to do a better job of compensating utilities for outcomes rather than just inputs when it comes to grid planning and increasing the resources available in the grid.