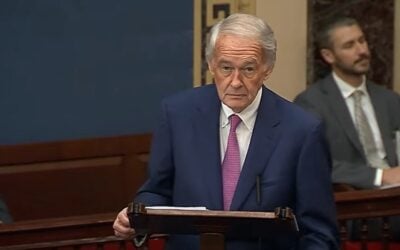

Image: S&C Electric.

Storage projects have landed more than 3.2GW of contracts in the provisional Capacity Market auction results.

This week’s auction secured around 52GW of electricity capacity for the winter 2020/21 period and storage – competing for the first time – landed more than 6% of the total allocated capacity.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Most notably four of the battery projects previously successful within National Grid’s Enhanced Frequency Response (EFR) tender also gained 15-year contracts as new build generators in this week’s Capacity Market auction, further endorsing their application for grid stability.

Those four projects are the 10MW Cleator and 40MW Glassenbury projects undertaken by Low Carbon, the 49MW West Burton site being developed by EDF Energy Renewables and the 10MW Blackburn Meadows project being constructed in Sheffield by E.ON UK.

The results also show that some of the unsuccessful EFR projects have also been accepted within the capacity market, such as Centrica's 48MW Roosecote projects which was also awarded a long-term contract.

I count 28 new-build battery projects getting Capacity Market agreements - totalling 501MW. Only 1 battery failed to get an agreement.— Jonathan Davison (@_jonnydavison) December 9, 2016

UK business and energy secretary Greg Clark welcomed the results, lauding the auction’s potential to secure electricity “years in advance”.

"Technological innovation, as part of our low carbon future, will create jobs and opportunities across the UK. We are rebuilding an archaic energy system, bringing forward brand new gas power and innovative low-carbon capacity like battery storage to upgrade our energy mix.

“This is about more than just keeping the lights on. A modern, reliable, and flexible electricity system powers the economy and Britain’s future success,” he added.

But while the results are a positive step forward for battery storage, the lower-than-anticipated clearing price of £22.50/kW have proven not enough to incentivise new-build combined cycle gas turbine generators which are essential to the government’s energy strategy. This was reflected by the capacity awarded to existing generators, which stands at just over 84%.

Jonathan Marhsall, energy analyst at the Energy and Climate Intelligence Unit, said the low clearing price suggested that the market considers there to be “more than enough capacity” in the system already.

“Only considering peak load capacity, the current system is often skewed to less efficient technologies that are good for short runs over the winter, but not a sensible long-term plan for the electricity network.

“Making small changes in the system, mirroring policies in both the US and across Europe to prioritise low-carbon flexibility tools such as demand side response and storage could not only keep bills down, but would increase the ease of the ongoing transition to a low-carbon system with renewables at the core,” he said.

The results remain provisional until 20 December 2016.