The UK saw a slowdown in both BESS installations and submitted applications in 2024, while applications in Ireland grew by capacity, writes PV Tech Research analyst Charlotte Gisbourne.

With another record-breaking year in global energy storage deployment, the UK and Ireland saw diverging trends. The UK’s energy storage market seemingly slowed down in 2024, compared to Ireland’s strong growth.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

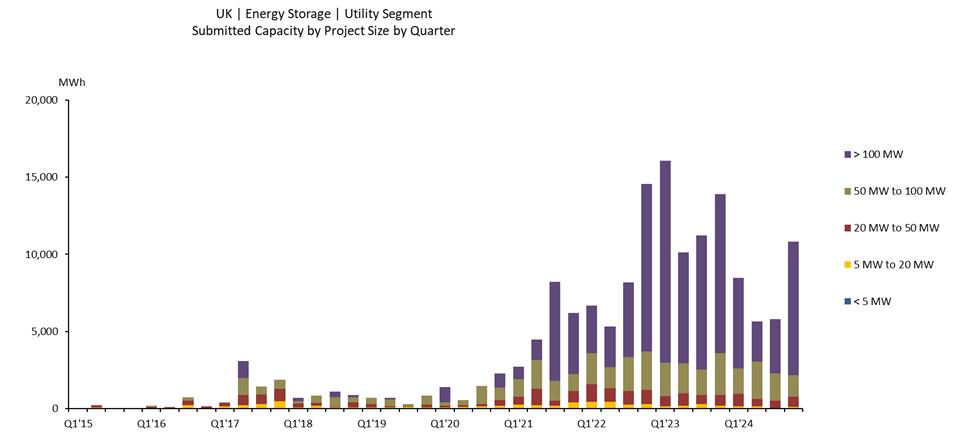

In the UK, over 30GWh of battery energy storage system (BESS) planning applications were submitted, with over 35% coming from the last quarter alone: whereas in Ireland, despite having less than four times the capacity submitted, there was a 63% rise in new capacity submitted compared to 2023.

However, there is still strong potential for future growth in each country, with 409GWh and 16GWh in the development pipeline for the UK and Ireland, respectively.

UK Energy Storage Market

2024 saw a significant decline in projects submitted, before picking up again in the last quarter, resulting in submitted capacity down 40% from 2023 for the whole year. This Q4 uptick follows the same trend as the previous two years, but did not reach the levels of either Q4’22 or Q4’23.

Overall, last year not only saw the capacity submitted decrease, but also the number of projects fell by 21%. However, the capacity submitted was still over 30GWh and the average capacity submitted across the quarters was 7.6GWh.

However, energy storage is still a growing industry. Several large projects have been announced and are in the TEC register (remaining in the pre-planning stage). This slow-down in applications could possibly show that developers are now focusing on the build-out of projects. Some notable applications in 2024 included NatPower’s Teeside Green Energy Park with a capacity over 1GW.

The number of large projects is staying at about the same level: in both 2024 and 2023, around 23% of applications submitted were for BESS projects over 100MW. But the proportion of >100MW projects in the overall capacity submitted decreased by 10 percentage points, showing that 2024 saw developers prioritising larger projects.

By country, England maintained the most applications at 62%, followed by Scotland at 21%, then Northern Ireland and Wales. Wales also saw the largest increase in applications in 2024, growing 150% from the prior year; the county is ramping up its energy storage plans with the 1GW Rover Way Energy Storage projects both submitted and approved last year, and the overall capacity submitted nearly quadrupling from 2023. The country with the highest average capacity per site was England at 167MWh/site.

2024 saw more movements in the pipeline, with more capacity approved than in any other year. Excluding already operational projects, over 101GWh of projects have been approved and over 18GWh are currently under construction. However, as local residents worry about fire safety risks, there has been backlash over new sites and the refusal rate is up by over 10 percentage points compared to 2023.

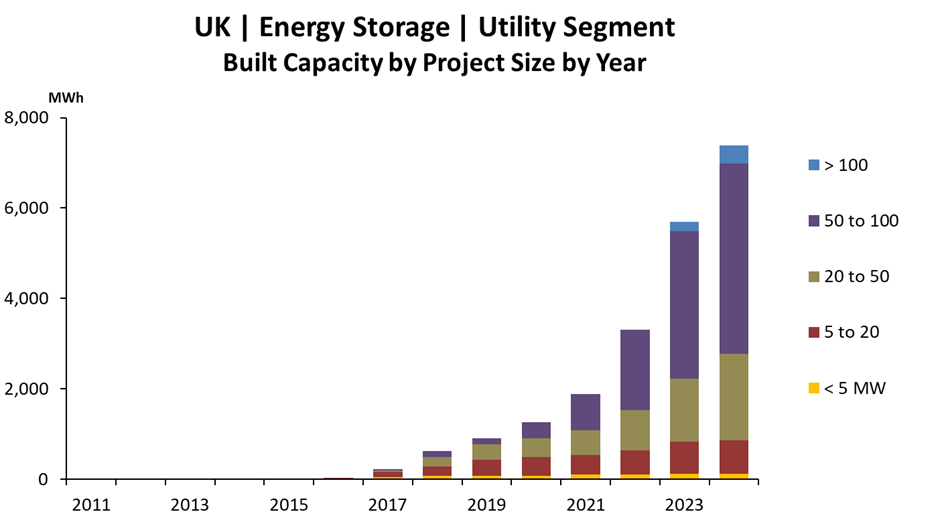

Over 1.5GWh was completed in 2024, including the largest BESS connected to the transmission network: Cero Generation’s 99MWh Larks Green site. This brings the total operational capacity to over 7GWh .

While completed capacity in 2024 was 28% lower than 2023, there was an increase in the capacity per built site in 2024, at 62MWh compared to 52MWh in 2023.

Over 84% of operational capacity is in England, where the South East and South West regions lead the way.

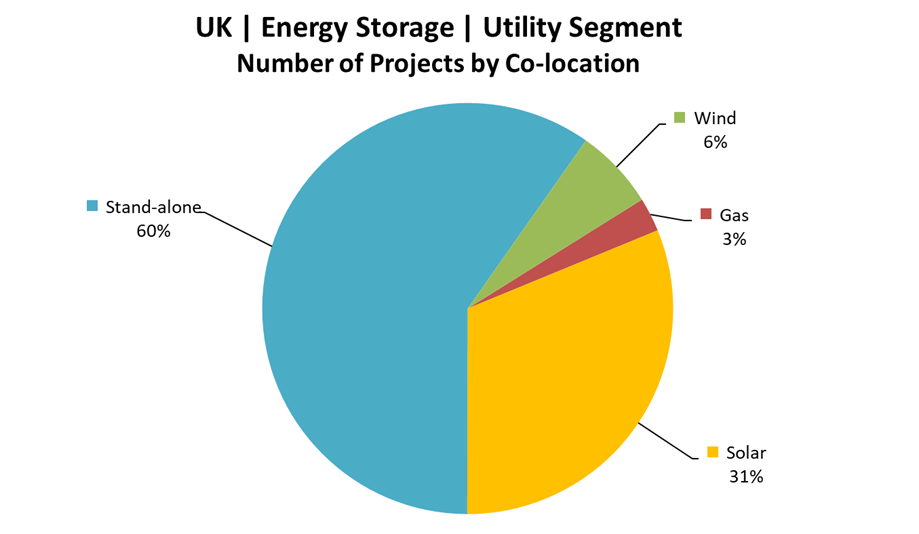

In regards to co-location, stand-alone BESS is still the most popular, with the proportion of stand-alone battery sites increasing since 2022. This is followed by solar where over 2.6GWh of energy storage co-located with solar were submitted in 2024; now there is over 23GWh of BESS with solar either submitted, approved, or under construction. With the ban on onshore wind lifted in England last year, it is predicted the number of BESS co-located with wind will rise.

The average submitted size of co-located batteries has decreased from 219MWh in 2023 to 73MWh in 2024, with the larger capacity batteries mainly for solar farms. 2024 applications co-located with solar had an average of 76MWh compared to 47MWh for batteries on wind farms. However, the proportion of battery capacity in regards to the total capacity of co-located sites has been increasing in the last few years.

Understandably, stand-alone energy storage is also seeing more build-out, with 64% of operational projects and 85% of operational capacity being stand-alone batteries.

Ireland Energy Storage Market

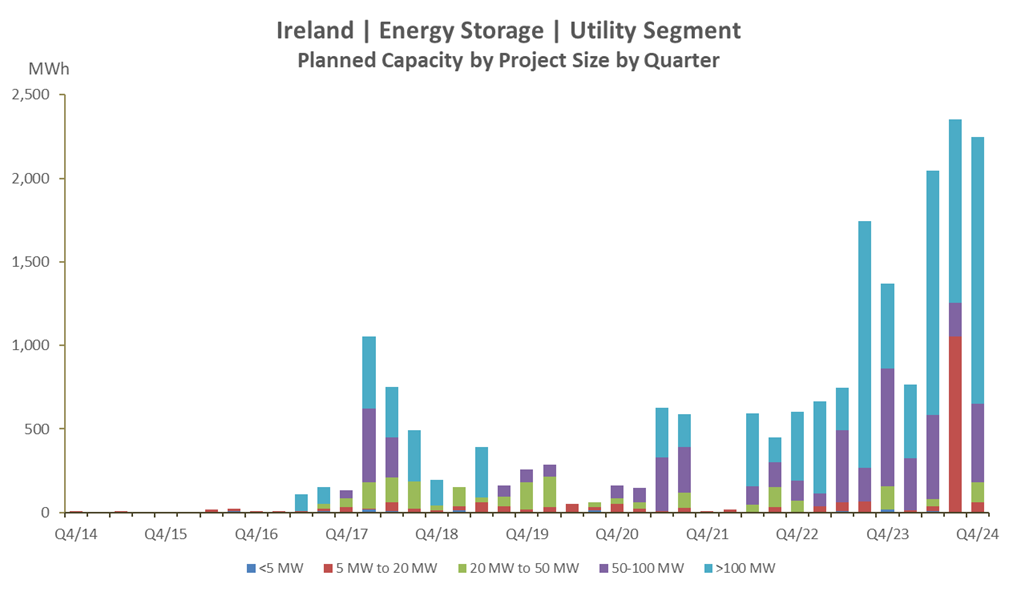

Ireland has seen healthy growth in the energy storage planning applications submitted in 2024, with Q3 having the most capacity submitted at 2.3GWh. Last year, even with a slump in the first quarter, the submitted capacity reached an all-time high of over 7.4GWh, an increase of 63% from 2023.

The number of total applications submitted in both years has remained the same, meaning the growth in 2024 was driven by the increased capacity. The average capacity per site rose from 113MWh in 2023 to 185MWh in 2024.

However, the size of co-located projects has slightly decreased from around 54MWh in 2023 to around 45MWh in 2024. Solar remains the most common co-located generator, with over 500MWh of co-located solar and storage submitted in 2024, and the proportion of standalone to co-located projects has also remained at around 60%. However, there has been an increase in BESS for C&I as more businesses are incorporating this technology.

County Cork has the most capacity submitted, at 10% of the total, and by having the second largest city in Ireland means there are substantially more grid lines in the area, which proves very enticing as a potential site location.

One notable planning application, both submitted and approved last year, was made by FuturEnergy for a ‘first of its kind’ iron air storage, capable of storing 1GWh. Longer duration seems to be the key in Ireland, with ESB’s Lough Ree Power Station project which previously gained planning approval in 2022 for the demolition and construction of 75MW of battery; but the resubmitted plans in December 2024 marked the company’s intention for 100MW of battery storage with an impressive 8-hour duration.

2024 continued to see slow build-out. Although a time lag is expected from a planning application submitted to the completion of a site, Ireland has seen significant stagnation, especially compared to the more mature UK pipeline. However, this could be changing in the upcoming years as the decision time for applications appears to be getting quicker.

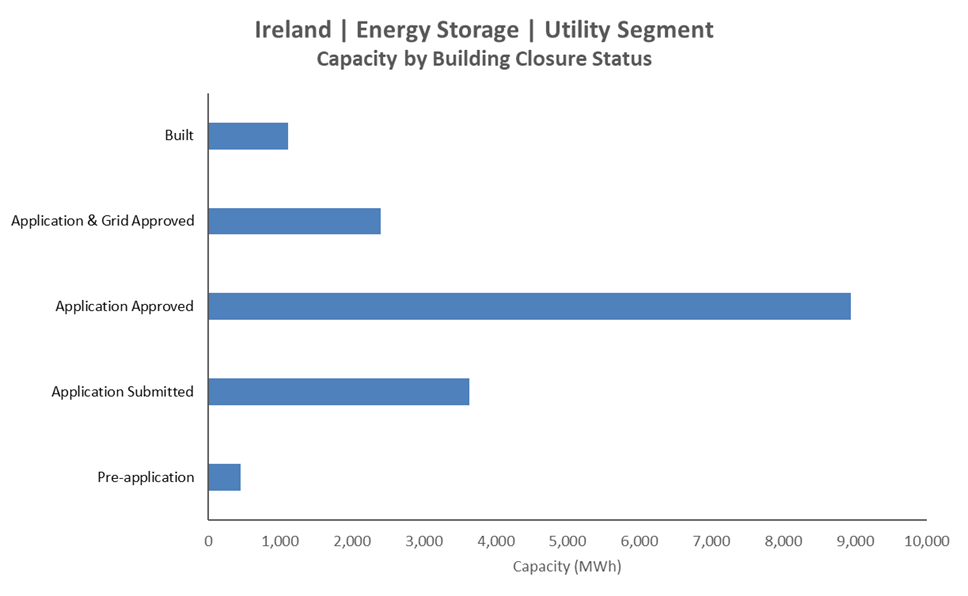

Over 1GWh of ESS has been built, and last year ESB energised a 300MWh battery in Cork resulting in 11% more operational capacity built in 2024 compared to 2023. Over 5GWh was approved in 2024, including an 800MWh battery developed by Regnum Renewables, whereas in 2023, only around 1.5GWh was granted approval. However, the rejection rate for projects last year has risen slightly from 12% in 2023 to 13% in 2024.

Little change has been made in regards to new grid connections since the last article on energy storage in Ireland, as grid connections are only released once a year. But with a new electricity connection policy for faster connections – in addition to two application processes a year starting in September 2025 – there is hope this will bring about more movement.

Both the UK and Ireland are still waiting on the promised build-out growth. However, with several projects over 1GWh gaining approval in the UK and construction set to begin on two sites primed to be Europe’s largest when completed, the UK is cementing its place as a hub for renewable energy. Grid reforms, in addition to the increased urgency of operational BESS, provide hope for the energy storage market to push through this current lull.

The strong divergence in the regions shows the general evolution of the energy storage market, as the UK’s status as an early mover in energy storage does not necessarily guarantee sustained growth. Ireland still remains in its infancy with energy storage, as proven by the few operational sites, but the strong pipeline shows great promise for the future.

All data and analysis shown in this article comes from our in-house market research at Informa Markets PLC. Full details on how to subscribe to our UK Battery Storage Project Database Report and Republic of Ireland Battery Storage Project Database Report can be found here.