Chinese solar PV inverter and energy storage provider Sungrow has announced two major developments: plans for a Hong Kong IPO and the release of its half-year 2025 interim report.

On the evening of 25 August, Sungrow announced that it had held its 18th meeting of the fifth board of directors, during which relevant proposals regarding the proposed issuance of H-shares and listing on the Stock Exchange of Hong Kong Limited were reviewed and approved.

According to the announcement, the company plans to issue overseas-listed foreign shares (H-shares) and apply for listing on the Main Board of the Hong Kong Stock Exchange. This initiative aims to deepen its global strategic footprint, enhance its international brand image, build diversified financing channels, and thereby strengthen its core competitiveness.

H-shares are issued for firms based in mainland China and listed on the Hong Kong exchange, regulated by Chinese law but denominated in Hong Kong Dollars, enabling Chinese firms to tap broader sources of financing.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

As previously reported by ESN Premium, since the second half of last year, a wave of companies in China’s energy storage industry have been seeking listings on the Hong Kong Stock Exchange. These include players across the industry chain, such as CATL, Sunwoda, BYD, CALB, REPT Battero, Hithium, and Sigenergy.

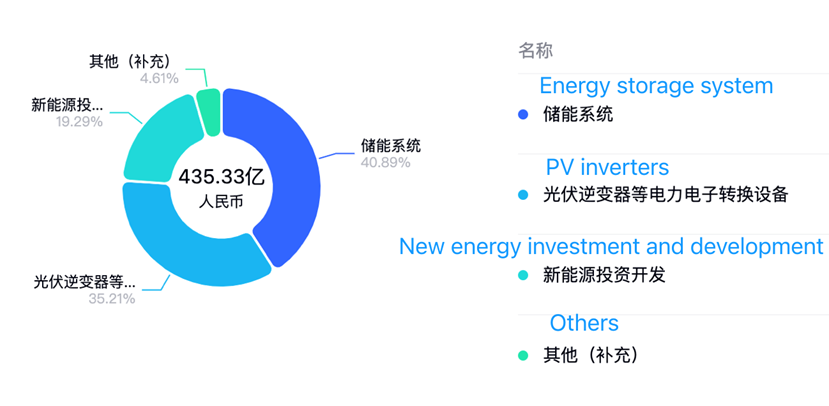

At the same time, Sungrow also disclosed its 2025 interim report. According to the report, from January to June 2025, Sungrow recorded operating revenue of RMB43.533 billion (US$6.09 billion), a year-on-year increase of 40.34%. Net profit attributable to shareholders of the listed company stood at RMB7.735 billion, a year-on-year increase of 55.97%. Its profitability was remarkable, with both revenue and net profit hitting record highs since the company’s listing.

The report highlighted the explosive growth in Sungrow’s energy storage business in the first half of the year, with revenue amounting to RMB17.803 billion, a surge of 127.78% year-on-year. During this period, the company launched the PowerTitan 3.0 AC Smart Storage Platform, with the Plus version offering a capacity of up to 12.5MWh, cementing its position as one of the largest energy storage systems in the industry.

In the inverter segment, Sungrow generated revenue of RMB15.327 billion, a year-on-year increase of 17.06%. In the first half of the year, the company launched the world’s first 400kW+ string inverter, the SG465HX, and the world’s first split modular inverter, the 1+X 2.0.

Behind the impressive performance, two notable shifts have taken place in Sungrow’s business.

First, in terms of revenue share, the company’s largest business segment has shifted from PV inverters to energy storage systems, accounting for 35.21% and 40.89% of its total revenue respectively. At the end of 2024, these proportions were 37.41% and 32.06% respectively.

Second, overseas business has grown rapidly. Revenue from overseas markets now surpasses that from the Chinese mainland, accounting for 58.30% and 41.70% of total revenue respectively. As of the end of 2024, these proportions were 46.64% and 53.38% respectively.

Market research and analysis firm Wood Mackenzie Power & Renewables found that Sungrow was the leading energy storage system integrator by market share during 2024 in Europe and the Middle East and second in North America, the Asia-Pacific region, and overall global rankings.

According to the annual system integrator market landscape report issued by Wood Mackenzie a few weeks ago, Sungrow doubled its market share in Europe year-on-year. Overall, the market is seeing “tense competition” globally, Wood Mackenzie analyst Kevin Shang told Energy-Storage.news.