Over 9,000MWh of battery energy storage could be deployed in Britain over the next five years as the sector enjoys a trend towards “explosive growth”, a market analyst has said.

Lauren Cook at Solar Media’s Market Research division spoke to Energy-Storage.News this week on the publication of 'UK Battery storage: Opportunities & Market Entry Strategies for 2018-2022', a new report.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

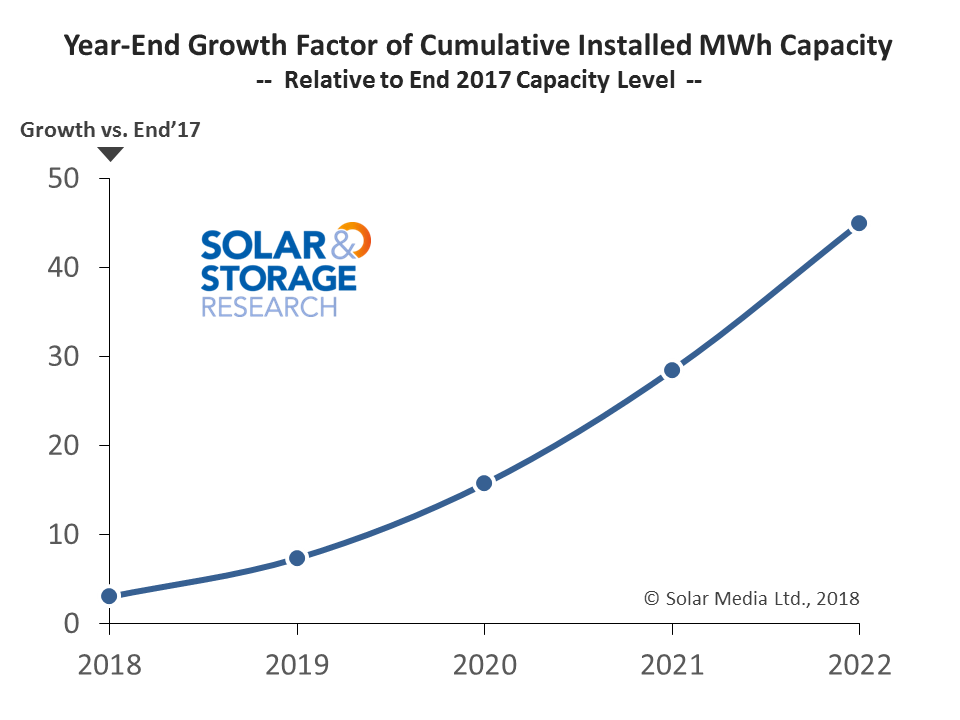

Cook found that in just 12 months, the UK’s pipeline for new battery storage projects has grown by over 240%, with forecasted installations in 2018 set to rise more than 200% year-on-year. Opportunities are being created by a range of drivers including a national commitment to phase out coal, falling technology costs and more than 30GW of wind and solar capacity ripe for co-location with batteries.

According to Cook, this means the UK could quickly becoming a market of strategic focus for international players.

“The market is growing and it’s changing rapidly. There’s now projects completed on the ground. Once global companies start to see it’s not just a speculative market, it will make sense for them to think about how to enter the market and what the opportunities are for them.

“They will then need to know who is active in the market, who has these opportunities and who they will have to work with to take advantage of those opportunities.”

Going beyond the deployment figures, Solar Media Market Research also looked extensively at business models, another aspect of the industry analyst Cook said is changing fast. With an emphasis on projects earning long-term revenues, it is becoming commonplace to speak of a “revenue stack” – earning multiple revenues streams for providing a range of services. However, Cook said, there is no such thing as a “typical” stack in the market today.

“I’m not sure there’s any such thing as a typical stack because there are many factors involved, but if you look at the timeline from the EFR of 2016 you had those projects were successful, those projects then went on to apply for the Capacity Market (CM), T-1 and T-4 in early 2017,” Cook said.

“Some of those were successful, some of those weren’t. We then saw the FFR auctions happening throughout 2017. Those projects also participated in those auctions, new projects also came in.

“Then I think the most recent phase of the Capacity Market – so again, the T-1 and the T-4 – was just another opportunity to add to those stacks. So you might see projects with an EFR contract, they may also have a T-1, they may also look to get a T-4 in the future, because of the different lengths of contracts – you can simultaneously run some contracts but you may want to have consecutive CM contracts. So you might see T-1 as a way of filling the time between a project becoming operational and the T-4 contract beginning. It’s not just about stacking them in one moment – so having multiple sources at one point in time – it’s about stacking the revenue streams across the lifetime of the project and having long-term revenue.”

In megawatt-hours, battery energy storage capacities installed in the UK by the end of 2022 will be 50 times what they were as 2017 ended. The report also covers a predicted trend towards longer duration storage in future, comprehensive evaluations of leading players in the industry and analysis of stakeholders.

Learn more about 'UK Battery storage: Opportunities & Market Entry Strategies for 2018-2022', here.