The UK market saw strong interest and activity in 2025 but now appears to be shifting from a development market to one focused on execution, writes Solar Media analyst Charlotte Gisbourne.

The UK energy storage market has remained strong amid increased global interest. Being an early mover in large-scale ESS, the UK is one of the more mature markets in Europe, meaning its recent pipeline capacity growth and future operational capacity growth may be slower than other, newer markets.

New grid policies shaping much of the movement this year and showcasing how congested the grid connection queue had become. This article examines the developments in the UK energy storage landscape in 2025, based on our UK Pipeline & Completed Assets Database.

Last week, we published a piece focused around operational capacity, read it here.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Project submissions

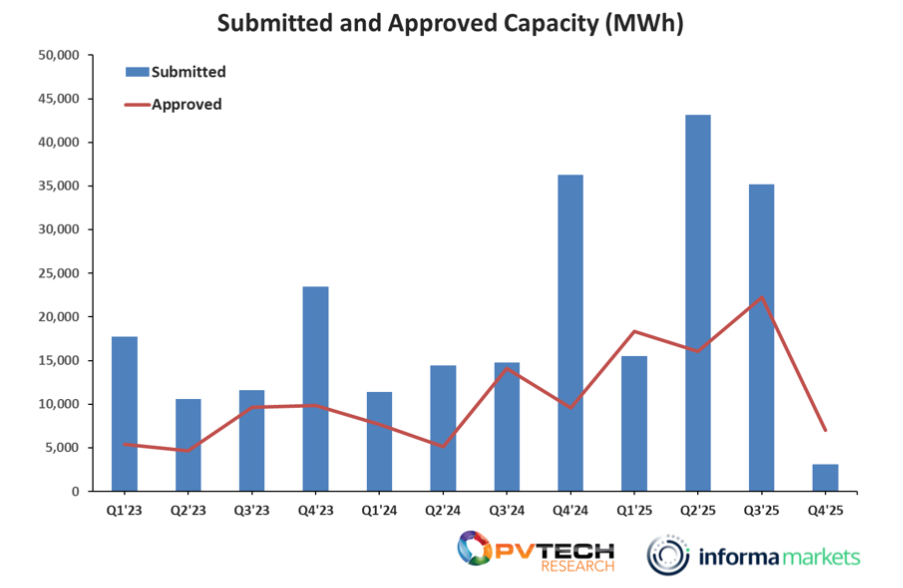

Looking at the year as a whole, 2025 had the highest capacity submitted at over 96GWh (an increase of 25% from 2024). The second quarter of the year managed to surpass Q4’24 as the highest quarterly capacity.

However, the last quarter of 2024 remains unbeaten in terms of the number of applications. This was driven by grid reform, which required projects to be submitted to planning before the end of 2024 to be eligible for a Gate 2 connection. As a result, this made the typical first quarter slump in submissions all the more prominent in 2025.

The peak in Q2’25 was aided by multiple large-capacity projects being put forward to planning. In general, the UK is moving towards larger projects, with the average submitted capacity in 2025 being over 400 MWh compared to 257 MWh the year prior. There has been an increased interest in long-duration energy storage (LDES) with multiple projects over the usual two-hour duration, such as the AW2 Uskmouth BESS, aiming for up to five hours. This is largely due in part to the new Cap and Floor Scheme.

July saw the highest number of applications submitted, but the largest capacity submitted was in May, with over 20% of the full year’s capacity submitted occurring that month. The later months of the year saw a significant drop, falling 91% quarter-on-quarter. A possible reason could be the passing of gate submission deadlines and the uncertain market landscape before outcomes were revealed.

Having a high number of projects submitted the year prior and a flurry of applications in December did help increase the number of decisions being made in 2025. Around 78% of applications submitted in 2024 have been decided upon. The submitted and approved capacities have a correlation of around 0.58 (weakly positive), indicating that general activity does seem to occur around the same time.

Scotland saw the largest total submitted capacity, looking at just England (which consists of over 80% of operational capacity in the UK) the East Midlands saw the most submitted capacity both in 2025 and overall.

In the Eastern region, it is slightly more likely that a project submitted is co-located with solar, with around 50% of projects submitted being co-located with solar, compared to the North West, where this falls to only around 10%.

Project approvals

The month with the most decisions made was July which had over 16 GWh of approvals (including appeals). The rejection rate decreased from 21% in 2024 to 14% in 2025, with over 10 GWh rejected in 2025. However, for projects that choose to undergo appeal, these are generally approved, but this does lengthen the planning process significantly.

Even with the fall in applications in Q4 there is still a robust interest in projects, during 2025 over 75 GWh of pre-applications were submitted in 2025 and over 37 GWh do not have a corresponding full application. Looking at all the projects submitted for an application during the year, including pre-applications, the UK pipeline grew 34% from the year prior.

The Cap and Floor Scheme for LDES, of which 52.6 GW were eligible in the first window, could see some alternative chemistry on the rise in the UK. Despite lithium-ion BESS dominating the eligible projects, the second highest technology used in the applications was vanadium flow batteries. Highview Power started the construction of a 300MWh liquid air project in 2025 and Invinity has started the delivery of what will be Europe’s largest vanadium flow battery project.

Yorkshire and Humberside had the most capacity approved at over 8.4GWh with the South East having the highest number of refusals.

Final investment decisions (FIDs)

Significant projects have reached final investment decisions, and with what is set to be the UK’s largest project at over 3.1 GWh, currently under construction, the next couple of years will see operational capacity soar even further. While investor interest in battery storage on a global scale is high, the UK is not the most sought-after market. However, the strong government support of the market does have its appeal; AIP Management made its first investment in standalone battery storage sites in the UK through a deal with BW ESS. In addition, when looking at Gresham House Energy Storage Fund, one of the largest BESS funds in the UK, the share price did manage to finish at 41% higher in 2025 than the end of the year prior.

Tolls and floor deals on the rise

There appears to be an increase in tolling and floor agreements when it comes to revenue, highlighting the increased caution possibly due to the often turbulent nature of energy storage revenue. This is despite 2025 having slightly more favourable conditions for BESS revenue compared to 2024 and the benefit of the new Quick Reserve grid service. With more projects coming online, the ancillary service market is likely to become even more competitive, lowering prices and forcing asset owners to seek a new revenue stacking mix.

Supply deals

Some notable suppliers are Sungrow, which signed a 4.4GWh agreement with Fidra Energy in late 2024 and has had a long track record in the solar market in the country, and Canadian Solar. The latter’s development arm Recurrent Energy has multiple sites in the UK across the pipeline and is expected to boost the presence of the company’s storage products as well.

However, long-term supply agreements between developers and BESS suppliers seem to be more prevalent in the younger markets in Europe (such as the Central and Eastern regions) than the UK. This could be a combination of manufacturers wanting to capture new markets as competition intensifies globally in addition to developers seeking more stability in an emerging market.

Conclusion

With some of the fat trimmed via the grid reforms and a shift towards building out projects, in addition to the focus on larger capacity sites, the UK energy storage market could be evolving into a more streamlined landscape as it matures.

Battery storage prioritised for 2030 for grid connections through the new reforms greatly exceeds what is required for the UK to reach its Clean Power 2030 aim of 23-27 GW. With such a crowded playing field and still long queues, this could discourage developers from new projects and the current application slump could continue to early 2026 as focus is shifted onto currently planned sites.