While the UK grid-scale BESS market continues to be among the busiest in Europe, there are still huge questions and plenty of work to be done in several key policy areas.

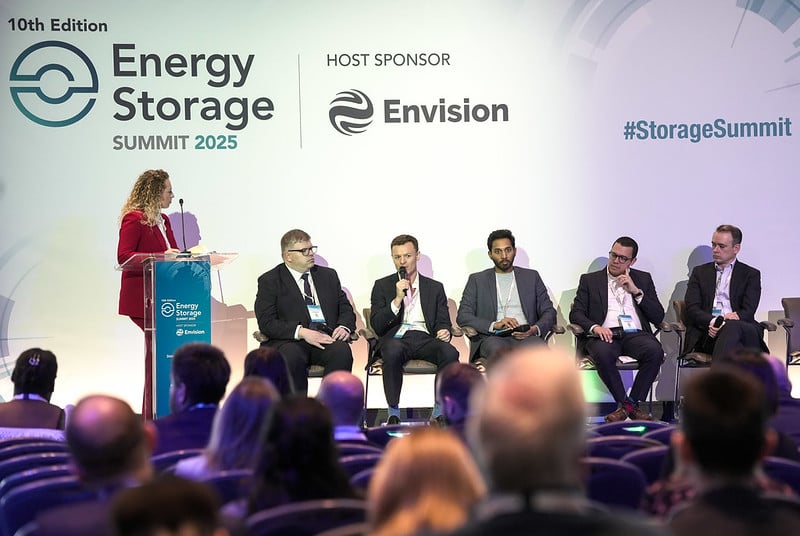

That’s according to Andy Willis, CEO and founder of developer Kona Energy, speaking to us ahead of the Energy Storage Summit EU 2026 in London next month, on 24-25 February.

Willis will be speaking on a panel discussion on Day One, titled ‘What Separates Survivors from Casualties in Europe’s Storage Markets?’.

In this Q&A, Willis discusses the UK’s grid connections reform, the long-duration energy storage (LDES) cap-and-floor, as well as the evolution of financing, commercialisation and project delivery for large-scale battery energy storage systems (BESS).

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

It follows discussions primarily around the German market with other speakers at the upcoming conference: owner-operators Noveria Energy and Green Flexibility.

Energy-Storage.news: How would you characterise the current state of the UK energy storage market, in terms of the key trends, major successes and achievements, and challenges still to be overcome?

Andy Willis: In the UK, 2025 was characterised by Grid Connection Reform and the Clean Power 2030 agenda. In 2026, attention will move decisively to delivery. Early indicators point to a strong pipeline of projects ready for execution, but the main uncertainty lies in whether distribution and transmission operators can scale their resources quickly enough to deliver connections on schedule.

Many developers shifted their focus toward European markets such as Italy and Germany, attracted by greater contractual revenue certainty and materially higher returns than are currently available in the UK. Although grid connection activity surged, it remains to be seen whether delivery volumes will match the pace of committed connections.

How is the financing of BESS projects evolving?

The financing landscape for BESS projects continues to evolve. Debt products are becoming more sophisticated, with a growing number of lenders in the UK actively engaged and familiar with the asset class. Equity investment has slowed over the past year, largely due to uncertainty created by grid connection reform. However, this is expected to pick up again as projects receive their final grid connection offers and progress toward bankability. NESO’s approach to ‘grandfathering’ projects has been helpful, but in many cases has not gone far enough to provide the certainty required for projects to reach full FID.

Closely related to that is how projects are monetised: how is the balance between merchant and tolling/fixed revenue schemes changing?

The balance between merchant exposure and tolling or floor-based structures continues to shift. Larger assets increasingly resemble traditional infrastructure projects, with investors seeking long-term contracted revenue mechanisms to underpin financing and reduce volatility.

Tolling and floor providers are receiving an unprecedented volume of approaches and are having to balance asset fundamentals against a fast-moving policy landscape, particularly the evolving remit of LDES and how future procurement rounds may reshape system needs and revenue certainty.

What are the key evolutions in how BESS projects are being optimised and dispatched?

Kona continues to believe that operability revenues remain materially undervalued by both the market and many optimisers. We expect a significant increase in the utilisation of BESS assets for non-energy services from 2027 onwards, as system needs evolve and the value of stability, voltage and other operability products becomes more clearly recognised.

What is the current mix of ‘full wrap’ and ‘multi-contracting’ for BESS project delivery, and is this/how is this expected to change going forward?

Both ‘full wrap’ EPC structures and multi-contracting remain viable delivery models for BESS projects, and both continue to attract interest from developers and investors. The growing success of integrated BESS solutions globally means developers now have access to a wide range of experienced counterparties capable of delivering proven, standardised systems at scale.

However, the real constraint in delivering high-quality projects often lies within the Balance of Plant (BoP) scope. Securing a capable BoP contractor with the right experience, engineering capacity and supply-chain strength is increasingly critical. As project sizes continue to grow, and as connection programmes become more demanding, we expect developers to place greater emphasis on BoP capability and interface management, regardless of whether a full-wrap or multi-contracted structure is selected.

How is BESS supply and technology evolving to meet key market challenges?

Energy density continues to increase and product performance is improving year on year. This will benefit projects as system durations naturally move from 2-hour toward 3- and 4-hour configurations. The planned phasing out of Chinese supplier VAT rebates in 2026 and 2027 will create upward pressure on costs, and both developers and suppliers are likely to seek mechanisms to share or smooth these increases across the commercial structure.

What are the key policy questions and grey areas which industry and government still need to find solutions for, to unlock storage’s full potential for the grid?

Several long-standing policy questions remain unresolved, and these continue to limit the full system value that storage can deliver. Skip rates and TNUoS charging remain at the top of the list, with both expected to evolve further over the coming year.

UK curtailment is almost certain to break new records in 2026. This is becoming a central issue for both public policy and energy affordability. NESO now has an unprecedented volume of BESS capacity either operational or committed, and the key question is whether these assets will be deployed more frequently and more intelligently to address curtailment and system balancing challenges.

Grid and long interconnection backlogs are commonly cited as a major challenge: what measures do you see being taken to alleviate this, and how would you assess/estimate their impact?

In the UK, Grid Connection Reform will undoubtedly rationalise the queue, but it does not mean projects will suddenly reach the promised land of fast or straightforward connections. The emerging reality is that projects will not be advanced under the new reform framework, even where they are materially ready. While the methodologies prioritise readiness, they place equal weight on historic queue position. As a result, the earliest connection dates remain locked in by projects that have been in the queue for many years.

The real test will be whether these long-standing projects ultimately proceed to construction. If they do not, it will be important to see whether NESO exercises its queue-management powers to remove them, opening up earlier delivery opportunities for genuinely ready-to-build assets. The overall impact will depend on how firmly and consistently NESO applies these powers.

Do you expect LDES to be deployed at scale, and will it be new, novel technologies used or lithium-ion?

Much will depend on the outcome of the Zenobē Energy challenge (which has now opposed the scheme via the courts, having initially voiced its opposition mid-last year).

If the scheme proceeds in its current form, lithium-ion BESS will almost certainly secure contracts. The real question is whether Ofgem ultimately prioritises projects based on location, technology type, or underlying economics. At present, the published material provides little clarity on how these trade-offs will be assessed, making it difficult to predict how selection decisions will be made.

Energy-Storage.news publisher Solar Media is hosting the Energy Storage Summit EU 2026 in London, UK, on 24-25 February 2026 at the InterContinental London – The O2. See the official website for more details, including agenda and speaker lists. Also, ESN Premium users can get a 30% discount.